Credit Cards

Apply for the Mission Lane Visa® Credit Card: Learn how!

Looking to apply for the Mission Lane Visa® Credit Card but don’t know how? We’ll give you a hand getting yours today!

Advertisement

Mission Lane Visa® Credit Card: Bad credit? No problem! Can’t make an initial deposit? No problem either!

Let me take a wild guess about why you’re ready about the Mission Lane Visa® Credit Card. If you are reading this it means possibly two things.

The first is that you have a less than perfect credit score. The second is that you are looking for an easy-to-follow step-by-step guide to how to apply for this card.

If so, then search no longer! Applying for the Mission Lane Visa® Credit Card is a very simple process which will take you only a few minutes.

Apply Online

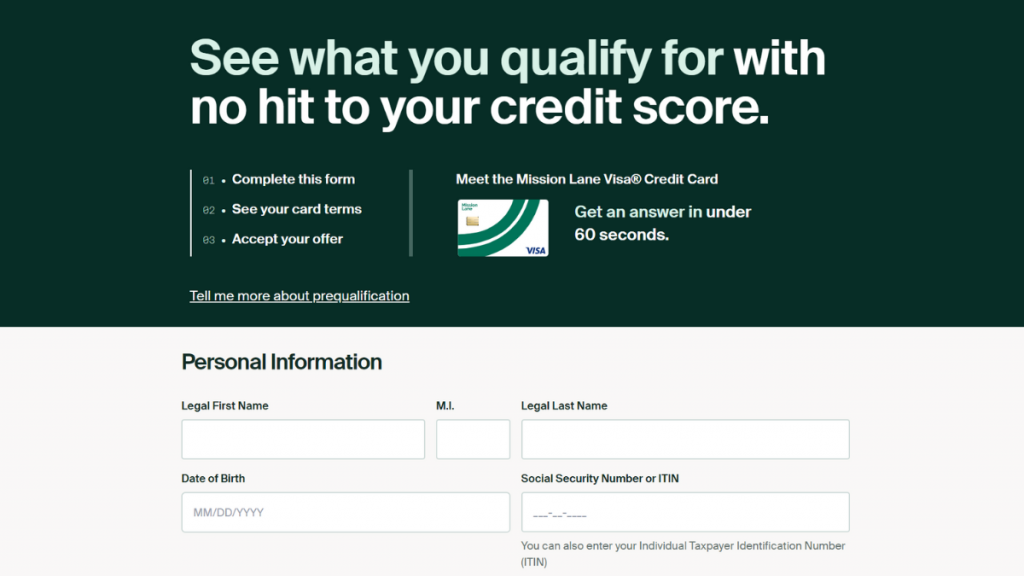

On Mission Lane’s website, hit the “See if I’ll Be Approved” button in the middle of the page. This should take you to a second page. In it you will find a summary of the approval process.

Read it and click on the “See if I’ll Be Approved” button once again. This will take you to Mission Lane’s secure application form.

On the form page enter your personal information such as first and last name, date of birth, Social Security Number and home address with Zip code.

This is the address you will receive your Mission Lane Visa®, so make sure it’s correct.

Next, the website asks you for some financial details such as whether you rent or own a home, your monthly rent or mortgage payment, employment status and total annual income.

You must also inform them of the type of bank accounts you have. Now fill in your contact info with email address and personal phone number.

Lastly make sure to check the boxes at the end of the application form to confirm you agree with Mission Lane’s privacy terms. Then click on “See if I’ll Be Approved”.

The website is going to run its algorithmic check on you for a few seconds, and once it is done, you will be shown a statement informing whether you have or haven’t been approved and why.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Mission Lane Visa® Credit Card vs. Upgrade Bitcoin Rewards Visa® Credit Card

Maybe you are looking for a more rewards-oriented credit card. How about instead of simply getting cash back, you get rewards in one of the most promising technologies in the history of money?

With the Upgrade Bitcoin Rewards Visa® Credit Card you get 1.5% cash back in bitcoin which is kept in a safe digital wallet until you decide to cash it in.

Check out a comparison between the Mission Lane Visa® Credit Card and this rewards-oriented card. One of them is likely right for you.

| Mission Lane Visa® Credit Card | Upgrade Bitcoin Rewards Visa® Credit Card | |

| Credit Score | Bad to Fair | Average |

| Annual Fee | $0 | $0 |

| Regular APR | 29.99-33.99% variable. | 14.99%-29.99% variable. |

| Welcome bonus | N/A | None |

| Rewards | N/A | Unlimited 1.5% cash back on every purchase |

How to apply for the Upgrade Bitcoin Rewards Visa®

Here's a step-by-step guide for you to get your card and start earning bitcoin ASAP.

Trending Topics

5 best cards that offer welcome bonuses: choose and enjoy!

Wondering what are the cards that offer welcome bonuses? Check out the best sign-up rewards products and start earning points today!

Keep Reading

FIT™ Platinum Mastercard® Review

If you're having trouble getting a credit card because of a poor credit score, check the FIT™ Platinum Mastercard® terms in this review.

Keep Reading

Temporary Assistance for Needy Families (TANF): get the help you need

Do you know what Temporary Assistance for Needy Families (TANF) is? It is a social program that lifts families out of poverty. Read on!

Keep ReadingYou may also like

Netspend® Prepaid Card review

The Netspend® Prepaid Card review is a solid option for anyone who wants to avoid high fees. Check out more!

Keep Reading

Savings vs. Checking Accounts: A Comprehensive Comparison

Savings vs. checking accounts: Discover their contrasts and similarities to identify the right one. Learn more!

Keep Reading

Citizens Bank HELOC: how to apply now!

Interested in a home equity line of credit from Citizens Bank with flexible terms? Learn how to apply for Citizens Bank HELOC!

Keep Reading