Credit Cards

FIT™ Platinum Mastercard® Review: Build credit easily

Having a poor credit score is a challenging situation. Fortunately, the FIT™ Platinum Mastercard® will not deny your application because of this. You'll have the opportunity to rebuild your credit history.

Advertisement

$400 credit limit to build a responsible credit history

If you’re struggling with your credit score and need a better relationship with credit, this FIT™ Platinum Mastercard® review is perfect for you.

Whatever caused you to get in this situation, having a bad credit score isn’t the end of the road. You can build your yellow brick road towards financial success again.

Read on to learn how the FIT™ Platinum Mastercard® can get you where you need to be financially.

| Credit Score | Poor/Fair |

| Annual Fee | See Terms |

| Regular APR | 35.90% fixed |

| Welcome bonus | No welcome bonus |

| Rewards | No rewards |

How does the FIT™ Platinum Mastercard® work?

The FIT™ Platinum Mastercard® is for people with poor credit scores who struggle to be approved for more demanding credit cards.

Nowadays, having a credit card is a necessity. With the popularization of the e-market, many people need them to buy everyday items.

There are many opportunities for discounts and facilities in the online markets that can only be accessed through a credit card.

It’s easy to get approved for this card. However, for the same reason, interest rates are pretty high. In addition, you will have to pay various fees, both annual and monthly.

If you consider that this money will be lost, hiring a secured card to recover your deposit after a certain period is better.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

FIT™ Platinum Mastercard® pros and cons

Consider the following highlight of the pros and cons of the card to see if it is the best option for you.

Pros

- Credit Building Opportunity – Reports to all three major credit bureaus, helping improve your credit score over time.

- No Security Deposit – Unlike secured cards, it provides an unsecured credit line without requiring upfront collateral.

- Fast Application Process – Simple online application with quick approval decisions for eligible applicants.

- Accepted Nationwide – Works wherever Mastercard® is accepted, making it a reliable option for everyday spending.

Cons

- High Fees – Comes with an annual fee, monthly maintenance fees, and other charges that add up quickly.

- Steep APR – High-interest rates make carrying a balance costly, especially if payments aren’t made in full.

- No Rewards or Perks – Lacks cashback, points, or other benefits typically found on competing credit cards.

- Credit Check Required – Unlike secured cards like OpenSky®, approval isn’t guaranteed and depends on your credit profile.

- Low Initial Credit Limit – The starting limit is modest, and high fees reduce available spending power.

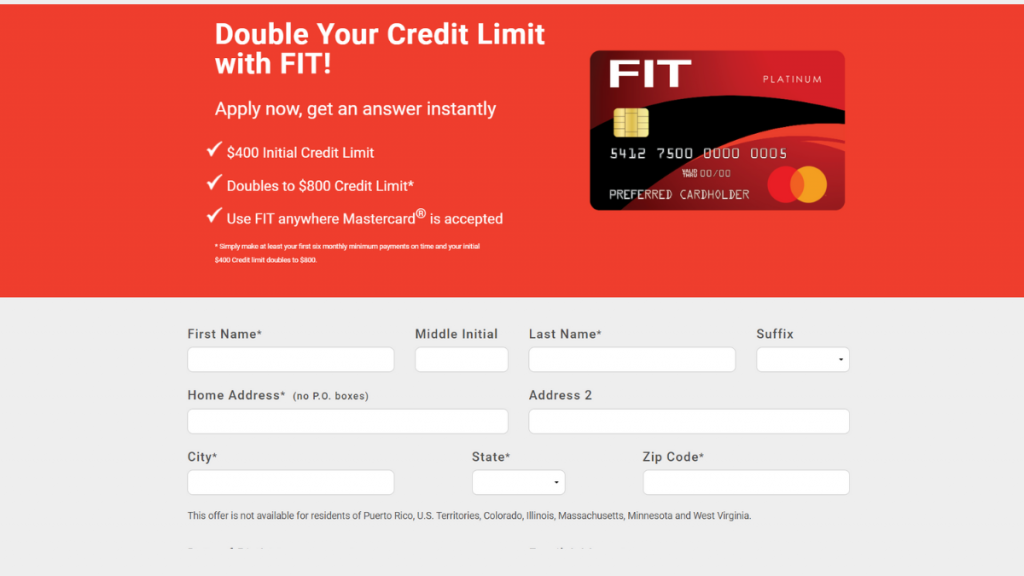

Want to apply for the FIT™ Platinum Mastercard®?

You can apply for the FIT™ Platinum Mastercard® online, quickly, regardless of your credit score. This card excels in credit-building features!

You can receive a $400 credit limit to use responsibly and reestablish your score. As it is a card without many requirements for approval, it has some fees to be paid.

