Credit Cards

Applying for the Chase Sapphire Preferred® Credit Card

The Chase Sapphire Preferred credit card will amaze you. If you like being rewarded for your purchases and traveling, consider applying for this card. This content will show you how!

Advertisement

High benefits for a low annual fee in this amazing travel credit card

If you’re looking for a travel rewards credit card with high benefits and low annual fees, the Chase Sapphire Preferred® Credit Card is definitely worth considering.

With this card, you’ll earn points that can be redeemed for travel expenses, merchandise, or gift cards.

So if you’re ready to start enjoying all the fantastic benefits a Chase Sapphire Preferred® Credit Card has to offer, read on to find out more!

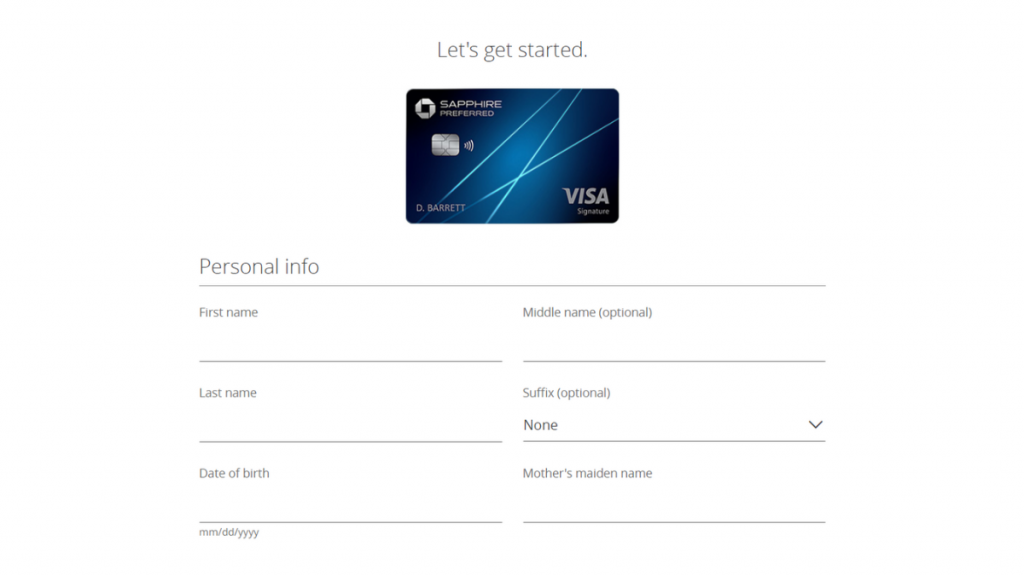

Apply online

The application for the Chase Sapphire Preferred® can be done online. All you have to do is go to the official Chase website and look for the page of the card.

After you hit the button to apply, you’ll be redirected to a form. It is relatively long, where you’ll have to inform your contact and personal information, like full name, e-mail, address, and so on.

Also, you’ll have to inform your Social Security Number and your income.

Remember to check the eligibility requirements before doing it.

- Credit score great or excellent.

- Open less than five credit accounts in the last 24 months.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

Chase Bank has an app for its users to administrate their bank and credit accounts. However, if you’d like to apply for a credit card, you’ll have to go to their website.

Chase Sapphire Preferred® Credit Card vs. The Platinum Card® from American Express

Another option for a travel credit card is The Platinum Card® from American Express. This is a way more luxurious and expensive card.

So, check out the comparison chart below to learn more about it and choose the best option for your financial needs!

| Chase Sapphire Preferred® Credit Card | The Platinum Card® from American Express | |

| Credit Score | Good to Excellent. | Excellent. |

| Annual Fee | $95 | $695 |

| Regular APR | 21.49% – 28.49% variable. | 21.24% to 29.24% variable on eligible charges. |

| Welcome bonus | 60K bonus points after $4,000 spent in the first 3 months. | Earn up to 125,000 Membership Rewards® Points after spending $8,000 within the first 6 months. |

| Rewards | 5x points on travel purchased through Chase Ultimate Rewards; 3x points on dining; 3x points on select streaming services and online grocery purchases; 2x points on other travel purchases; 1 point per $1 spent on all other purchases. | 1x to 5x Reward Points for each dollar spent (according to the category of each purchase). |

If you’d like to get your Platinum membership and get your travel credit card, we have an article about it here at the Stealth Capitalist. Read the content below and apply for your card.

How do you get The Platinum Card from Amex?

Learn how to apply for The Platinum Card® from American Express and check out the benefits you'll get with the best travel card in the market!

Trending Topics

Applying for the Coutts World Silk card: learn how!

Learn how to apply for the exclusive Coutts World Silk card to enjoy its many perks. We've got all of the information you need right here!

Keep Reading

Rocket Loans personal loan application: how to apply now!

Do you need a loan with no hidden fees and that you can apply for online? Read on to learn about the Rocket Loans personal loan application!

Keep Reading

Applying for the First Digital Mastercard®: learn how!

Improving your credit score is a big challenge, but the First Digital Mastercard® can help. Learn how to apply!

Keep ReadingYou may also like

Merrick Bank Personal Loan review: is it worth it?

In this Merrick Bank Personal Loan review you will learn if borrowing from this bank is a good deal, and whether it is for you.

Keep Reading

PREMIER Bankcard® Mastercard® review: Maximize your credit!

Are you ready to build credit with confidence? Then read our PREMIER Bankcard® Mastercard® review! Enjoy credit monitoring services and more!

Keep Reading

PenFed Power Cash Rewards Visa Signature® Card full review

Read our PenFed Power Cash Rewards Visa Signature® Card review to learn about a card that can give you cashback on all purchases!

Keep Reading