Financial Education

Emergency Fund: What it is and how to build one?

An emergency fund is one of the most important parts of building a solid financial foundation. We’re going to show you what it is and how you can build one.

Advertisement

What is an emergency fund? We tell you why it matters!

Before considering investing your money in riskier assets such as stocks, options and futures, it is important that you learn how to build an emergency fund. But do you know what an emergency fund is?

Emergency funds explained

An emergency fund is a stash of money that you keep safe and easily accessible in case you lose your job, fall ill, or for any other reason can not produce an income that allows you to make ends meet. Usually it amounts to at least 6 months worth of living expenses, and it’s not money you plan on spending ever. It’s a safety reserve.

In times of financial distress, an emergency fund helps you avoid having to make expensive loans which are going to charge you high interest rates, defaulting on your mortgage or car payment, overdrafting or maxing out your credit cards in order to pay for basic everyday expenses.

These things can jeopardize your financial security in the short term, but especially in the long term because earning money takes time.

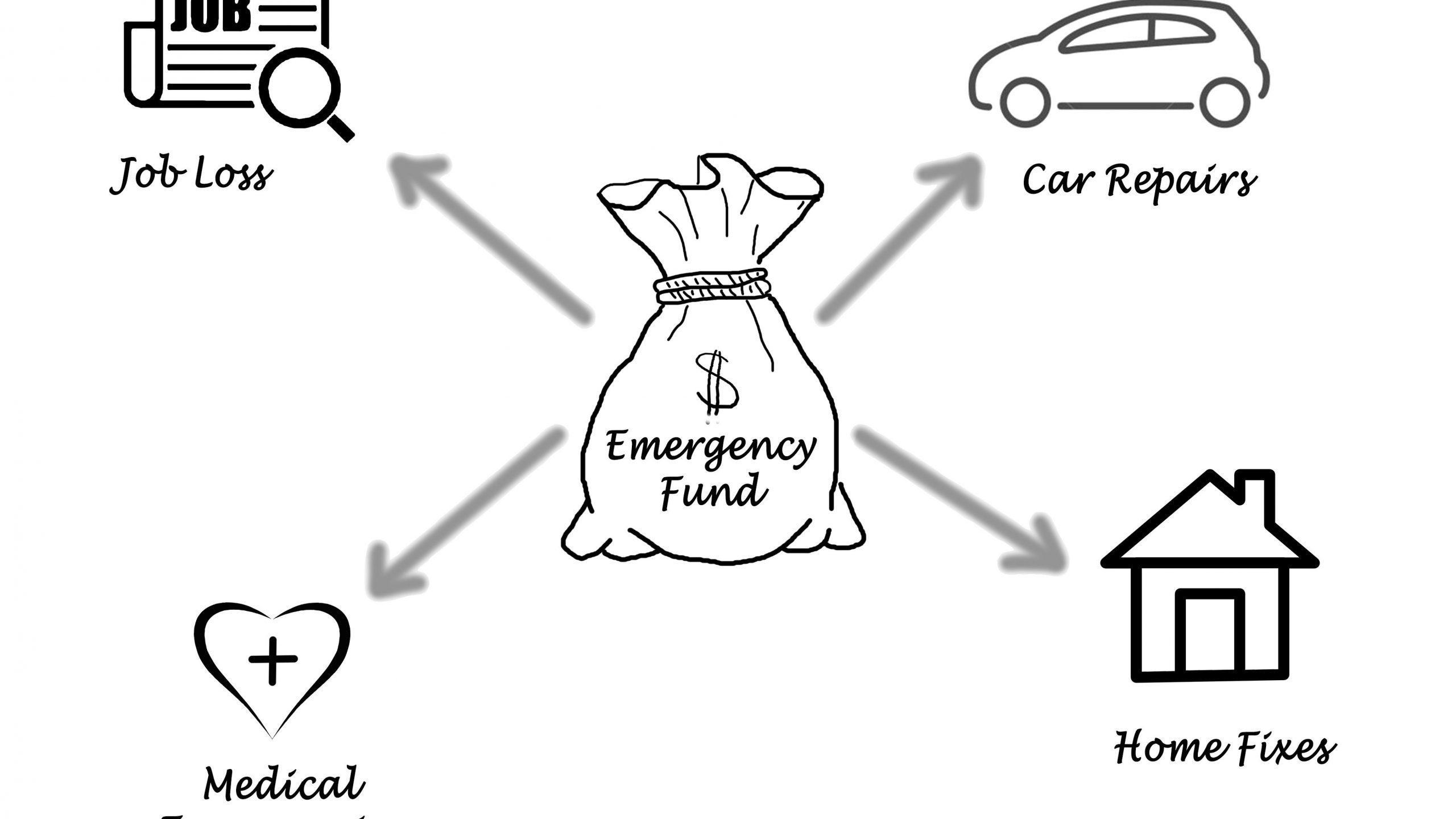

So let’s dive a little deeper and see a few example situations where an emergency fund can keep you out of trouble.