It is not a card for your lifetime but can be a stepping stone to getting cards with lower interest rates and more benefits.

Does my credit score need to be good?

The FIT™ Platinum Mastercard® doesn’t require a good credit score for approval. It’s designed for those with fair or poor credit looking to rebuild their financial standing.

Applicants with limited or damaged credit histories can qualify, but approval isn’t guaranteed. Responsible usage, like on-time payments, helps improve credit.

Since it’s a high-fee card, using it wisely is crucial. Regular payments and low balances can boost your credit score, making better financial options available over time.

Requirements

Age and Residency:

- Must be at least 18 years old.

- Must be a legal resident of the United States.

Social Security Number:

- Possess a valid Social Security Number.

Physical Address:

- Provide a physical residential address; P.O. boxes are not accepted.

Income:

- Demonstrate a steady source of income to ensure the ability to meet credit obligations.

Credit History:

- While the card is designed for individuals with less-than-perfect credit, having a good credit history can enhance approval chances.

Checking Account:

- Maintain an active checking account in your name.

Apply online

Start by visiting the official FIT™ Platinum Mastercard® website. Look for the application section, where you’ll find an online form requesting personal, financial, and contact information.

Fill in your full name, address, Social Security Number, and income details accurately. Providing correct information helps speed up the application process and avoids unnecessary delays.

Next, review the card’s terms and conditions. Understanding fees, interest rates, and repayment obligations ensures you make an informed decision before proceeding with your application submission.

After reviewing, submit your application for processing. The system evaluates eligibility based on provided details, credit history, and financial stability before determining approval or denial.

If approved, you’ll receive your card by mail within a few weeks. Activate it using the provided instructions and start using it responsibly to build credit.

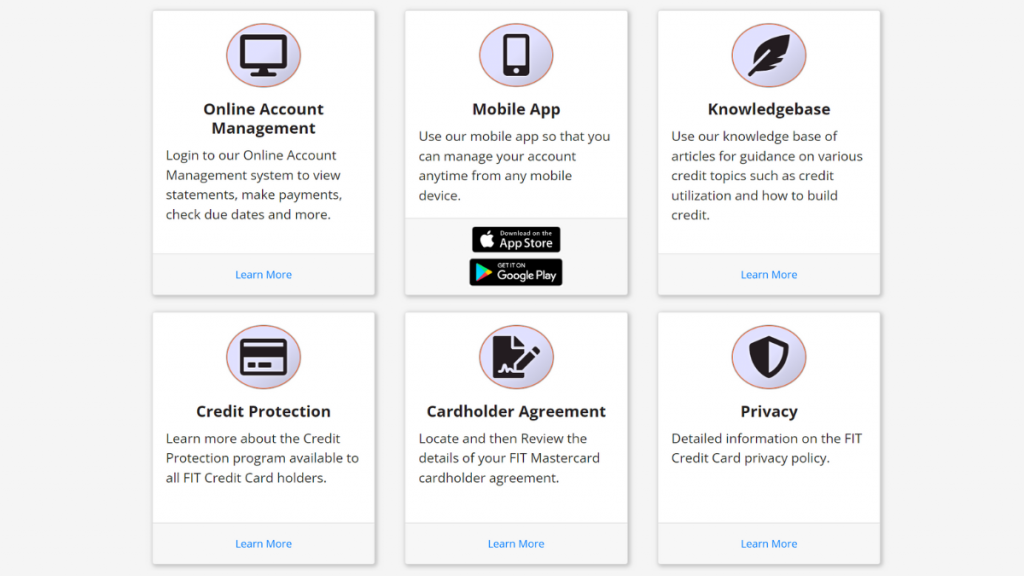

Apply using the app

You can’t apply for the FIT™ Platinum Mastercard® using a mobile app. Applications are only accepted through the official website to ensure accuracy, security, and proper identity verification.

This online-only process helps prevent fraud and ensures applicants provide complete financial details. By using a browser, FIT™ can better assess eligibility before making approval decisions.

While the mobile app helps manage payments and balances, applying still requires a website visit. This guarantees a controlled, secure process while meeting banking regulations and approval standards.

