Credit Cards

Mission Lane Visa® Credit Card Review: Up to $2,000 credit line

Having a hard time getting approved for a new credit card? Then you might want to take a look at this card which has low credit requirements.

Advertisement

Note: Some information in this post might be outdated. For the most current documentation and updates, please refer to the product’s original page.

Mission Lane Visa®: Get your credit score on the move.

If you have been having a hard time applying for a new credit card because of poor or limited credit history, the Mission Lane Visa® Credit Card can be an option worth looking into.

It presents an excellent chance for you to boost your credit score without having to keep a security deposit stuck in your account earning zero interest.

Keep in mind you can get more flexibility, a lower annual fee or even a $0 annual fee and a higher credit limit if you opt for a secured card instead.

If you have bad credit and would like to learn more about Mission Lane before you make your decision, have a look at the numbers below.

| Sign-up bonus | N/A |

| Annual fee | $0 to $59. |

| Rewards | N/A |

| Other perks | N/A |

| APR | 26.99% – 29.99% variable. |

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

How does the Mission Lane Visa® Credit Card work?

With this card you get access to a minimum $300 credit limit without the need for a security deposit.

This gives you a short-term opportunity to work on your credit score before moving on to another card with better benefits.

Besides, by demonstrating you are a responsible cardholder, making your payments always on time for at least six months, you make yourself eligible for a higher credit limit.

The Mission Lane Visa® Credit Card doesn’t offer much when it comes to perks and benefits. You get access to the regular services offered by any Visa cardholder.

Services such as roadside assistance, 24-hour support in case your card is lost or stolen and zero liability for fraud. It also doesn’t offer any cash back or points rewards.

Mission Lane Visa® Credit Card pros and cons

Now that we have covered important details about this card, it is time to put pros and cons on a scale and evaluate which factors represent a bigger weight in our final decision.

Pros

- Accepts applicants with poor or no credit history

- No security deposit

- Potential credit increase in as little as 6 months

Cons

- Possible $59 annual fee

- High variable purchase APR

- No benefits, perks or rewards

Does my credit score need to be good?

This card was created having in mind folks with poor or no credit history at all. If your credit isn’t in its best shape, don’t worry.

This card can be your ally in building or rebuilding your creditworthiness, and you don’t even need to make a security deposit to get yours.

Requirements

- Age Requirement: Must be at least 18 years old (19 in some states).

- Residency Status: Must be a U.S. resident with a valid Social Security Number.

- Credit History: Accepts applicants with fair to poor credit histories.

- Income Verification: Proof of sufficient income to support credit obligations.

- Contact Information: Valid U.S. mailing address, phone number, and email address required.

- Legal Capacity: Must have the legal capacity to enter into a credit card agreement.

- No Recent Bankruptcies: Applicants should not have recent bankruptcy filings.

- Debt-to-Income Ratio: Reasonable debt-to-income ratio indicating ability to manage new credit.

- Identification: Government-issued photo ID for identity verification purposes.

- Application Information: Complete and accurate personal and financial information on application.

