Reclaim your financial freedom while you build up your credit score

The Surge® Platinum Mastercard® gives you an initial credit limit up to $1,000!

Advertisement

Step into the world of credit building with the Surge® Platinum Mastercard®. Designed for those starting out or rebuilding, this card offers a chance to enhance your credit score. With potential credit limit increases and essential online tools, managing finances becomes simpler. Embrace the opportunity to transform your credit journey while keeping track of your progress with ease.

Step into the world of credit building with the Surge® Platinum Mastercard®. Designed for those starting out or rebuilding, this card offers a chance to enhance your credit score. With potential credit limit increases and essential online tools, managing finances becomes simpler. Embrace the opportunity to transform your credit journey while keeping track of your progress with ease.

You will remain in the same website

This credit card option can save your finances and expand your financing possibilities. It has many benefits, check it out:

You will remain in the same website

Navigate your credit journey with the Surge® Platinum Mastercard®, a beacon for those rebuilding or establishing credit.

Tailored for diverse financial backgrounds, this card paves the way for credit improvement with thoughtful features.

Delve into the aspects that make Surge® a notable choice for credit-building endeavors.

Advantages to Enjoy

- Welcomes a Range of Credit Histories: Ideal for those building or rebuilding credit, offering a fresh financial start.

- Opportunity for Credit Limit Increases: Use responsibly for a chance to double your limit, enhancing your credit potential.

- Accessible as an Unsecured Card: Available without a security deposit, making it easier to start your credit journey.

- Regular Reporting to Credit Bureaus: Builds your credit history through consistent reporting to major bureaus.

- Easy Online and Mobile Management: Conveniently track and manage your spending and account online or via mobile.

- Prequalification with Minimal Credit Impact: Check your eligibility without significantly affecting your credit score.

- User-Friendly Account Alerts: Stay informed with automatic alerts for account activity, helping manage your finances effectively.

Disadvantages to Keep an Eye On

- Higher Annual and Possible Monthly Fees: Comes with a significant annual fee and potential monthly maintenance charges.

- High Interest Rates: Carrying a balance can be costly due to the card’s high APR.

- No Rewards or Cashback Program: Lacks the benefits of rewards or cashback incentives found in other credit cards.

- Requires a Checking Account: Must have a checking account to qualify, which might not be feasible for everyone.

- Possible Security Deposit Requirement: In certain cases, a security deposit might be necessary.

- Limited Additional Benefits: Offers basic features with few extra perks or luxury benefits.

- Charges for Cash Advances and Transfers: Additional fees apply for cash advances and balance transfers.

In conclusion, the Surge® Platinum Mastercard® is a practical choice for those aiming to improve or establish their credit history.

Its credit limit growth potential and user-friendly management tools are major pluses. However, its high fees and interest rates necessitate careful budgeting and spending habits.

This card is ideal for users who are diligent with their payments and seek to enhance their credit score through consistent use and management.

Personal information is important for you to apply for the card because federal law requires it. It is essential that the information is computed correctly to identify the accounts and credit cards that every citizen has. That is, this information is used for personal identification. In addition, personal information is used so that the credit agency can analyze your credit score and other information such as monthly income. Thus, interest rates can be customized.

You have several ways to pay your credit card installment. The main way is online or by calling the official number. In the online option you need to have internet banking installed on your computer to ensure security, or the official application on your smartphone. Phone payments can be quick, but are only available during business hours. There is also the alternative of using the mail for payment. In that case, you must send a check.

You need to contact the Surge® Platinum Mastercard® customer service at the official phone number and request a PIN if you don’t already have one. Then, you will need to enter the card data to have your PIN. At the ATM, you will need this PIN and you must select the cash advance option and the amount you want to withdraw.

Applying for the Surge® Platinum Mastercard® is easy and only takes a few moments. Follow the link below for a complete walkthrough of the process.

How to apply for the Surge® Platinum Mastercard®?

The Surge® Platinum Mastercard® allows you to rebuild your credit score. See how to apply correctly to be approved.

However, if you’re still looking for alternatives, the FIT™ Platinum Mastercard® is a solid choice. It helps you build your score while offering Mastercard perks.