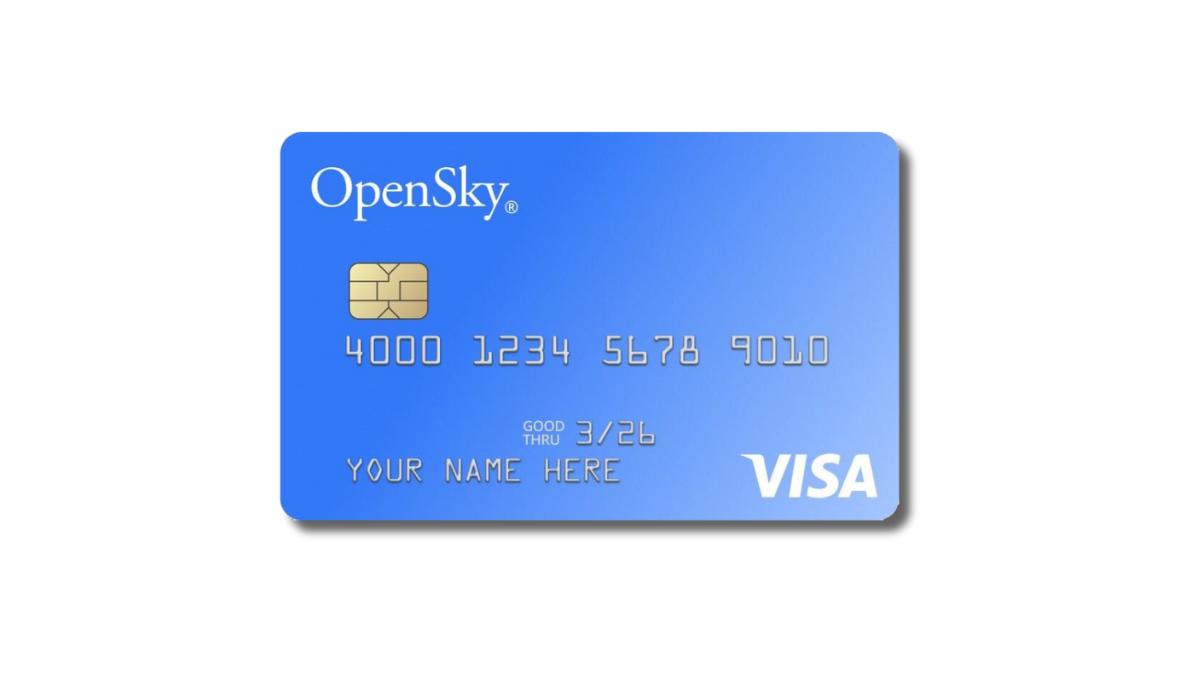

FIT™ Platinum Mastercard® vs. OpenSky® Secured Visa® Credit Card

The FIT™ Platinum Mastercard® offers an unsecured credit line, while the OpenSky® Secured Visa® requires a security deposit, making it better for those rebuilding without upfront costs.

Unlike the OpenSky® card, which doesn’t require a credit check, FIT™ considers your credit history. This difference affects approval odds, especially for those with very low scores.

Both cards report to major credit bureaus, helping build credit. However, OpenSky®’s deposit reduces risk, while FIT™ provides an immediate credit limit without needing collateral upfront.

Check the comparison between both cards in the table below to get a better understanding of what they can offer.

| FIT™ Platinum Mastercard® | OpenSky® Secured Visa® Credit Card | |

| Credit Score | Poor/Fair | All credit levels are welcome |

| Annual Fee | See terms | $35 |

| Regular APR | 35.90% fixed | 24.89% (variable) |

| Welcome bonus | No welcome bonus | It does not offer a welcome bonus |

| Rewards | No rewards | Up to 10% cash back |

If you want to apply for the OpenSky® Secured Visa® Credit Card instead, check the following link to learn more about the process.

OpenSky® Secured Visa® Credit Card Review

If you have no credit, getting a card might be challenging. But if you apply to OpenSky® Secured Visa® Credit Card, you'll easily have tons of benefits!

Trending Topics

PenFed HELOC review: Get up to $500K quickly

Read our full review if you want to know if PenFed HELOC is the right loan for you! Borrow up to $500K quickly at affordable terms.

Keep Reading

Spotify is testing the display of artists’ NFT galleries

Some users on Android are seeing a new feature from Spotify that allows artists to showcase their non-fungible token collections.

Keep Reading

Up to $100K quickly: Wells Fargo Personal Loan Review

Renovate your home, conquer debt, or make a major purchase- Discover how easy in our Wells Fargo Personal Loan review! Enjoy flexible rates!

Keep ReadingYou may also like

Supplemental Security Income (SSI): ensure financial help

Have a disability that limits your ability to work? Learn about Supplemental Security Income, who is eligible for it, how to apply, and more!

Keep Reading

What is an NFT: understand how this digital asset works

Ever wondered what is an NFT? This digital asset works as a new fully digital currency. Learn more about this new technology.

Keep Reading

Achieve Personal Loan (formerly FreedomPlus) review: is it worth it?

Read our Achieve Personal Loan review and learn more about this lender's services! Borrow up to $50,000 for multiple purposes!

Keep Reading