Reviews

Wells Fargo Active Cash® Credit Card Review

Wells Fargo Active Cash® Credit Card is a great way to earn cash back on all of your purchases. Read our full review and find out how you can qualify for a $200 cash rewards bonus.

Advertisement

Wells Fargo Active Cash® Credit Card: Welcome bonuses!

The Wells Fargo Active Cash® Card of this review is a new cash-back credit card that offers unlimited 2% cash back on all purchases, a sign-up bonus, and more!

Interested? Then read our full analysis to learn more about this credit card and why having it might be a great addition to your arsenal.

This makes it an ideal match for those who prefer the ease of using one card whenever they shop.

Therefore, Wells Fargo Active Cash® Card provides a strong overall value proposition that is difficult to find on other cards. Know more!

- Credit Score: Good to Excellent;

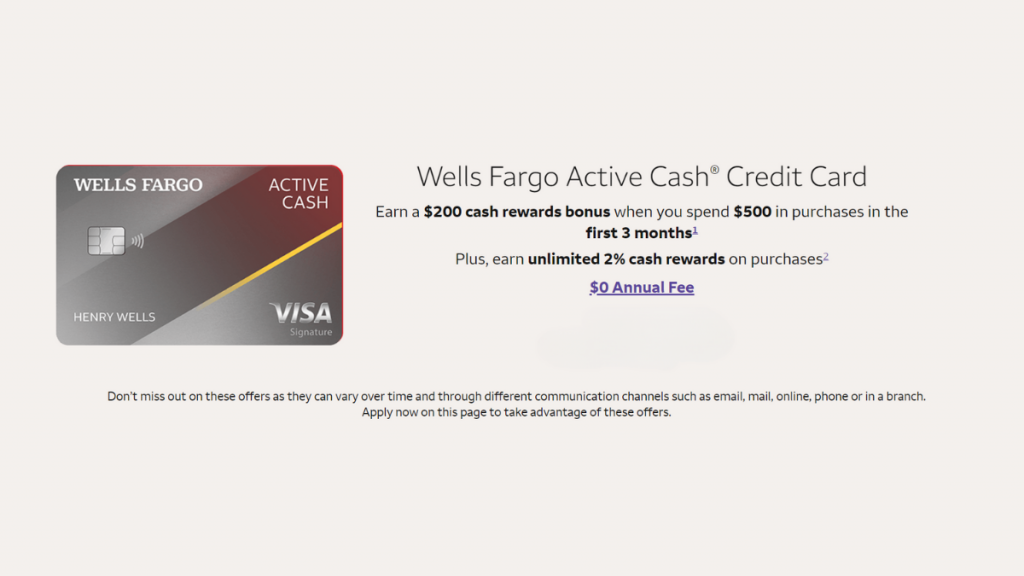

- Annual Fee: $0;

- Regular APR: 0% intro APR for 15 months from the account opening date. Then, 20.24%, 25.24%, or 29.99% Variable APR for purchases and balance transfers;

- Welcome bonus: $200 cash reward after spending $500 in the first three months of use;

- Rewards: Unlimited 2% cash rewards on purchases.

- Terms apply.

How does the Wells Fargo Active Cash® Credit Card work?

The Wells Fargo Active Cash® Card, presented in this review, is a new credit card that offers unlimited 2% cash back on all purchases.

It has no annual fee and comes with a sign-up bonus and a no-interest promotion on new purchases and balance transfers.

This makes it an ideal card for those who prefer the ease of using one card whenever they shop. The Wells Fargo Active Cash® Card is a great value proposition.

This card option has no associated annual fees and a $200 introductory bonus. However, you must spend over $1,000 in the first three months of use to use this benefit.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Wells Fargo Active Cash® Credit Card pros and cons

This Wells Fargo Active Cash® Card review brings you the main points of this card. As you’ve seen, it has excellent cashback on all purchases.

However, it does have some associated fees for foreign transactions. In addition, to qualify for the introductory bonus, it is necessary to use the card frequently.

Pros

- Get 2% cash back on all purchases with no limits and no gimmicks;

- 0 percent intro APR for 15 months on purchases and qualifying balance transfers (then 20.24%, 25.24%, or 29.99% variable APR);

- Balance transfers made within 120 days of account opening qualify for the intro rate and fee of 3% (then a balance transfer fee of up to 5%, with a minimum of $5);

- Valuable benefits, including cellphone protection and Visa Signature perks;

- No annual fee.

Cons

- For foreign transactions, there is an additional fee of 3%;

- To qualify for the introductory $200, you must spend a relatively large amount in the first few months.

Does my credit score need to be good?

The Wells Fargo Active Cash® Card in this review has many rewards. As such, he requires a good to excellent credit score. You need to have a score between 670 and 850 to apply.

Want to apply for the Wells Fargo Active Cash® Credit Card?

The Wells Fargo Active Cash® Credit Card in this review has many benefits and an incredible 2% cashback on all purchases.

So, learn how to apply for this card in our post below!

Trending Topics

Balance transfer credit card: what is it?

Read this article to learn what is a balance transfer credit card and how it can help you save a lot of money on interest rates!

Keep Reading

Apply for Sky Blue: quick online and in-app help

Recovering your credit can be an outsourced service, but hiring is necessary. Learn how to apply Sky Blue and earn back a good credit score.

Keep Reading

How to do a balance transfer in 10 simple steps

Learn how to do a balance transfer in 10 simple steps and save money on high-interest credit card debt. Keep reading and learn more!

Keep ReadingYou may also like

Make up to $20 per hourworking at Texas Roadhouse: see job vacancies

Receive weekly pay at Texas Roadhouse: browse job openings now, plus average salary. Medical coverage, paid vacation, and much more!

Keep Reading

Applying for the Wells Fargo Reflect® Card: learn how!

If you're looking for a new card, the Wells Fargo Reflect® Card is worth considering. Apply and enjoy 0% intro APR for up to 21 months!

Keep Reading

Applying for the First Access Visa® Card: learn how!

The First Access Visa® Card is a good option for anyone who needs to build credit. Learn how to apply and be approved for this option!

Keep Reading