Credit Cards

Discover it® Miles Card Review: $0 annual fee

If you're looking for a credit card that offers great travel rewards, the Discover it® Miles card is definitely one to consider. Check our review to learn about all the features and benefits this card has to offer!

Advertisement

Discover it® Miles credit card: Earn rewards that won’t expire

Suppose you’re looking for a good financial product that offers attractive perks and travel rewards. In that case, the Discover it® Miles credit card might just fit your needs.

Its special welcome bonus for new cardholders provides a miles-for-miles match for every mile earned during your first year.

That means that the first 12 months of owning your Discover it® Miles can be very profitable, depending on how much you spend on it.

So, are you interested in learning more about the Discover it® Miles? Then check out our review below to see how this fascinating credit card can be the best option for your financial needs.

| Credit Score | Good – Excellent. |

| Annual Fee | $0. |

| Regular APR | Zero interest for the first 15 months, then a variable between 18.24% and 27.24%. |

| Welcome bonus | Miles-for-miles match at the end of your first year. |

| Rewards | 1.5x Miles on every dollar spent. |

How does Discover it® Miles credit card work?

The Discover it® Miles is an excellent introductory card for anyone looking for an easy-to-use product with exciting travel rewards.

It is widely accepted nationwide, and you can purchase goods and services to earn 1.5x miles on every dollar you spend.

Its welcome bonus offers a double rewards rate by matching every mile gained by the end of the first year.

With a 0% intro APR free of charge for the first 15 months, this product also has no annual fee. That said, you can enjoy your earnings without having to worry about decreasing their value.

The flexible redemption options and the lack of an annual fee make it an interesting choice for consumers to prioritize the Discover it® Miles to cover their expenses.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Discover it® Miles Credit card pros and cons

Before applying to any product that can affect your credit history, you should consider the advantages they provide as well as their disadvantages.

Get to know some of the Discover it® Miles’ highlights and drawbacks below.

Pros

- No annual or foreign transaction fees.

- 0% APR for the first 15 months for new members.

- It is ideal for big purchases after getting the card, offering significant savings.

- Earn 1.5x miles on every dollar spent.

- Discover matches all points earned in the first year, doubling rewards after 12 months.

- Versatile rewards redemption options allow you to collect bonus points in various ways.

- Redeem as cash back to pay off part of your credit card bill.

- Transfer rewards as money directly into your bank account.

- Use rewards for travel-related expenses like airfare, hotel stays, and dining.

- Rewards maintain their value regardless of how they are redeemed.

- Miles never expire as long as your account remains open.

Cons

- Discover it® Miles lacks loyalty programs, which may be a drawback for frequent travelers.

- Bonus points cannot be transferred to airlines or used for hotel upgrades.

- Does not include features often provided by competitors, such as travel or rental car insurance coverage.

- There are no balance transfer offers, unlike most travel-related credit cards.

Want to apply for Discover it® Miles card?

After seeing everything this product offers, how do you feel about applying for your very own Discover it® Miles?

The Discover it® Miles card is an excellent option for frequent travelers. Especially if you want to get bonus rewards without worrying about annual fees.

With an attractive feature for new clients, you can obtain 1.5x miles per dollar spent, and Discover will match the amount by the end of your first year.

No minimum spending is required, and you can choose how to redeem your reward to use it any way you want. So, keep reading if you’re interested in applying for it.

Does my credit score need to be good?

Most credit cards with travel-related perks as their primary benefit offer require a credit score between good and excellent.

That rule also applies to Discover it® Miles. So, to ensure your application is approved, your credit score must be somewhere between 670 and 850.

Requirements

- Age and Residency: Applicants must be at least 18 years old and legal residents of the United States with a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Income: While Discover does not specify a minimum income requirement, applicants should have a steady source of income to demonstrate the ability to manage credit obligations.

- Existing Discover Accounts: Individuals can hold up to two Discover credit cards simultaneously but must have owned their first Discover card for at least 12 months before applying for a second one.

