Debit Cards

Sable Review: read before applying

Are you looking for a new online bank account? Sable is a newer online bank that could be a good option for you. In this post, we'll give you an overview of Sable and review some of its features.

Advertisement

Sable Card is no longer accepting applications for new accounts. See our best cards for other options. Below is our review of the card from when it was still available.

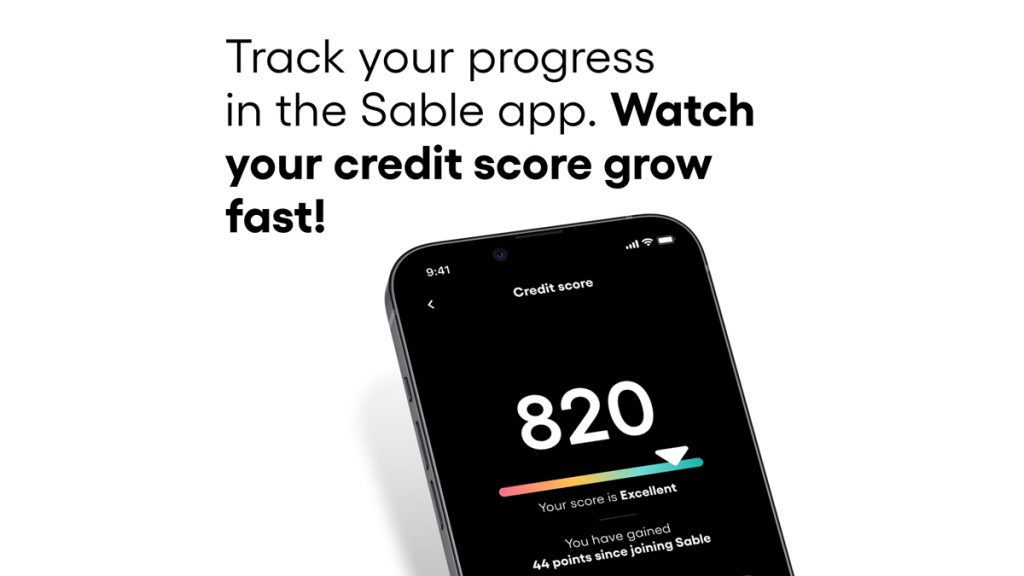

Sable Account: an excellent option for those looking to build credit score, with access to both debit and credit cards, all of it for $0 fees.

This Sable account review is for young people trying to get your first bank account. Or the ones with less-than-perfect credit history. Or even for immigrants without U.S. citizenship. Regardless of what your situation is, the Sable Account is definitely an option worth looking into.

We all know how much red tape stands in the way when you are not at your financial best and need to get access to financial services. The Sable account helps you cut through red tape and provides you with high quality online banking with access to both debit and credit cards, and you may not even need a Social Security number to apply.

Join us now on this review of the Sable account, and let’s find out if this is really the best option for you to get access to debit, credit and improve your overall credit history.

| Intro Balance Transfer APR | N/A |

| Regular Balance Transfer APR | N/A |

| Balance Transfer Fee | N/A |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is The Sable Account Legit?

The Sable account is FDIC-insured up to $250,00 per depositor. It is hard to get any more legit than that.

The company’s history is entangled with that of its founders’, who were immigrants themselves, and realized the barriers in the U.S. financial system prevented many people from having access to banking services.

Aiming at solving this problem, Sable became one of the most accessible accounts for individuals to acquire, offering financial services for $0 annual or monthly fees, rewards that range from 1% to 2% cash back, and it stands out as one of the best ways to build a solid credit score.

Sable Account: how does it work?

Next in our Sable account review, we’ll look over its pros and cons so you can decide if it works for you.

Pros

- No Social Security number required

- Debit and credit spending earn rewards

- No annual or monthly fees

Cons

- Not the best rewards

- No sign-up bonuses

- Not an interest bearing account

Credit scores need to be good?

The Sable Account does not have minimum credit score requirements. It actually boasts its ease of access to individuals with limited or poor credit history, and therefore it is the perfect account for anyone looking to get their foot in the door of the financial system.

But remember: you shouldn’t look at this account as nothing but an easy way of getting access to credit. Instead you should think about it as your first step towards building a reputation in the financial system so that you can access better offers in the future.

Want to apply for a Sable Account?

After looking through all the options, you have finally come to the conclusion that the Sable Account is the best one for you. That’s great, but it’s just the start. Now it’s time to take action and open your account so you can have access to all the benefits this account has to offer.

Applying for the this account is a simple and quick process which shouldn’t take you more than a few minutes. Any U.S. resident at 18 years of age or older is eligible for the account, and you can apply through the Sable app, both on Android and iOS.

If you are an immigrant without a social security number, that is not a problem. The account was designed by immigrants for immigrants (but not for immigrants only), this means cutting through red tape so you have immediate access to the banking system.

So, without further ado, here is a quick step-by-step guide for you to open your Sable account today.

Apply via app

Once you have downloaded the app, you will be required to provide an active email address and create a password for your account with a minimum of 8 characters and containing at least 1 number. Then, select whether you want to get both the debit and credit cards or debit only.

You will then be taken to the next set of screens where you must provide your full home address, phone number and legal name.

You are almost there! Now, confirm your identity by inputting your nationality as well as your Social Security number (if you are a U.S. citizen), and you are done! You have made it. Sit back and relax while Sable runs its analysis on your data, and soon you will be getting an email confirming that your account has been opened.

As soon as your account has been set up, your virtual debit and credit cards become available to you. As simple as that. No waiting in line to get things done. The Sable account was designed to make things simple.

Trending Topics

Horizon blockchain bridge targeted in massive crypto heist

$100 million-worth of cryptocurrency was stolen as part of a coordinated heist that targeted blockchain company, Horizon.

Keep Reading

Upgrade Triple Cash Rewards Visa® Credit Card Review

The Upgrade Triple Cash Rewards Visa® Credit Card has an excellent performance, with good cashback rates. It will optimize your money.

Keep Reading

What are the retirement accounts alternative to a 401(k) plan?

If you're looking for retirement accounts that will give you the most financial freedom, skip the 401(k). Here are two better options.

Keep ReadingYou may also like

Destiny Mastercard® Review: Reach Better Credit!

In our Destiny Mastercard® review, you’ll learn about this product that can help you repair your credit and build a strong financial future.

Keep Reading

Unlock Your Home’s Value Today: PNC HELOC Review

Get the facts in our review before you commit to a PNC HELOC. Discover what credit score you need, potential tax benefits, and more!

Keep Reading

Credit Cards for Good Credit: Compare the 4 Top Options

If you have a good credit history, these are the best credit cards to choose from. Compare features and find the card that's right for you.

Keep Reading