5 steps to start budgeting today!

We are going to give you some tips and tricks on creating a budget that works for you.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What is an emergency fund for?

This article started with a line about investing in stocks. But the reality is that an emergency fund is something you should build regardless of whether you consider investing or not. It is a form of investment in that you are investing in your financial security.

An emergency fund is not money you are saving to buy a house or a car. It is not money you are saving for a trip to the bahamas. An emergency fund is money you can easily access to cover basic expenses during difficult times, such as what happened to many families who lost their jobs during the 2020 lockdown.

If you are an investor, an emergency fund helps you make sure you will never have to sell your investments at the wrong time because you need the money. To use 2020 as an example again, during the first months of the crisis the S&P plummeted nearly 20%.

Imagine if you had no emergency fund. What if all your money were invested in the market and the lockdown caused you to lose your job? You would have to sell your investments at a significant loss just to pay your bills and feed yourself.

Individual circumstances play an important role when building an emergency fund. The younger you are the more comfortable you may feel having a smaller emergency fund. The opposite may be true if you have people who depend on you and your ability to generate an income.

In either case, now that you know what an emergency fund is and what it’s for, it’s time to learn how to build one. Keep scrolling.

How do I get an emergency fund?

It’s hard to think in the long run when you’re young. You don’t have enough time and experience on your back that allows you to say: “if only I had done this a few years ago”. But one thing is certain: starting early is key. If you’re starting later, though, better late than never. Building an emergency fund will still pay off in the long run, regardless of when you built it.

The first thing you need to do is to calculate your monthly living expenses. Then make it your target to put together 6 months worth of that amount. Then calculate how much of your paycheck you can set aside to build the fund. To maintain discipline, you can set up automatic transfers to a highly liquid savings account, preferably a high-interest one.

Another thing you should do is to divert your tax refund toward your emergency fund. This will add an extra financial cushion to it. And speaking of optimizing, you might also want to consider keeping your money in other types of accounts. Money market accounts and no-penalty certificates of deposit (CDs) are a few examples.

This guarantees your money will not only be safe, but earning high interest while remaining easily accessible, with no penalty fees in case you need to withdraw it.

Example of Emergency Fund

Let’s have a look at a hypothetical example which helps to illustrate how you can build your emergency fund.

Imagine a married couple who spends a total of $5,000 a month on mortgage payments, food bills, car payments and other regular everyday expenses. The couple is young and doesn’t have children, so 6 months worth of living expenses sounds a little above what they need. Instead, they decide to set aside enough money to cover 3 months of living expenses. That totals an emergency fund of $15,000.

Should they change their mind for any reason, they may keep on saving for 6 months (which would total $30,000) or even 8 months (totalling $40,000)

What if I can’t save any money?

You would be surprised at the number of people who can’t save any money because they overspend. If you feel like you have no money left to save after you have paid for everything, the first thing you should pay attention to is your spending.

For other people, however, things are just tough. Paychecks are small, bills and food prices are always increasing, and it feels like we are drowning in expenses. In that case, you might have to do some extra work. Literally. Like finding a second source of income.

Another thing that you can do is to save a little right at the moment you get your paycheck. Once you get paid, immediately set aside 1% or 2% of your salary and see if you can do without it. You may be surprised to find out you can.

Check out the link below and discover a way to keep your budget organized with one single account.

Applying for the One Finance Account

With the One Finance account, you can track your expenses, monitor your bank account, and even pay bills online.

Trending Topics

TOP 10 best personal loans 2022: even for bad credit!

Do you have a low credit score and need an affordable loan? Read this article to discover the best personal loans for bad credit.

Keep Reading

Custom Choice student loan review: is it worth it?

Do you need money to complete your studies? The Custom Choice student loan may be what you are looking for. Learn more!

Keep Reading

Up to $250K quickly: Apply now for Alliant Credit Union HELOC

Learn how to apply for Alliant Credit Union HELOC and take advantage of the benefits offered by this financial institution - low rates!

Keep ReadingYou may also like

Seeking New Talent: How to apply for a Job at AutoZone Today!

AutoZone job openings: Apply online now – Learn the requirements and what to expect after submission. Read on!

Keep Reading

Walmart MoneyCard full review

This card is ideal for you if you frequently use the Walmart network. Check out this Walmart MoneyCard review and learn more.

Keep Reading

5kFunds personal loan review: is it worth it?

Difficulties appear when we least expect them, right? Find out everything 5kFunds personal loan has to help you in these moments!

Keep Reading