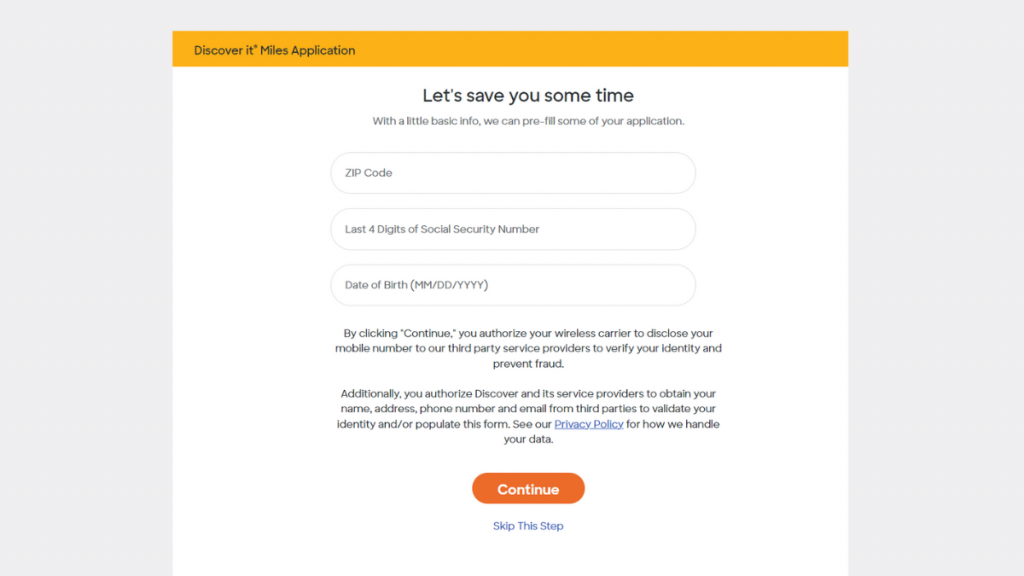

Apply online

You can apply for your own card in a few easy steps, and it will only take a few minutes.

First, you need to access Discover’s official website and click on “all products.” Then, select the “credit cards” option and look for the “travel card” alternative.

By clicking on Apply Now, the website will redirect you to a security form you must fill out with your personal information.

Once you’re done providing all of your info, read the terms and conditions carefully to avoid any confusion about any fees and payment conditions in the future.

If you agree to those terms, tap the box next to it and send in your request. If your application is approved, you should receive a call or an e-mail in the next few days.

Apply using the app

Discover has a fantastic app that helps Discover it® Miles card clients manage their accounts and stay on top of their finances.

However, you can’t apply for any of their products on it. You must visit their website for new credit card requests or call 1-800-DISCOVER.

