Reviews

LoanPioneer review: is it worth it?

LoanPioneer is a kind of service for those who don't have huge bills to pay. Find out how this type of loan works.

Advertisement

LoanPioneer review and benefits: Loans for all credit types!

A low-value loan can meet some one-off needs or an emergency type. Therefore, this LoanPioneer review will show you how it can be an interesting option.

How to apply for LoanPioneer

LoanPioneer has the solution for your small debts up to $5,000. But how to apply for LoanPioneer? Find out in this post.

This type of loan grants an amount of up to $5,000 to people with a minimum credit score of 500. Plus, you can use the money for various things and pay it back within 36 months. Know more!

| APR | 5.99% to 35.99%. |

| Loan Purpose | Major purchases, emergencies, bills, other expenses, vehicle repairs, vacations and travel, debt consolidation, home improvements, and medical bills. |

| Loan Amounts | $300 to $5,000. |

| Credit Needed | Minimum FICO score of 500. |

| Origination Fee | N/A. |

| Late Fee | N/A. |

| Early Payoff Penalty | N/A. |

LoanPioneer: how does it work?

The LoanPioneer featured in this review is a great choice for anyone looking for a secure loan. After all, the company has good reviews in the market and is always available for consultations.

This LoanPioneer service aims to award between $300 and $5,000 at fair APR rates. However, it offers three main types of loans: personal installments, peer-to-peer, and bank.

Thus, the APR rates will vary between 5.99 to 35.99%, depending on the credit score, which must be at least 500. However, you can pay this loan in up to 36 months and solve several things in your life.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Is it worth it to apply for LoanPioneer?

This LoanPioneer review brings you the main features of this service option. After all, you need to know the advantages and disadvantages of what you are purchasing.

In this sense, LoanPioneer offers a good service with a loan of up to $5,000 that can be repaid in 36 months. However, the company does not disclose all the terms clearly. Check out the comparison.

Benefits

- The income to consider in the credit analysis can be from Work, Self-employed, or Other Monthly Income, different from other operators;

- Permanent residents are also eligible to apply for this loan;

- APR rates are fair considering the required FICO score;

- The approval and release of the money happen very quickly.

Disadvantages

- You can only borrow up to a limit of $5,000;

- Must have a FICO score of at least 500;

- Loan terms are only disclosed after your application.

What credit scores are required for the application?

As presented in this LoanPioneer review, you must have a minimum score to apply. In this regard, the company asks that you have a credit score of at least 500 to be eligible.

In addition, you need to provide a minimum monthly income of $1,200 and have an open checking account.

However, consulting your credit score does not generate a penalty, and you have quick feedback on the decision.

LoanPioneer: applying for this loan today

As you saw in this LoanPioneer review, this could be the option you are looking for to borrow up to $5,000.

However, you need to pay attention to the request, as there are many details. Check out in this post how to apply online and via the app.

How to apply for LoanPioneer

LoanPioneer has the solution for your small debts up to $5,000. But how to apply for LoanPioneer? Find out in this post.

Trending Topics

Credit card rewards: does it make you spend more money?

Do credit card rewards make you spend more? Learn if it is true, and how to use your card to your benefit without overspending it.

Keep Reading

Applying for the Chase Sapphire Reserve card: learn how!

Applying for the Chase Sapphire Reserve card is easy! Learn everything you need to know about the process and start earning points today!

Keep Reading

Citi Strata Premier℠ Card Review: Earn Much More!

Explore our Citi Strata Premier℠ Card review to learn how you can get a substantial welcome bonus, enticing rewards, and exclusive perks.

Keep ReadingYou may also like

Apple Financing: minimum credit score and how to get it!

Do you think you have the credit score for Apple financing? It can help you to get the best products for your business. Learn how it works.

Keep Reading

Up to 25K: OnPoint Community Credit Union Personal Loan review

Achieve your financial goals! Read our OnPoint Community Credit Union Personal Loan review and learn how to get up to $25,000 quickly!

Keep Reading

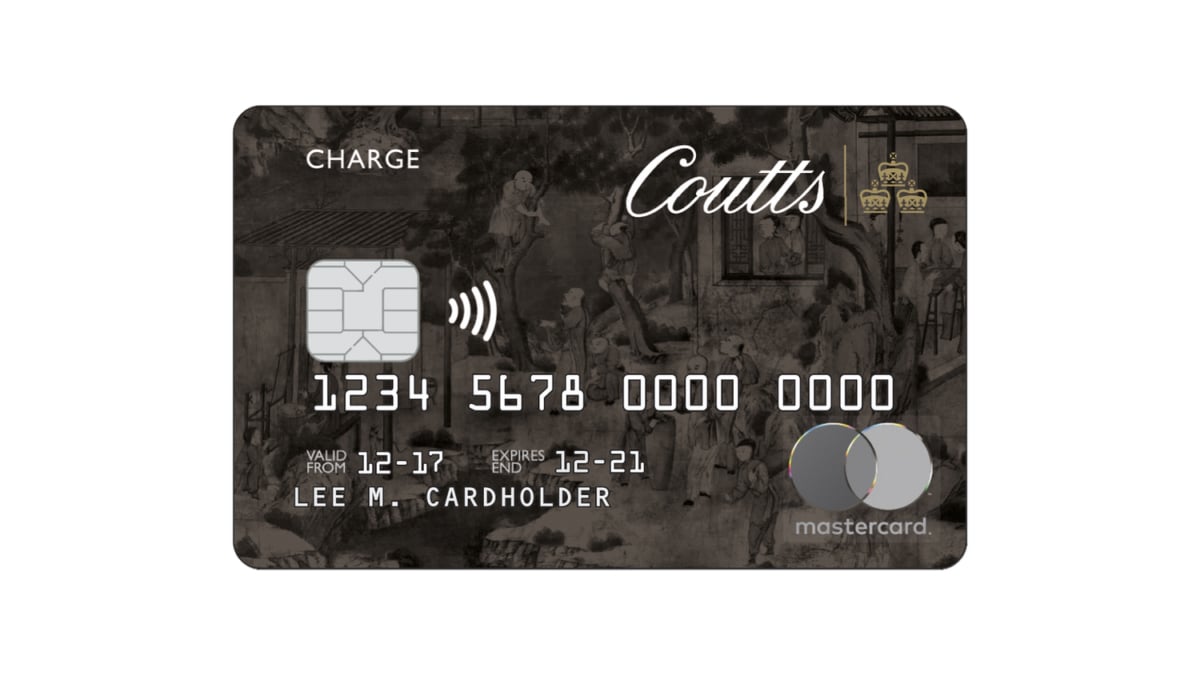

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep Reading