Credit Cards

Capital One SavorOne Rewards for Students Credit Card Review

Are you a student in need of a credit card? If so, the Capital One SavorOne Rewards for Students can help you out. Read our review to learn more!

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Get incredible rewards for no annual fee

Do you already know the Capital One SavorOne Rewards for Students credit card? It’s the ideal option for you who are starting in life and need to build a credit score for your routine.

With this card, you can get unlimited cash back of up to 3% on restaurants and 1% cash back on other purchases. Amazing, Huh? Capital One’s credit card offers:

- Credit Score: Fair

- Annual Fee: $0

- Regular APR: 18.74%, 24.99% or 28.74% based on your creditworthiness for purchases (variable)

- Welcome bonus: Earn a one-time $50 cash bonus after spending $100 on purchases in three months from your account opening

- Rewards: 8% cashback on tickets purchased through the Vivid Seat platform, 5% on hotels and car rentals through Capital One Travel, unlimited 3% cash back on dining, entertainment, streaming services, and at grocery stores, and 1% cash back for other purchases

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Capital One SavorOne Rewards for Students credit card work?

The SavorOne Rewards for Students is a model to meet the main needs of students who have low credit limits and need to build a history.

However, the cashback package gets 8% on tickets purchased exclusively through the Vivid Seat platform.

Furthermore, get 5% on hotels and car rentals through Capital One Travel, and 3% on restaurants, streaming services, or grocery stores.

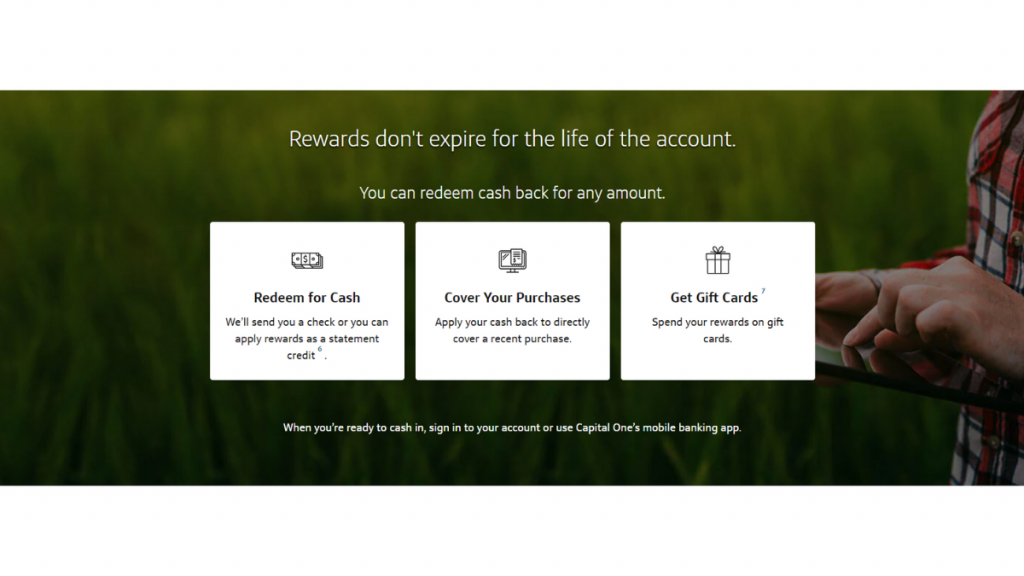

You can choose to receive by check, PayPal, gift card, or statement credit, in any amount and date.

Capital One SavorOne Rewards for Students card pros and cons

The SavorOne Rewards for Students credit card is a great option for anyone starting their financial life and need assistance and low fees on a card.

In addition, it facilitates cashback by encouraging the use of the card. Check out the pros and cons of this student card.

Pros

- This card has low associated fees, meaning you don’t have to worry about annual fees or fees for foreign transactions;

- Potential to reach high limits after 6 months of use even without a perfect credit history;

- Great and unlimited bonuses with a 3% cashback rate for food and 1% for other types of necessary purchases;

- Regardless of the lifetime of the account, rewards earned are not lost;

- Offers a welcome bonus for new users of $50 after purchases made totaling over $100 on purchases in three months from your account opening.

Cons

- High-interest rate. If you don’t pay attention, your card bills can get out of hand;

- Low basic rewards rate, contemplating a 3% cashback only in specific cases. On other purchases, the refund is only 1%;

- No advance spending bonus like some other student cards.

Does my credit score need to be good?

To apply for the Capital One SavorOne Rewards for Students card, you do not need to have a great credit history, just a fair level. Capital One classifies someone at the fair level when they have:

- history of non-payment of the loan in the last 5 years;

- limited credit history;

- credit card or other credit less than 3 years old (including students, people new to the US, or authorized users on someone else’s credit card);

Want to apply for Capital One SavorOne Rewards for Students credit card?

Do you already know the Capital One SavorOne Rewards for Students card? With it, you, the student, who is starting your financial life, can have several benefits with incredible cashback.

Through this rewards program, you get 8% cashback on tickets, 5% on hotels and car rentals made by Capital One, 3% on restaurants and streaming services, and 1% on all else.

Are you interested? Then today’s tips are for you! Today, you will learn how to apply for the card through the website and the app. Check out!

