Loans

Up to $250K quickly: Apply now for Alliant Credit Union HELOC

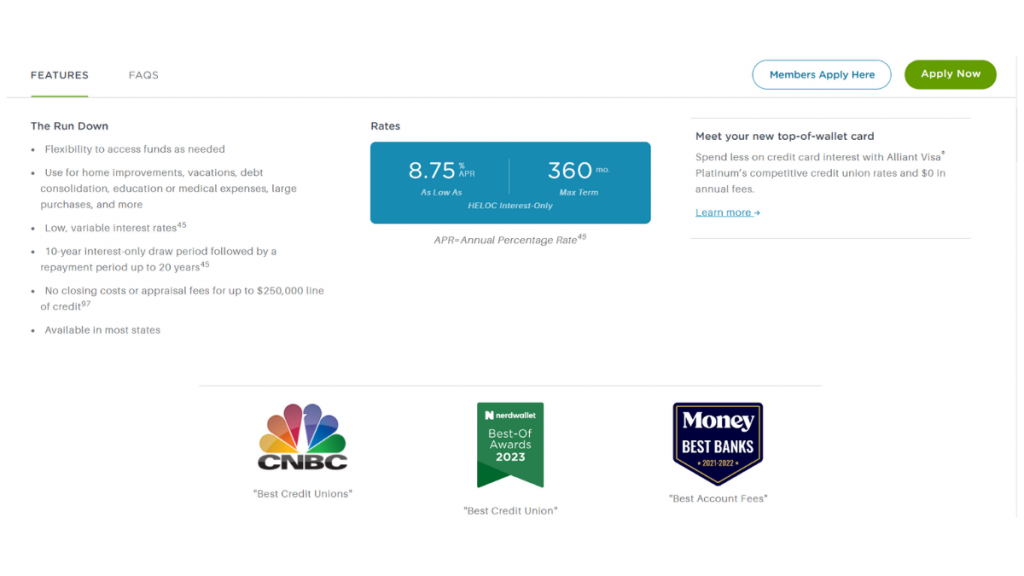

Get access to flexible financing options - up to $250,000 fast! Discover how to apply for Alliant Credit Union HELOC!

Advertisement

All information on a unique website for fast funds

Alliant Credit Union HELOC might be the right option if you’re in the market for a home equity line of credit and we’ll teach you how to apply for it today!

Moreover, it’s perfect for homeowners looking into their home’s equity. So here’s what you need to know to apply for an Alliant Credit Union HELOC.

Apply online

Indeed, to apply for an Alliant Credit Union HELOC online, follow these simple steps:

- Visit the Alliant Credit Union website and navigate to the HELOC page;

- Click on the “Apply Now” button;

- Enter your personal information, such as your name, address, and social security number;

- Provide information about the property you are using as collateral for the loan.

- Input your employment information and income details;

- Review your application and submit it for review.

After submitting your application, you will receive an email confirmation. Alliant Credit Union will review your application and let you know if you have been approved.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Requirements

To be eligible for an Alliant Credit Union HELOC, you must have a minimum credit score 660 and at least 20% equity in your home.

You’ll also need to provide proof of income and other financial information.

Alliant Credit Union doesn’t disclose its origination fees but charges a $200 early payoff penalty.

Apply on the app

Indeed, if you prefer to apply for a HELOC on the go, Alliant Credit Union offers a mobile app that you can download for free.

Thus, the app allows you to check your account balances, make payments, and even apply for a HELOC directly from your phone or tablet.

Alliant Credit Union HELOC vs. PenFed HELOC: which one is the best for you?

When choosing between Alliant Credit Union and PenFed HELOCs, there are a few key factors to consider.

Indeed, Alliant Credit Union offers a slightly lower minimum loan amount.

In terms of credit requirements, Alliant Credit Union doesn’t disclose its minimum credit score requirement, while PenFed requires a minimum credit score of 660.

Furthermore, your best HELOC will depend on your needs and financial situation.

Further, we recommend comparing rates and terms from both lenders to determine which one fits you. So, check out!

| Alliant Credit Union HELOC | PenFed HELOC | |

| APR | Starting at 8.75%; | Rates starting at 8.625%; |

| Loan Purpose | Home improvements, vacations, consolidate debt, large expenses, and more; | Debt consolidation, home improvement, large purchases, and more; |

| Loan Amounts | Up to $250,000; | $25,000 to $500,000; |

| Credit Needed | Not Disclosed; | 660 Minimum |

| Terms | 10-year draw period and 20-year repayment; | Draw: 10 years, Repayment: 20 years; |

| Origination Fee | Not Disclosed; | Not Disclosed; |

| Late Fee | Not Disclosed; | 5%; |

| Early Payoff Penalty | Not disclosed. | Not Disclosed. |

So we’ve provided an overview of the Alliant Credit Union HELOC and compared it to PenFed HELOC to help you make an informed decision.

However, if you’re interested in applying for a PenFed HELOC, check out our article on “How to Apply for a PenFed HELOC” for more information.

Get up to $500K quickly: Apply for PenFed HELOC

Learn how to apply for a PenFed HELOC now – get the money you need quickly and use it for several purposes! Keep reading and learn more!

Trending Topics

A guide to Chase Ultimate Rewards partners: learn all the benefits!

Do you know how Chase Ultimate Rewards partners can help you maximize your points in amazing travel opportunities. Learn all about it!

Keep Reading

The current state of the stock market: is the US in a bear market?

The great world economic crisis is raising a question: is the US in a bear market? We have separated some information that will answer.

Keep Reading

Flexible financing options: MyPoint Credit Union HELOC review

Read our MyPoint Credit Union HELOC review and discover the perfect product for you! Enjoy a promotional 1.01% off on your APR and more!

Keep ReadingYou may also like

Start today investing in Canada: an easy guide for beginners

This article will explain how you can start investing in Canada. It includes the steps needed and a few tips on making it work for you!

Keep Reading

SoFi Private Student Loan review: is it worth it?

Looking for a student loan? This SoFi Private Student Loan review will point you in the right direction. Enjoy flexible terms and more!

Keep Reading

Sable account review: read before applying

Need a Sable account review you can rely on? We got you! In this review we cover fees, perks, benefits, its pros and its cons.

Keep Reading