Credit Cards

Applying for the X1 Credit Card: learn how!

Have you been thinking about getting a new credit card? Here's a step-by-step guide to applying for and using the X1 credit card. No annual fee!

Advertisement

Simple, fast, and fully online application to release points earning

Do you have your eye on the X1 Credit Card but aren’t sure how to apply? Don’t worry! We’re here to help you!

Here, you’ll find out the requirements and the right documentation! So if you’re looking for an easy way to get started, read our guide now!

Apply online

Applying for the X1 Credit Card couldn’t be simpler: just fill in the application form easily found on the official website.

As long as you are over 18 and a U.S. resident, you only need to enter personal data, like your name, address and social security number, and bank details.

In addition, you’ll also have to provide your credit score. They’ll review your application – which takes just minutes.

If approved, you can enjoy all the exclusive benefits before you know it.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

The application for the X1 Credit Card is made exclusively through the website.

However, if you want to apply via mobile devices, you can access your smartphone or tablet browser and start the procedure.

In this sense, you must complete the same form with personal and financial information.

Then simply submit your proposal and wait for the credit analysis that does not affect your credit score.

X1 Credit Card vs. Wells Fargo Autograph℠ Card

X1 Credit Card is an excellent choice for those looking to reap the rewards of their purchases.

However, consider the Wells Fargo Autograph Card if you seek a card with more immediate bonus rewards.

After all, he offers 20,000 bonus points after $1,000 worth of purchases in the first three months.

Furthermore, the Autographś Card also offers a great deal with 3X on restaurants, travel, and other eligible purchases and 1X points on other purchases.

Are you interested in learning more? Then see the comparison and choose the best card for you!

X1 Credit Card

- Credit Score: Excellent/Good Credit;

- Annual Fee: $0;

- Regular APR: 15.50% – 27.75% Variable;

- Welcome bonus: None;

- Rewards: 3x points per dollar every time you spend $1k monthly, 2x points on all purchases, and more.

Wells Fargo Autograph℠ Card

- Credit Score: 690-850 (Good – Excellent);

- Annual Fee: $0;

- Regular APR: 0% intro APR on Purchases for 12 months from account opening. Then, 19.49%, 24.49%, or 29.49% Variable APR;

- Welcome bonus: Limited offer of 20,000 bonus points after $1,000 worth of purchases in the first three months;

- Rewards: 3X on restaurants, travel, and other eligible purchases; and 1X points on other purchases;

- Terms apply.

The Wells Fargo Autograph℠ Card is a great addition to the X1 Credit Card. After all, you have a welcome bonus of 30,000 points.

Check the post below for the documentation required to apply.

How to apply Wells Fargo Autograph℠ Card

Find out how to apply for the Wells Fargo Autograph℠ Card. Enjoy rewards and no annual fee. Read on and learn more!

Trending Topics

Applying for the Sable Account: learn how!

This is a quick step-by-step guide with all the information you need to open your Sable Account today in just a few minutes!

Keep Reading

Who can Apply for the Navy Federal HELOC? Answers here!

Read on for a comprehensive guide on how to easily apply for a Navy Federal HELOC within minutes, covering all necessary steps.

Keep Reading

IHG® Rewards Traveler Credit Card full review

Read our IHG® Rewards Traveler Credit Card review and learn how to benefit from this card. Earn up to 17X points for every $1 spent!

Keep ReadingYou may also like

Net First Platinum credit card full review

The Net First Platinum credit card is the perfect card for individuals who shop at the Horizon Outlet website. Check it out!

Keep Reading

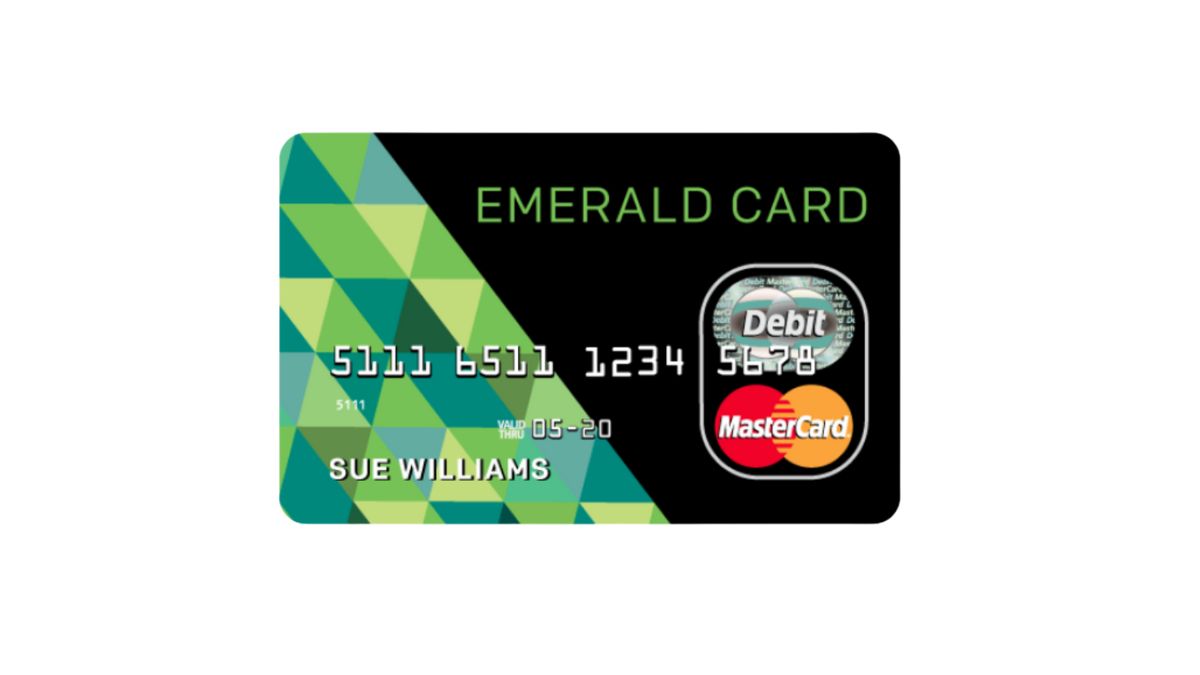

Applying for the H&R Block Emerald Prepaid Mastercard®: learn how!

The H&R Block Emerald Prepaid Mastercard® might be what you're looking for if you don't have a good credit score. Learn how to apply today!

Keep Reading

Merrick Bank Personal Loan application: how to apply now!

The Merrick Bank Personal Loan application process is simple and straightforward, and approval comes out within a day. Come and get it!

Keep Reading