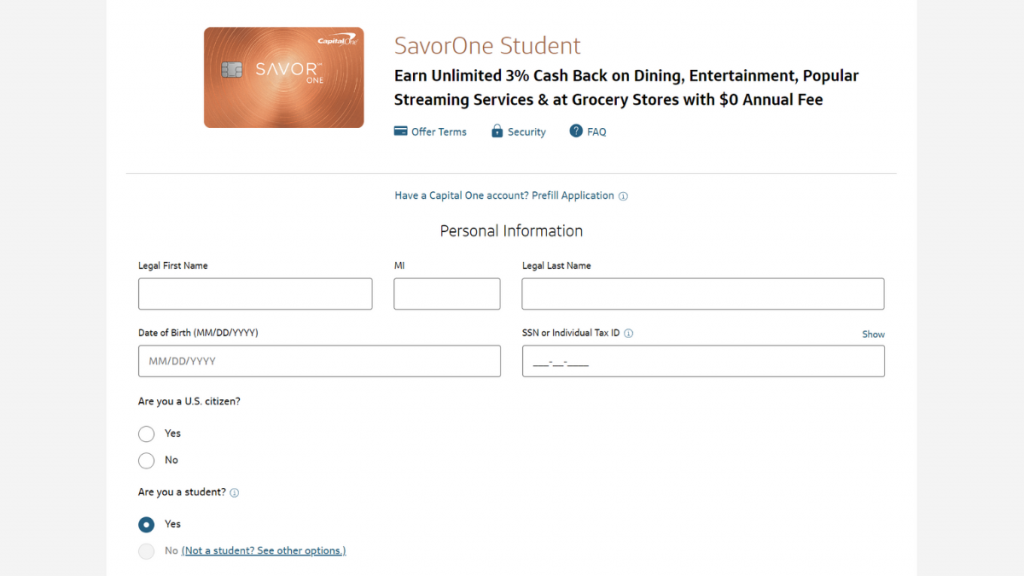

Apply online

If you want to apply for the Capital One SavorOne Rewards for Students credit card online from your computer or tablet, you can do so through the Capital One website.

You will then need to complete the requested fields with your information.

The site requests personal information such as name and MI, contact information such as phone number, and financial information such as income and employment status.

At the bottom of the page, you will find additional information and important disclosures.

Apply using the app

While the application process can be done through the website, you will need the application to manage the account. Therefore, you can also take the opportunity to apply there.

To carry out the application process through the app, you need to check if your smartphone or tablet system is Android or iOS. Then, look for the app in the store, download it, and open registration.

As with the website, the application will ask you to register personal information, such as an address, name, MI, and contact information, such as phone number.

You will also be asked for information about your financial history. From this data, the company will generate a credit proposal, and you can accept or decline it.

Capital One SavorOne Rewards for Students credit card vs. Upgrade Triple Cash Rewards credit card

Choosing a new credit card that meets your needs is not always easy.

However, the Capital One SavorOne Rewards for Students credit card offers similar benefits to others like the Upgrade Triple Cash Rewards credit card, but without requiring an excellent credit history.

Capital One SavorOne Rewards for Students

- Credit Score: Fair

- Annual Fee: $0

- Regular APR: 18.74%, 24.99% or 28.74% based on your creditworthiness for purchases (variable)

- Welcome bonus: Earn a one-time $50 cash bonus after spending $100 on purchases in three months from your account opening

- Rewards: 8% cashback on tickets purchased through the Vivid Seat platform, 5% on hotels and car rentals through Capital One Travel, unlimited 3% cash back on dining, entertainment, streaming services, and at grocery stores, and 1% cash back for other purchases

Upgrade Triple Cash Rewards Visa®

- Credit Score: Average to excellent

- Annual Fee: $0

- Regular APR: variable between 14.99% – 29.99% depending on the credit limit

- Welcome bonus: offer of a $200 bonus if you open a Rewards Checking account and make at least three transactions with your debit card

- Rewards: up to cashback of 3% on selected purchases

Apply for the Upgrade Triple Cash Rewards Visa®

Don't know how to apply for your Upgrade Triple Cash Rewards Visa®? Don't worry. This article has every piece of information you need to get this card.

Trending Topics

Medicaid: what it is, who it helps, and how to apply

Learn everything you need to know about the Medicaid program, including how it works and different eligibility requirements.

Keep Reading

Extra Debit Card Review

Your debit card can be better. This review will show the benefits of using Extra debit card to spend your money in a better way.

Keep Reading

Home Depot Consumer Credit Card full review

Looking for a comprehensive review of how the Home Depot consumer credit card works? Read on to find out! No annual fee!

Keep ReadingYou may also like

Is The Stealth Capitalist safe?

Are you wondering if the Stealth Capitalist is safe? So read this article to learn about it. We'll clarify everything about this website.

Keep Reading

Qtrade Investing brokerage platform full review

Qtrade Investing is a brokerage platform which offers you both a mobile and a web-based application, and the best customer service.

Keep Reading

Reflex® Platinum Mastercard® Review

Rebuild your credit score with the confidence of a good spending limit! Read our Reflex® Platinum Mastercard® review to learn how.

Keep Reading