Reviews

Applying for the PREMIER Bankcard® Mastercard® Card: learn how!

Not everyone has a good credit history, but everyone needs a good credit card. Learn how to apply for the PREMIER Bankcard® Mastercard® Card and get an unsecured credit line up to $700.

Advertisement

PREMIER Bankcard® Mastercard® Card: fast and easy application

Getting a credit card with a bad credit score is a great difficulty for many. But the PREMIER Bankcard® Mastercard® Card is a solid option that can save you if that’s your situation.

However, it is not just the score that will be taken into account for approval. It is essential that your data is filled in correctly, as it increases the chances. So, check out how to apply correctly.

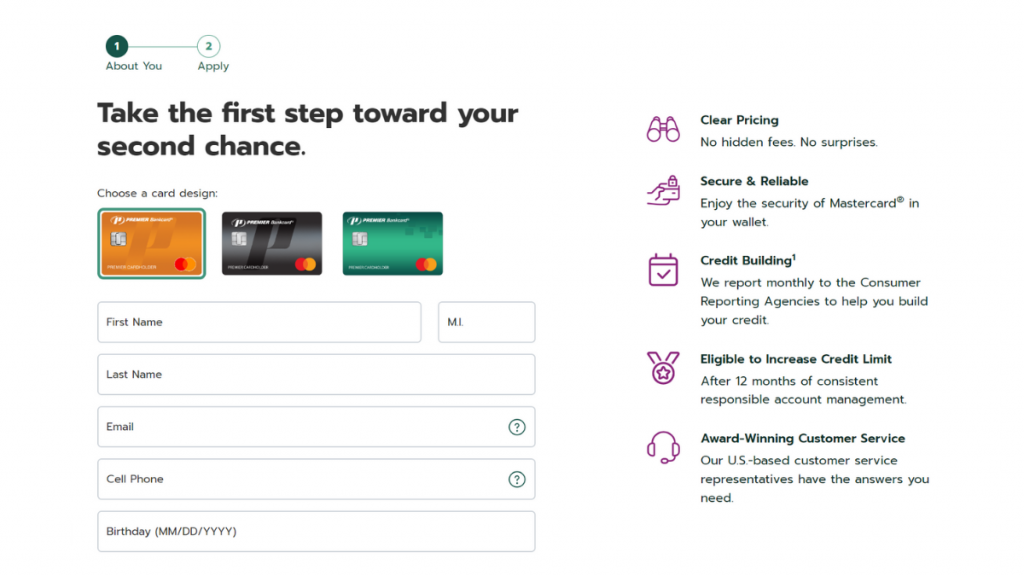

Apply online

Visit PREMIER Bankcard®’s official website. Then, on the homepage, look for the “Apply Now” option for the Mastercard® Card. Click on it to get started.

You’ll be prompted to enter your personal details. This typically includes your name, email, date of birth, and cell phone number. Ensure accuracy for smooth processing.

Next, take a few minutes to review the card’s fees, interest, and important disclosures. Then, check the box agreeing to the Communications Authorization and click on “continue”.

Then, provide employment details and income information. This helps determine your credit limit and approval. Always be honest and provide up-to-date details.

Once you’ve reviewed your application, click on the “submit” button. Wait for the system to process your information; this may take a few moments.

Most online applications offer instant decisions. If not, you’ll receive an email about your application results. Check your email regularly.

If approved, your new PREMIER Bankcard® Mastercard® Card should arrive at your address within a few business days.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

The PREMIER Bankcard® Mastercard® mobile app lets you effortlessly track balances and transactions. You can also make payments, and much more.

However, you cannot apply for the PREMIER Bankcard® Mastercard® Card through it.

Applying online ensures stronger security protocols, and the website’s designed to handle the rigorous checks, guaranteeing your data’s safety.

So while the website handles applications, the app’s tailored for current cardholders. It provides a clear and intuitive experience for account management only.

PREMIER Bankcard® Mastercard® Card vs. First Savings Card

The PREMIER Bankcard® Mastercard® can be a very good option for anyone looking to build credit.

It provides an unsecured credit line, and you can even waive the monthly fee depending on your creditworthiness.

However, a good alternative lies in the First Savings Credit Card. You can get fraud coverage, and there is no penalty APR! Check out the comparison below.

PREMIER Bankcard® Mastercard® Card

- Credit Score: A 500+ score is required;

- Annual Fee: $50 – $125 depending on your creditworthiness;

- Regular APR: 36%;

- Welcome bonus: N/A;

- Rewards: N/A.

First Savings Card

- Credit Score: N/A;

- Annual Fee: It depends on your card and credit score;

- Regular APR: N/A.;

- Welcome bonus: N/A;

- Rewards: N/A.

Do you want to learn more about the First Savings Card’s offerings? Then you can check out our post below to learn all about the application process for this card!

Applying for the First savings card: learn how!

Applying for the First Savings credit card is simple. But can you do it? This article will give you the answer.

Trending Topics

How to Save Money: The Best Tips and Tricks

Learn the best tips on how to save money effectively! Discover smart, easy strategies for maximizing your savings and financial growth.

Keep Reading

Applying for The Credit Pros: get debt relief!

You can repair your credit with The Credit Pros. Just read this content and learn how to fix your credit and get your finances on track.

Keep Reading

The Robinhood Investing brokerage platform full review

The Robinhood Investing brokerage platform was designed for inexperienced investors to start building their portfolios fast and easy.

Keep ReadingYou may also like

Apply for the Employee Retention Tax Credit and earn up to $26k/Employee!

Learn how to earn up to $26k per employee through the Employee Retention Tax Credit. Find out how to apply in our comprehensive guide.

Keep Reading

Mercury Mastercard Credit Card full review

If you're looking for a card to build credit, with low rates and no annual fees, you should check this Mercury Credit Card review!

Keep Reading

ELFI Student Loan: how to apply now!

Applying for an ELFI Student Loan is easy! Enjoy low rates and several benefits. Keep reading and learn more!

Keep Reading