Financial Education

What credit score do you need to lease a car?

Discover what credit score you need to qualify for a lease, as well as other factors that can impact your ability to get approved!

Advertisement

Leasing a car requires a good credit score

Are you wondering what is the ideal credit score to lease a car? Your credit score is essentially a measure of how well you handle credit and how financially reliable you are!

Tier 1 Credit 101

What is Tier 1 Credit? It is a common question among borrowers seeking the best credit opportunities. Keep reading to learn more!

A higher score can help you secure better leasing terms. So, what credit score do you need to lease a car? Let’s explore this question in more detail.

Understanding Credit Scores

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

There are three main credit bureaus – Equifax, Experian, and TransUnion – that each generate their credit reports and scores based on your credit history.

Your credit score is based on several factors, including your payment history, credit utilization, length of credit history, types of credit, and new credit.

Credit utilization refers to the amount of credit you use relative to your credit limit. Length of credit history looks at how long you’ve been using credit.

Types of Credit refer to the mix of credit you have, such as credit cards, loans, and mortgages. Finally, new credit looks at how much new credit you’ve applied for recently.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Credit Scores and Leasing a Car

When you apply for a car lease, the leasing company will typically run a credit check to determine your creditworthiness.

They’ll look at your credit score and credit report to see how you’ve managed credit in the past. This information helps them assess the risk of leasing a car to you.

So, what credit score do you need to lease a car? While there’s no set answer, most companies prefer to work with customers with a credit score of 700 or higher.

This is considered a good credit score and shows that you’re a reliable borrower who’s likely to make your lease payments on time.

If your credit score is below 700, don’t worry – you may still be able to lease a car. However, you’ll likely face higher interest rates and monthly payments.

What happens if I don’t have a good credit score to lease a car?

If you plan to lease a car, having a good credit score is crucial.

A credit score is a reflection of how well you have managed your finances in the past, and it can affect your ability to get approved for a lease and the terms you’re offered.

Most car leasing companies require a credit score of at least 680 to qualify for a lease. But what happens if your credit score is below 680? Check out more.

Higher Interest Rates

If your credit score is below 680, leasing companies may consider you a risky borrower.

As a result, they may require you to pay a higher interest rate to compensate for the perceived risk.

This can make your monthly lease payments higher than someone with a good credit score.

Is $5000 enough to move out?

Moving can be expensive, but it doesn't have to break the bank. Discover effective ways to save money on your next move!

Higher Down Payment

In addition to higher interest rates, leasing companies may require a larger down payment if you have a credit score below 680.

This is because a higher down payment reduces the risk for the leasing company.

The down payment amount will vary depending on the leasing company and the vehicle you’re leasing.

Limited Vehicle Selection

Having a credit score below 680 can also limit your selection of vehicles.

Leasing companies may only approve you for certain models or makes, which may not be your first choice.

Additionally, some leasing companies may not approve you for a lease at all if your credit score is too low.

Co-signer Requirement

Another option, if you have a credit score below 680, is to have a co-signer.

A co-signer is someone who agrees to assume responsibility for the lease if you’re unable to make the payments.

Having a co-signer with a good credit score can increase your chances of getting approved for a lease and can also result in better lease terms.

Rejection of Lease Application

Lastly, having a credit score below 680 can result in the rejection of your lease application altogether.

Some leasing companies have strict credit requirements and may not approve your application if your credit score is too low.

In this case, it’s important to take steps to improve your credit score before reapplying for a lease.

Tips for Improving Your Credit Score

If you’re planning to lease a car in the near future, it’s a good idea to work on improving your credit score. Here are a few tips to help you get started:

- Make your payments on time. Payment history is the most important factor in your credit score, so it’s essential to make your payments on time each month;

- Keep your credit utilization low. Try to keep your credit card balances below 30% of your credit limit. This shows you’re using credit responsibly and not maxing out your cards;

- Check your credit report regularly. Look for errors or inaccuracies on your credit report and dispute them with the credit bureaus if necessary;

- Avoid applying for new credit. Applying for new credit can lower your credit score, so try to avoid applying for credit cards or loans unless you really need them;

- Build a longer credit history. If you’re just starting with credit, try to build a longer credit history by opening a credit card or taking out a small loan.