If you’d like to learn more about the FIT™ Platinum Mastercard® and how to apply for it, check te following link!

How to apply for the Fit Mastercard card?

Facing financial trouble can happen to everybody. But you can always rebuild your economic life with good information and discipline. The Fit Mastercard can help you.

Trending Topics

Applying for the Chase Freedom Unlimited® Credit Card: learn how!

Learn how to apply for Chase Freedom Unlimited® card today and find out why this is one of the best cash back cards available in the market!

Keep Reading

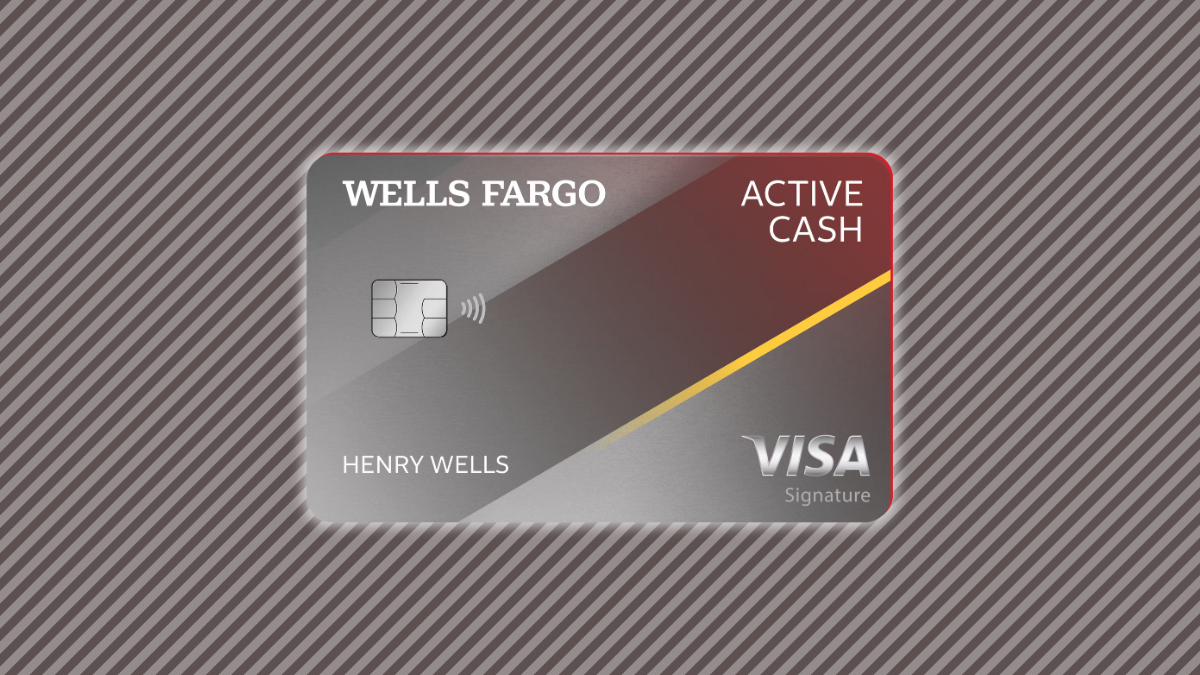

Apply for the Wells Fargo Active Cash® Credit Card: Learn how!

Wells Fargo Active Cash® Card allows you to earn a $200 cash rewards bonus when you spend $1,000 in the first 3 months. See how to apply!

Keep Reading

Regions Prestige Visa® Signature Credit Card full review

Check out our full review of the Regions Prestige Visa® Signature Credit Card. Earn points on every purchase and pay $0 annual fee!

Keep ReadingYou may also like

Fortiva® Credit Card full review

Need to rebuild credit and catch up on finances? Then check out this Fortiva® Credit Card review that will help you!

Keep Reading

OppLoans: how to apply now!

Need financial relief? Learn how to apply for OppLoans easily. Borrow up to $4,000 for several purposes! Keep reading and learn more!

Keep Reading

Seeking New Talent: Apply for a Job at AutoZone Now!

AutoZone job openings: Apply online now – Learn the requirements and what to expect after submission. Read on!

Keep Reading