Credit Cards

GO2bank™ Secured Visa® Credit Card full review

A credit card can be a great ally in improving your credit score. Get to know the GO2bank™ Secured Visa® Credit Card and how it can help you.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

GO2bank™ Secured Visa® Credit Card: Easily build credit!

Having a bad credit score can make any negotiation difficult. Therefore, the GO2bank™ Secured Visa® Credit Card review will show you how to improve your condition.

This credit card is perfect for all credit scores, and you can rebuild your score. You must use it responsibly, and the company reports to the credit bureaus. Find out more in this review.

- Credit Score: Bad credit score;

- Annual Fee: $0;

- Regular APR: 22.99% for purchases and 26.99% for cash advances;

- Welcome bonus: None;

- Rewards: None.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the GO2bank™ Secured Visa® Credit Card work?

With the GO2bank™ Secured Visa® Credit Card from this review, you can rebuild credit without losing purchasing power. After all, it is a perfect credit card for those who don’t have a good credit score.

This card has no associated annual or monthly fees. However, it charges an APR of 22.99% for purchases to accept a bad credit score.

Also, you have a 5% or $10 cash advance fee and a 3% foreign transaction fee.

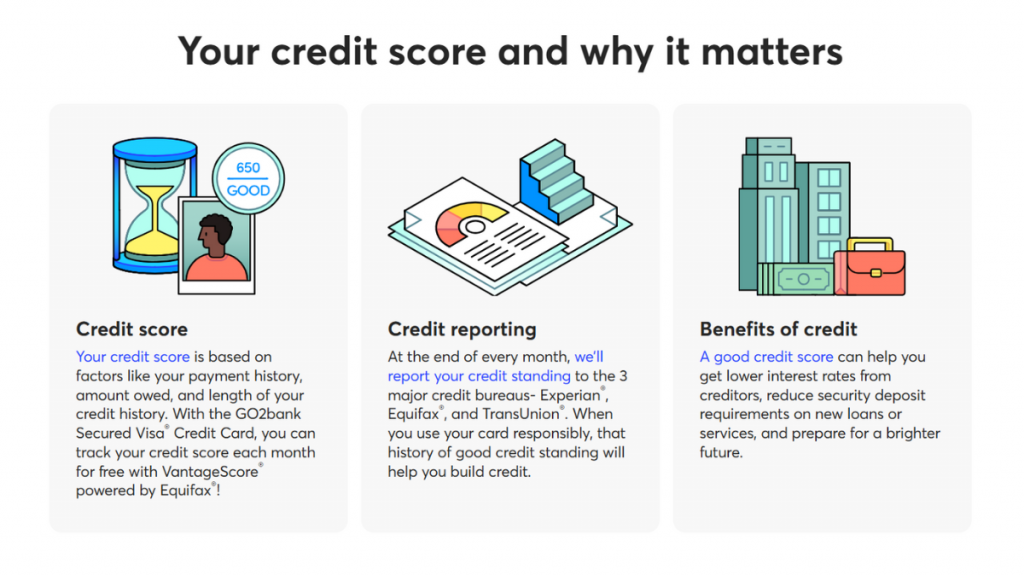

However, with the regular payment of its fees, the company reports usage to the three main credit bureaus. Thus, you can gradually improve your credit score after a few years of use.

GO2bank™ Secured Visa® Credit Card pros and cons

The GO2bank™ Secured Visa® Credit Card, presented in this review, is a good option for a bad credit score. After all, all types of credit are accepted, and the request is made quickly and online.

However, you may encounter several fees associated with cash advances and transactions.

But you can contribute to improving your credit score without paying a maintenance fee. Check out this option’s main pros and cons and see if it makes sense.

Pros

- It does not require a high credit score and is open to all types of credit scores;

- It has no associated annual or monthly fees;

- Help rebuild credit by reporting to major credit bureaus.

Cons

- An initial security deposit of $100 is required to apply;

- It has a high associated APR rate;

- Has associated fees for foreign transactions;

- It has no introductory rewards or bonuses.

Does my credit score need to be good?

As you saw in this GO2bank™ Secured Visa® Credit Card review, the card does not require a good score.

However, this card has no rewards or introductory bonuses. But, you can have a good result in improving your credit score. Thus, you can seek new financing and other credit options.