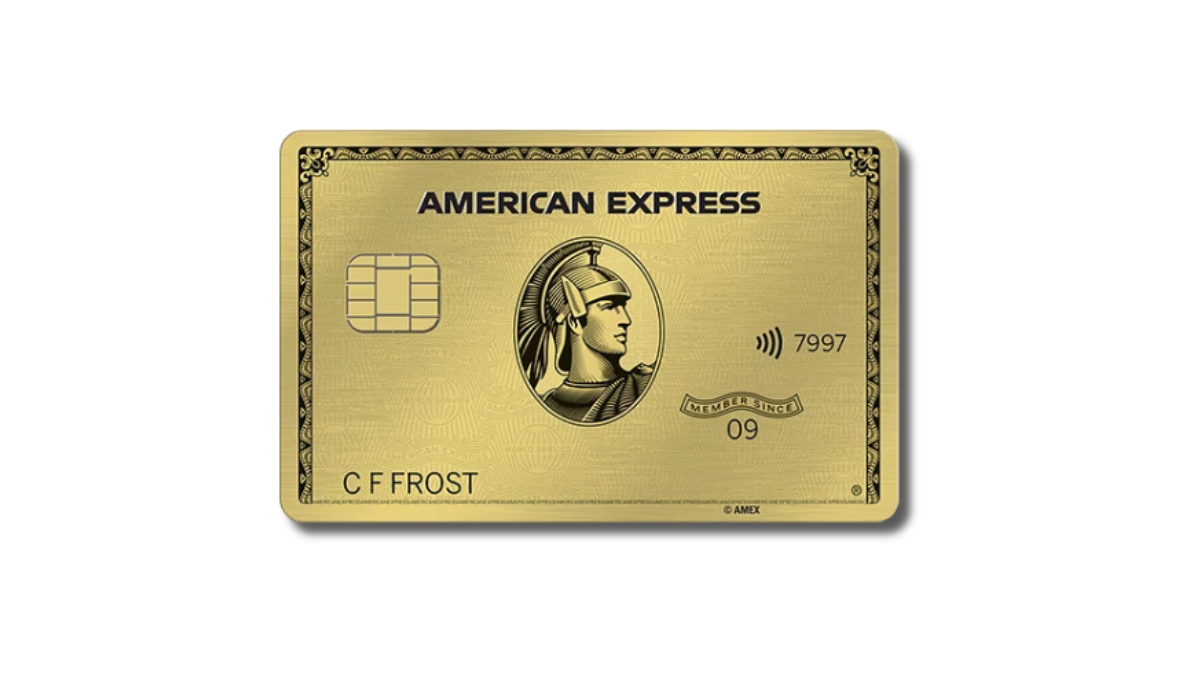

Discover it® Miles credit card vs. American Express® Gold Card

After learning all the benefits of the Discover it® Miles card, are you still unsure if it’s the right choice for you? No worries!

To help you decide, we have brought a similar product to the one in the same category. The American Express Gold card offers excellent travel bonuses and a unique Rewards Program.

| Discover it® Miles Credit Card | American Express® Gold Card | |

| Credit Score | Good – Excellent. | 670 or higher. |

| Annual Fee | $0. | $325. (rates & fees). |

| Regular APR | Zero interest for the first 15 months, then a variable between 18.24% and 27.24%. | 20.24% to 28.24% variable APR on eligible charges. (rates & fees). |

| Welcome bonus | Miles-for-match for every point earned after the first year as a new cardholder. | Up to 100,000 points after spending $6,000 in the first six months. (terms apply). |

| Rewards | 1.5 miles for every dollar spent using the card. | 4x bonus points on dining and groceries shopping; 3x on flights booked through Amex Travel; 1x on all other eligible buys. |

Do you want to learn more about the American Express® Gold Card? Then stay tuned! The following article will bring everything you need to know about this amazing card!

American Express® Gold Card Review

An excellent card for travel and dining enthusiasts who are looking for profitable rewards! Learn how to apply for the American Express® Gold Card!

Trending Topics

Medicaid: what it is, who it helps, and how to apply

Learn everything you need to know about the Medicaid program, including how it works and different eligibility requirements.

Keep Reading

The Robinhood Investing brokerage platform full review

The Robinhood Investing brokerage platform was designed for inexperienced investors to start building their portfolios fast and easy.

Keep Reading

Up to $25,000: U.S. Bank Personal Line of Credit review

Read our in-depth review of the U.S. Bank Personal Line of Credit to discover if it's ideal. Get affordable conditions and low rates!

Keep ReadingYou may also like

Maximize Rewards with Every Swipe: Pelican Points Visa Review

Looking for a reliable rewards credit card? Discover what the Pelican Points Visa has to offer in our review. Enjoy a special bonus offer!

Keep Reading

The best rewards credit cards of 2022: choose your favorite

The best rewards credit cards are the ones that meet our needs. Check out some amazing options for 2022 and choose your favorite!

Keep Reading

Capital One Quicksilver Student Cash Rewards Card Review: 1.5% cash back

Here is the best card for students: the Capital One Quicksilver Student Cash Rewards Credit Card. 5% cash back and Capital One benefits.

Keep Reading