Credit Cards

Applying for the Capital One Venture Rewards card: learn how!

If you're a traveler looking for a new rewards card, consider the Capital One Venture Rewards. Earn two miles for every dollar you spend, unlimited. Read on and learn how to get yours.

Advertisement

Capital One Venture Rewards Card: turn your expenses into travel experiences with the best rewards program

With the Capital One Venture Rewards card, you can travel the world and get rewarded for it.

This card lets you earn unlimited miles on every purchase you make. Plus, you can use your rewards to book any type of travel— plane tickets, hotel rooms, car rentals, and more.

So if you’re looking for a versatile and rewarding travel credit card, the Capital One Venture Rewards is a great option. Keep reading to learn how to apply for it.

Apply online

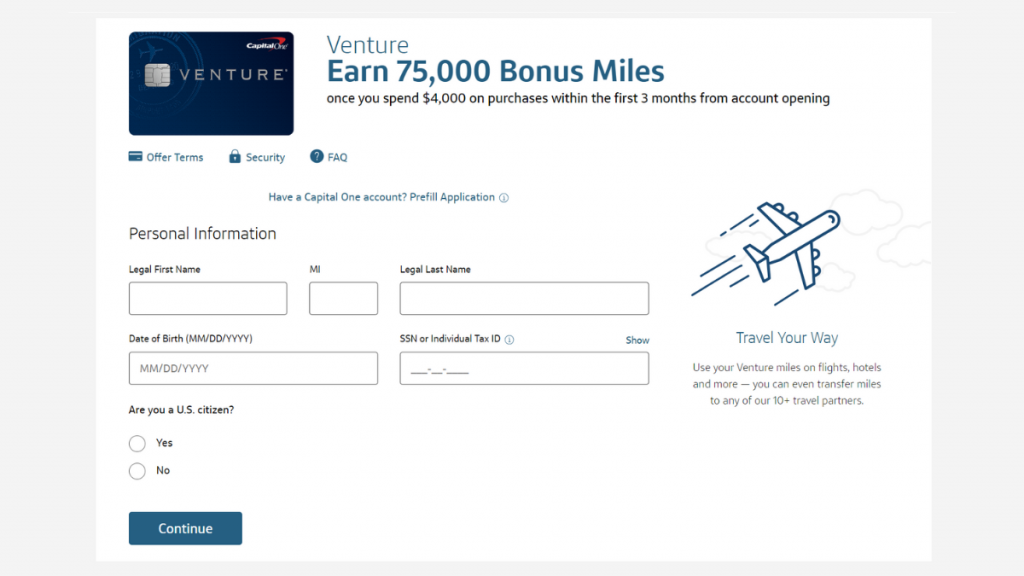

You can apply for this card online. It is easy, and you get the answer in your email.

On the Capital One website, you can see all the credit cards it has to offer. Search for the Capital One Venture Rewards credit card.

There will be an “apply now” button that will redirect you to the application form. You’ll answer questions about your personal and financial information.

At the end of the form, you’ll find the terms and conditions to apply. Read everything to know exactly which payment conditions you’ll face and how the rewards program works.

Once you finish to fill the form and accept the terms and conditions, send your application. You’ll get the answers in your email.

If you’re not approved for this card you may receive an offer for another Capital One credit card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Apply using the app

Capital One has a great app for its cardholders to administer their accounts. However, you can’t apply for a new credit card on it. For application, go to the Capital One website.

Capital One Venture Rewards Credit Card vs. Chase Sapphire Preferred® Credit Card

To help you decide whether you should apply for this card, we present you with a comparison with another card in the same category.

The Chase Sapphire Preferred credit card has similar benefits. Instead of miles, you’ll get reward points, but you can also exchange them for travel and hotels booking.

| Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Credit Card | |

| Credit Score | Excellent. | 690 or higher. |

| Annual Fee | $95. | $95. |

| Regular APR | 19.99% – 29.99% variable, based on your creditworthiness. | 21.49% – 28.49% variable APR. |

| Welcome bonus | 75,000 bonus miles after spending $4,000 on the first 3 months. | 60,000 bonus points after $4,000 spent in the first 3 months |

| Rewards | 2 miles per dollar on every purchase; 5 miles per dollar on car rentals and hotels booked through Capital One Travel. | 5x points on travel purchased through Chase Ultimate Rewards; 2x points on other travel buys; 3x points on dining at restaurants; 3x points on select streaming services and online grocery purchases; 1 point per $1 spent on all other purchases. |

If you found the Chase Sapphire Preferred® Credit Card an interesting option, you can check the post with more info about it. Check the content below to learn how to apply for it.

How do you get the Chase Sapphire Preferred® Card?

The Chase Sapphire Preferred® Credit Card will amaze you. If you like being rewarded for your purchases and traveling, consider applying for this card.

Trending Topics

Discover student loan application: how to apply now!

Discover has a great student loan option. Learn today about the Discover student loan application by website and app!

Keep Reading

Join the Carrabba’s Italian Grill Fam: Apply for a job!

Apply for a job at Carrabba's Italian Grill and start your career in the restaurant industry. Learn more here!

Keep Reading

Freedom Gold card: learn how to apply!

Bad credit? No credit? No problem! The Freedom Gold card says that on their application page and we are going to help you get yours.

Keep ReadingYou may also like

Journey Student Credit Card from Capital One full review

Journey Student Credit Card from Capital One is an excellent option. Offers 1% cashback and zero transfer fees. Check out!

Keep Reading

Applying for the Capital One SavorOne Rewards for Students card: learn how!

Get the best out of your student life with the Capital One SavorOne Rewards for Students card! Read on to learn about the application!

Keep Reading

Home Depot Project Loan review: is it worth it?

Read our Home Depot Project Loan review and learn how this product can help you! Borrow up to $55K to renovate your home! Read on!

Keep Reading