Credit Cards

U.S. Bank Visa Platinum® Card Review

This in-depth review will determine if the U.S. Bank Visa Platinum® Card is right for you. We cover everything from rewards to fees so you can make an informed decision!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

No annual fees, 0% APR for the first 21 billing cycles, and more!

Are you in the market for a credit card that can give you an easy and convenient way to manage your finances? Then look no further than this U.S. Bank Visa Platinum® Card review!

This card has zero annual fees, and many other unique benefits. Join us as we dive into this U.S. Bank Visa Platinum® Card review so you can decide if it’s right for you!

- Credit Score: Good/Excellent;

- Annual Fee: $0;

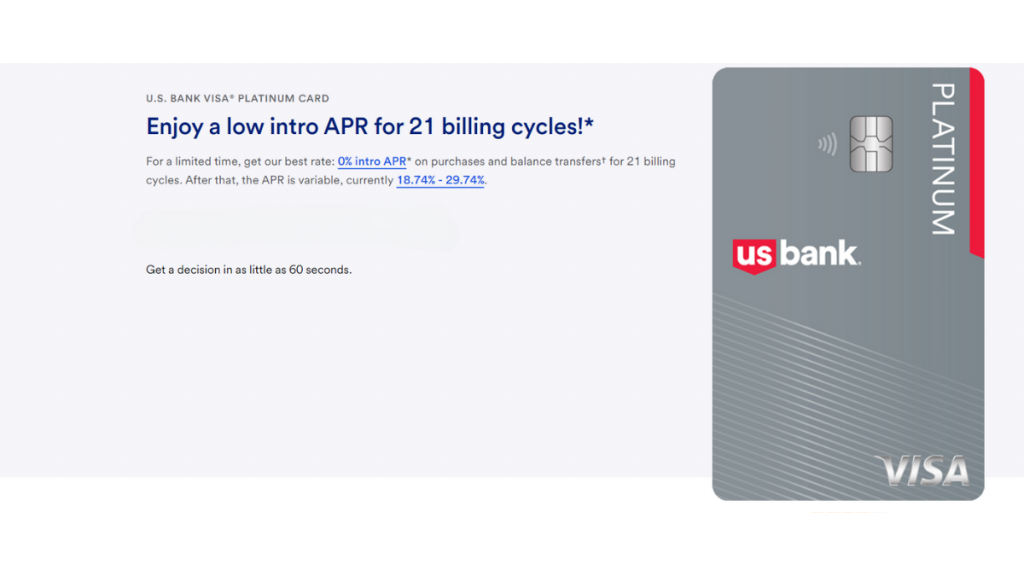

- Regular APR: 0% introductory APR for the first 21 months for purchases and balance transfers. After that, 17.24% – 28.24% (Variable);

- Welcome bonus: N/A;

- Rewards: Coverage against damage or theft of cell phones up to US$ 600.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the U.S. Bank Visa Platinum® Card work?

In this review, we brought the U.S. Bank Visa Platinum® Card. This credit card option is available to people with excellent or very good credit scores.

Furthermore, there is no annual fee associated with it. The card also guarantees a 0% introductory bonus for the first 21 months.

Although it is not a card with benefits, you can get cell phone theft protection. In this way, you can protect your mobile devices from misfortunes.

U.S. Bank Visa Platinum® Card pros and cons

The U.S. Bank Visa Platinum® Card in this review is not a great option for those with daily expenses. After all, you won’t get cashback returns or interesting rewards.

However, you will enjoy the benefit of cell phone theft protection. This way, it keeps your device protected. Moreover, check out this card’s main pros and cons and make your choice.

Pros

- It has no associated annual fee;

- Very interesting introduction bonus with 0% APR in the first year;

- Insurance against theft of mobile devices that pays off;

- Flexibility in choosing the date for monthly payment.

Cons

- There are no rewards programs like other cards;

- There is a balance transfer fee that applies to each transaction;

- Demands a high credit score but almost no benefits in return.

Want to apply for the U.S. Bank Visa Platinum® Card?

In this review, the U.S. Bank Visa Platinum® Card has a 0% APR introductory bonus for the first year. In addition, it has protection against cell phone theft.

However, it is important to be over 18 and have a good credit score to apply. Also, know how to apply. Check out all the process below.

Does my credit score need to be good?

A credit score is required to take advantage of everything this review showed about the U.S. Bank Visa Platinum® Card.

After all, a good or excellent credit score is essential to apply for and have your card. That is, you must have a score between 690 and 850 to enjoy the benefits.

However, the lower your score, the higher the associated APR.

Requirements

Here are the eligibility criteria to apply for the U.S. Bank Visa Platinum® Card:

- Minimum Age: You must be 18 or older (or the legal age of majority in your state).

- Residency: Applicants must have a valid U.S. physical address and reside in the United States.

- Identification: A valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is required.

- Income Information: You need proof of steady income to confirm your payment ability.

- Credit Score: This card is designed for individuals with good to excellent credit (typically a credit score of 700 or higher).

- Financial History: Your credit history will be reviewed to ensure you demonstrate responsible financial behavior, including on-time payments and manageable debt.

These factors help determine your eligibility and creditworthiness for the U.S. Bank Visa Platinum® Card.