Apply Online

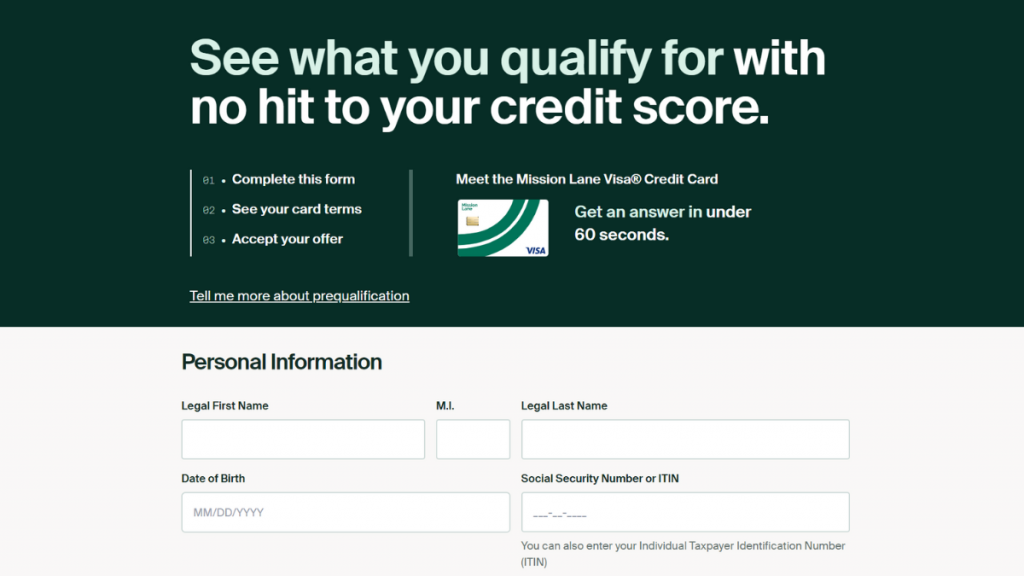

On Mission Lane’s website, hit the “See if I’ll Be Approved” button in the middle of the page. This should take you to a second page. In it you will find a summary of the approval process.

Read it and click on the “See if I’ll Be Approved” button once again. This will take you to Mission Lane’s secure application form.

On the form page enter your personal information such as first and last name, date of birth, Social Security Number and home address with Zip code.

This is the address you will receive your Mission Lane Visa®, so make sure it’s correct.

Next, the website asks you for some financial details such as whether you rent or own a home, your monthly rent or mortgage payment, employment status and total annual income.

You must also inform them of the type of bank accounts you have. Now fill in your contact info with email address and personal phone number.

Lastly make sure to check the boxes at the end of the application form to confirm you agree with Mission Lane’s privacy terms. Then click on “See if I’ll Be Approved”.

The website is going to run its algorithmic check on you for a few seconds, and once it is done, you will be shown a statement informing whether you have or haven’t been approved and why.

Apply using the app

The Mission Lane Visa® card doesn’t support mobile app applications. Instead, you must apply online through their website, ensuring a secure and efficient verification process.

This online-only approach helps verify identity and financial details, reducing fraud risks. It ensures applicants meet eligibility criteria before moving forward.

Although the Mission Lane app allows card management, applications require a browser. This ensures compliance with regulatory standards while providing a secure experience.

Mission Lane Visa® Credit Card vs. Upgrade Triple Cash Rewards Visa®

Maybe you are looking for a more rewards-oriented credit card. How about instead of simply getting cash back, you get rewards in one of the most promising technologies in the history of money?

With the Upgrade Triple Cash Rewards Visa®, you get cash back on select purchases and pay no annual fee. With a credit limit of up $50,000, is a great option to make the most of you money.

Check out a comparison between the Mission Lane Visa® Credit Card and this rewards-oriented card. One of them is likely right for you.

| Mission Lane Visa® Credit Card | Upgrade Triple Cash Rewards Visa® | |

| Credit Score | Bad to Fair | Good to excellent. |

| Annual Fee | $0 | $0 |

| Regular APR | 29.99-33.99% variable. | Get 14.99% up to 29.99% APR, depending on your |

| Welcome bonus | N/A | None |

| Rewards | N/A | Cash back, with bonus on selected purchases. |

If the Upgrade Triple Cash Rewards Visa® is more up your alley, check the following link to learn more details about the card.

Upgrade Triple Cash Rewards Visa® Credit Card

The Upgrade Triple Cash Rewards Visa® Credit Card has an excellent performance, with good cashback rates. It will optimize your money.

Trending Topics

10 best credit cards for limited credit: improve your finances

Having a good line of credit to get the best offers is what everyone wants. Check out our list of the best credit cards for limited credit!

Keep Reading

Sable Review: read before applying

Need a Sable account review you can rely on? We got you! In this review we cover fees, perks, benefits, its pros and its cons.

Keep Reading

Home Depot Consumer Credit Card full review

Looking for a comprehensive review of how the Home Depot consumer credit card works? Read on to find out! No annual fee!

Keep ReadingYou may also like

Capital One SavorOne Rewards for Students Credit Card Review

Discover the incredible advantages and cashback of the Capital One SavorOne Rewards for Students credit card. Check all about it here!

Keep Reading

Loan while in a consumer proposal: is it possible?

Are you wondering whether or not you can get a loan in a consumer proposal? The answer may surprise you! Read on and learn more.

Keep Reading

Merrick Bank Double Your Line Platinum Visa Review

The Merrick Bank Double Your Line Platinum Visa credit card will help you improve your credit score and double your limit within a few months.

Keep Reading