Requirements

- Must Have a GO2bank Deposit Account: Before applying, you need an active GO2bank account with a history of direct deposits. The bank requires at least $100 in qualifying deposits.

- Security Deposit Is Mandatory: To open this secured card, you must provide a refundable deposit of at least $100, which determines your initial credit limit and acts as collateral.

- Age and Residency Requirements Apply: Applicants must be at least 18 years old (or the age of majority in their state) and have a valid U.S. residential address for verification.

- Valid Social Security Number or ITIN Needed: A government-issued Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) is required to verify identity and report credit activity.

- Sufficient Banking History for Approval: While no credit check is required, GO2bank evaluates your account activity. Insufficient banking history or certain negative behaviors could affect eligibility for the secured card.

- Agreement to Credit Reporting Terms: By applying, you agree to have your financial activity reported to all three major credit bureaus, which helps build your credit score with responsible use.

Apply online

Before starting any application procedure, remember to open a GO2bank™ account. You can do this online or by an app by filling in your details.

You will then need to deposit at least $100 to apply for your credit card. In addition, you need to fulfill certain requirements, such as having valid social security and being over 18 years old.

The application does not require an accurate credit review, only the security deposit to proceed. So open your account as the first step.

You will need a device with internet access and a good browser to apply online. Then, access the official website with your account data in hand.

Finally, you will need to complete a form containing personal and financial details to make your request. So, wait for the analysis result to get your GO2bank™ Secured Visa® Credit Card.

Apply using the app

Applying for the GO2bank™ Secured Visa® Credit Card isn’t possible through the mobile app. Unlike some credit cards, GO2bank requires account verification and a security deposit process.

Since a linked GO2bank deposit account is mandatory, the application process ensures eligibility based on direct deposit history. This extra verification step isn’t fully integrated into their app.

Instead, applications must be completed through their official website, where users can confirm deposit requirements and submit the refundable security deposit to establish their credit limit.

GO2bank™ Secured Visa® Credit Card vs. FIT™ Platinum Mastercard®

The GO2bank™ Secured Visa® Credit Card has excellent conditions for bad credit scores. With this card, you pay no annual fee, only the APR and some specific transaction fees.

However, you can also count on other options such as the FIT™ Platinum Mastercard®. With this alternative, you have a higher APR fee, but will also have access to unsecured credit.

In addition, this alternative requires a higher credit score than the GO2bank™ Secured Visa® Credit Card. Therefore, your chances of approval may be reduced according to your credit score.

To make it clearer, we brought a comparison between the two options. Compare and see which best fits your needs.

GO2bank™ Secured Visa® Credit Card

- Credit Score: Bad credit score;

- Annual Fee: $0;

- Regular APR: 22.99% for purchases and 26.99% for cash advances;

- Welcome bonus: None;

- Rewards: None.

FIT™ Platinum Mastercard®

- Credit Score: Poor/Fair;

- Annual Fee: See terms;

- Regular APR: 35.90% fixed;

- Welcome bonus: None;

- Rewards: None.

Do you think the FIT™ Platinum Mastercard® is your best choice? If so, read our post below to learn more about it!

FIT™ Platinum Mastercard® Review

If you're having trouble getting a credit card because of a poor credit score, check the FIT™ Platinum Mastercard® terms in this review.

Trending Topics

Chase Freedom Flex® Credit Card Review

In this Chase Freedom Flex® Credit Card review, we'll look at the features of this cash-back powerhouse product. Keep reading to see more!

Keep Reading

What is a mortgage statement?

A mortgage statement is an important document that provides essential information about your mortgage loan. But, what is this? Learn now!

Keep Reading

Lexington Law review: repair your credit with confidence

Need to rebuild credit? This review will show you how Lexington Law can be an excellent option and help you.

Keep ReadingYou may also like

SoFi Personal Loan review: is it worth it?

Learn more about the pros and cons of a Sofi personal loan and whether it's worth getting one. No hidden fees and fast funding. Read on.

Keep Reading

Bank of America® Unlimited Cash Rewards Review: $200 online cash bonus

The Bank of Bank of America® Unlimited Cash Rewards credit card offers up to 2.62% cash back on, unlimited redemptions and zero fees

Keep Reading

The Robinhood Investing brokerage platform full review

The Robinhood Investing brokerage platform was designed for inexperienced investors to start building their portfolios fast and easy.

Keep Reading