Credit Cards

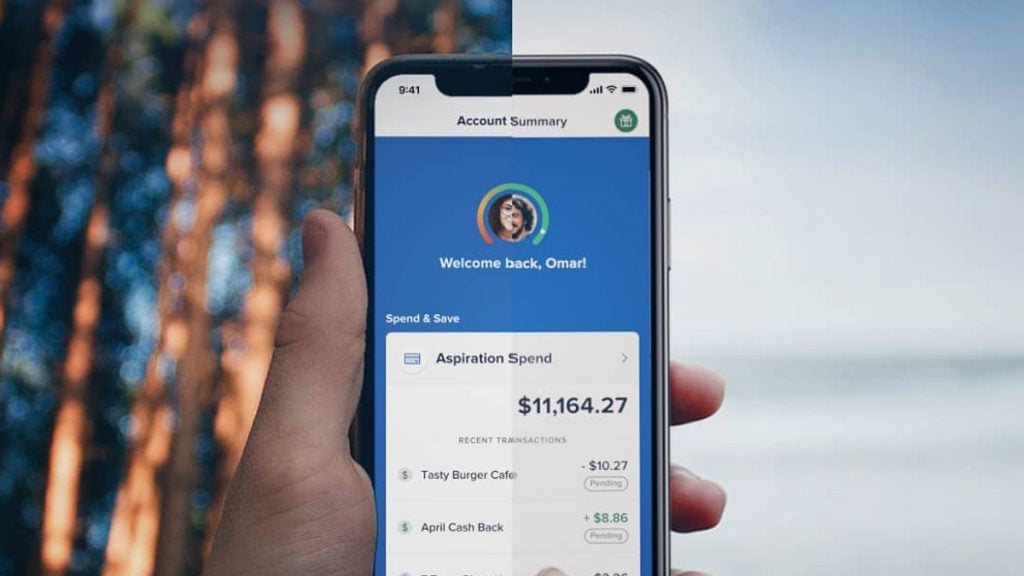

Applying for the Aspiration Spend & Save™ card: learn how!

Learn about the minimum requirements, where to get started and what you need to know when applying for an Aspiration Spend & Save™ debit card.

Advertisement

Aspiration Spend & Save™ Card: ready to build your credit score with as little as $0 monthly fees?

Looking for a way to easily and securely manage your finances? The Aspiration Spend & Save™ card may be just what you need! This card allows you to spend money and save money in a variety of ways, making it a great option for those looking for both convenience and value.

So, after doing your due diligence and learning about a number of debit card options, their pros and cons, benefits and perks, you have finally decided the Aspiration Spend & Save debit card is the right fit for your needs. Awesome! Now it’s time to roll up your sleeves and get that application going.

Applying for the Aspiration Spend & Save debit card is a very straightforward process which shouldn’t take you more than a few minutes. To make it even easier for you, we put together a step-by-step guide on how to apply. Check it out.

Apply Online

Log on to the Aspiration Spend & Save website where you will find the button “get started” at the top right corner of the page. Click on that button.

You will be taken to a page where you should add your email address. That will immediately take you to your card options.

After you have picked your card, you will be required to add some personal info such as your first and last name and birthday.

Once you have done that, click next and add in your social security number so that the platform can verify your identity. You will also be asked to enter your contact information with your mobile phone number and home address.

As soon as you confirm your home address, the website is going to send you a PIN number so that you can verify your phone number, and you are on your way to getting approved for the Aspiration Spend & Save debit card.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Another card recommendation: Revvi credit card

If you’re not sure that the Aspiration Spend & Save™ card is the best choice for you, we brought another option! The Revvi card is a great option for those looking to repair damaged credit. Besides, you can earn 1% cash back after just 6 months. Check its main features below and follow the recommended content for the application process!

| Revvi credit card | |

| Credit Score | Bad or limited |

| Annual Fee | $75 |

| Regular APR | 34.99% |

| Welcome bonus | N/A |

| Rewards | 1% cash back on every purchase |

How to apply for Revvi Credit Card?

See how to apply for a Revvi card and earn cash back while you rebuilt your credit score!

Trending Topics

What is a mortgage statement?

A mortgage statement is an important document that provides essential information about your mortgage loan. But, what is this? Learn now!

Keep Reading

Different types of loans available: which one is right for you?

Need a loan but don't know which one to choose? Don't worry. We'll help you. Check out the different types of loans.

Keep Reading

Avant Personal Loan: how to apply now!

Learn how to apply for Avant Personal Loan fast! Ensure up to $35,000 and fulfill your financial needs! Keep reading and learn more!

Keep ReadingYou may also like

Bilt Mastercard® full review

Are you looking for a new credit card? Check out our Bilt Mastercard® review. Earn points and pay no annual fee!

Keep Reading

Netspend® Prepaid Card review

The Netspend® Prepaid Card review is a solid option for anyone who wants to avoid high fees. Check out more!

Keep Reading

X1 Credit Card full review: earn up to 10x points

Check out our review of the X1 Credit Card to see how it can help you. Earn points on purchases and pay no annual fee!

Keep Reading