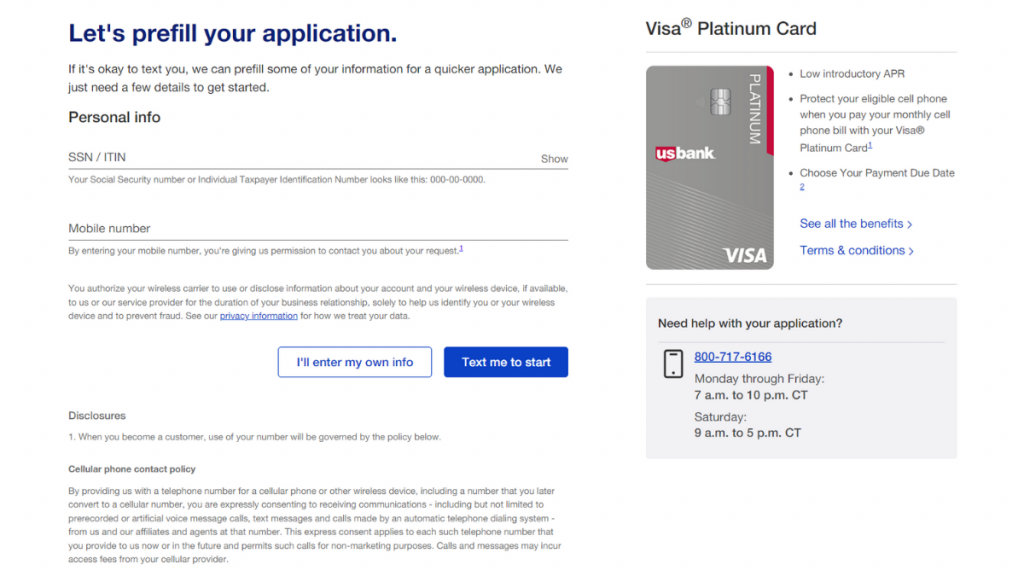

Apply online

Applying for the U.S. Bank Visa Platinum® Card is easy and convenient, with everything being done online through the website.

All you need is your financial information, personal data, and Social Security number. The process is straightforward! As a result, you can be approved in as little as 60 seconds.

There’s no need to worry about complex applications or hidden fees. Just apply online, and you’re on your way to enjoying all the U.S. Bank Visa® Platinum benefits.

Apply using the app

To apply for the U.S. Bank Visa Platinum® Card, you must use either a website or an app. Unfortunately, it cannot be done exclusively via the app itself.

You must provide your financial, personal, and security information when applying. It is also important to ensure that you are older than 18 years of age and currently residing in the U.S.

Once your account has been successfully opened, you can easily download and install the app via the respective store on your device and keep track of your finances.

U.S. Bank Visa Platinum® Card vs. Aspire® Credit Card

If you’re looking for a good credit card with no annual fee, the U.S. Bank Visa Platinum® is a great option.

With a 0% introductory APR for 21 months on both purchases and balance transfers, it’s a great way to save on interest.

The Aspire® Credit Card also has no annual fee. You can earn 3% cash back rewards on qualifying gas, grocery, and utility purchases and some payments.

Moreover, plus 1% cash back on any other eligible purchase if you enroll in the cash-back rewards program.

U.S. Bank Visa Platinum® Card

- Credit Score: Good/Excellent;

- Annual Fee: $0;

- Regular APR: 0% introductory APR for the first 21 months for purchases and balance transfers. After that, 17.24% – 28.24% (Variable);

- Welcome bonus: N/A;

- Rewards: Coverage against damage or theft of cell phones up to US$ 600.

Aspire® Credit Card

- Credit Score: 300 to 850;

- Annual Fee: $49 to $175. Then, $0 to $49 annually;

- Regular APR: 29.99% or 36% variable APR for purchases;

- Welcome bonus: None;

- Rewards: 3% cash back rewards on qualifying gas, grocery, and utility purchases and some payments. Also, you can earn a 1% cash-back reward on any other eligible purchase (valid if you enroll in the cash-back rewards program);

- Terms apply.

The Aspire® Credit Card is an excellent alternative. Want to know how to apply? Then check out the post we separated.

Aspire® Credit Card full review

Having a good credit score is not always possible, and you may need a credit card in these cases. Learn more about the Aspire® Credit Card.

Trending Topics

Netspend® Prepaid Card Review

The Netspend® Prepaid Card review is a solid option for anyone who wants to avoid high fees. Check out more!

Keep Reading

United℠ Business Card Review: Amazing Rewards

Find out how the United℠ Business Card can help you earn rewards and bonuses on your business expenses in this review!

Keep Reading

Discover Student Loan or Sallie Mae Student Loan: pros and cons

Need help completing your studies? Know about Discover Student Loan or Sallie Mae Student Loan. There are two great options!

Keep ReadingYou may also like

5kFunds personal loan review: is it worth it?

Difficulties appear when we least expect them, right? Find out everything 5kFunds personal loan has to help you in these moments!

Keep Reading

Upgrade Cash Rewards Visa® credit card full review

Want a card with good cashback and fixed monthly fees? Then, read on to learn about the Upgrade Cash Rewards Visa® credit card.

Keep Reading

Luxury Titanium or Luxury Gold card: find the best choice!

Torn between the Luxury Titanium or Luxury Gold? We can help you decide! Check this review to see what these premium cards have to offer.

Keep Reading