When it comes to leasing a car, your credit score is a crucial factor that can affect your leasing terms.

Bottom Line

While there’s no set credit score that you need to lease a car, most leasing companies prefer to work with customers with a credit score of 700 or higher.

If you don’t get a good credit score to rent a car, you can consider a loan for this purpose. Check out some personal loan options below.

Choose the perfect loan for your finances

Need a new car, home repairs, money for a wedding, or just some extra cash? Compare options and choose a loan for you.

Trending Topics

Is it possible to make money during a bear market?

Learn about the opportunities that exist in a bear market and how you can take advantage of them to grow your portfolio long-term.

Keep Reading

How to do a balance transfer in 10 simple steps

Learn how to do a balance transfer in 10 simple steps and save money on high-interest credit card debt. Keep reading and learn more!

Keep Reading

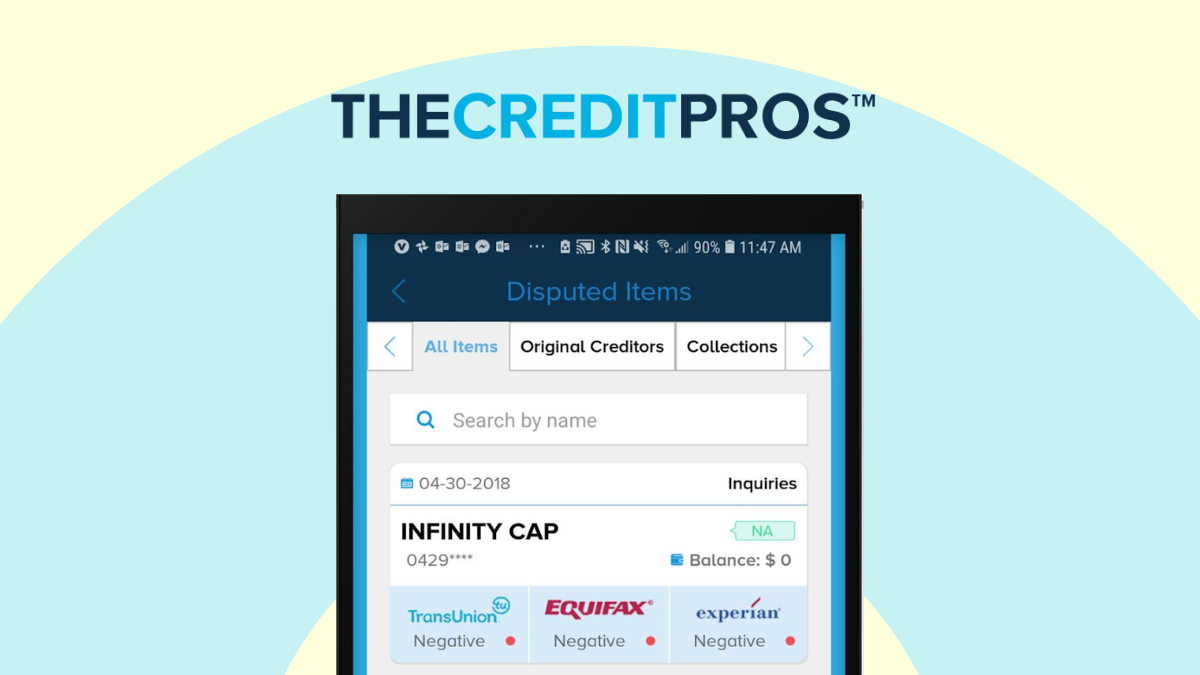

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep ReadingYou may also like

LendingClub Personal Loan review: is it worth it?

Read our LendingClub personal loan review and find out if it's right for you. No hidden fees, and fast funding. Read on for more.

Keep Reading

Credit-builder loans: get the help you need to improve your credit score

Need to build credit or improve your credit score? Then you need to know about credit-builder loans. Check out!

Keep Reading

Unlock your power: OnPoint Community Credit Union HELOC review

Unlock the power of your home equity! Read our OnPoint Community Credit Union HELOC review and learn to enjoy flexible conditions!

Keep Reading