Credit Cards

Oportun® Visa® Credit Card Review

If you're looking for a card that accepts fair credit and has good fees, read our Oportun® Visa® Credit Card review to learn more!

Advertisement

Disclaimer: The Oportun® Visa® Credit Card is no longer available for new applicants. The information in this article may be outdated.

Oportun® Visa® Credit Card: Pre-qualify even with a limited credit history!

If you are looking for a credit card with a limited credit history, our Oportun® Visa® Credit Card review is worth checking out.

This is because you can prequalify within minutes in Oportun’s own words. No credit history will be requested of you.

- Credit Score: Fair – Good.

- Annual Fee: $0 – $49.

- Regular APR: 24.90% to 29.90% variable.

- Welcome Bonus: None.

- Rewards: None.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How does the Oportun® Visa® Credit Card work?

The Oportun® Visa® Credit Card is simpler than traditional credit cards. With it, paying your bills online is as easy as logging in to your account and making one-time or recurring payments.

You can have the product you choose: checking or savings accounts, debit cards, and Oportun also allows you to apply for personal loans.

Oportun® Visa® Credit Card pros and cons

This credit card offers many benefits but can also have some downsides. So, read our list of pros and cons below!

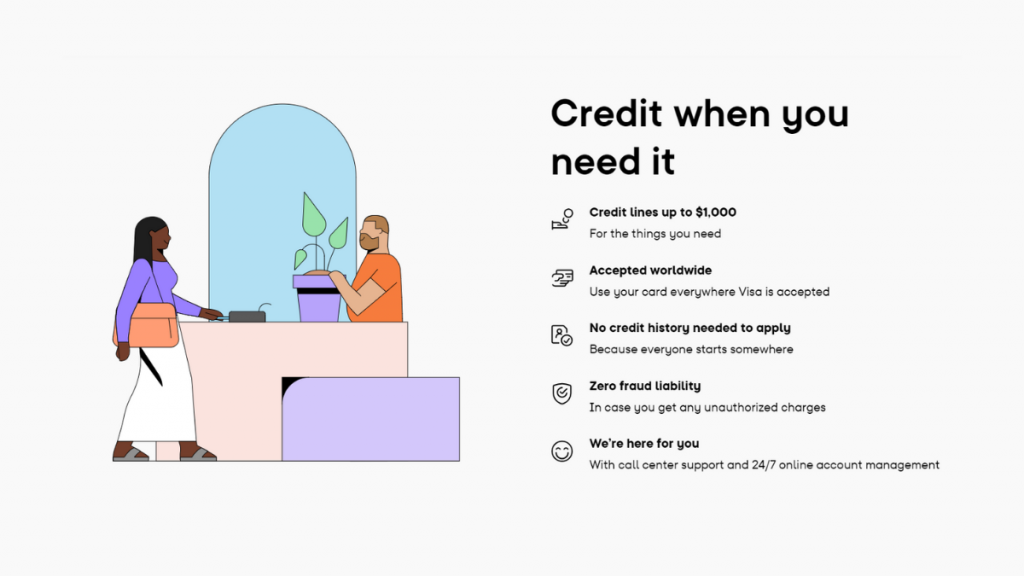

Pros

- Credit lines of up to US$ 1,000

- Zero fraud liabilities

- 24/7 online account management

- Suitable for daily purchases at grocery and gasoline stores

- Usable domestically and worldwide

Cons

- While the Oportun credit card offers great benefits, there are a few drawbacks.

- There are no current rewards or bonuses for credit holders despite the upcoming Oportun® Cash Back Visa® Credit Card.

- The card features a high regular APR compared to other credit products.

Does my credit score need to be good?

This is the most important section of this Oportun® Visa® Credit Card review. Because the answer is no, it does not need to be good.

However, you must understand that they run both a soft and a hard credit pull. So, you need to be sure that you understand this concept.

Briefly explained, although you can be qualified for this card with a poor or fair credit score, their credit pull may be able to affect your score.

But do not be upset. Because Oportun monthly reports your account behavior to credit bureaus around the country, they have the power to help you build a good credit history.

Want to apply for the Oportun® Visa® Credit Card?

As you can see, the Oportun® Visa® Credit Card is an amazing opportunity to build credit. However, it is no longer accepting new applications.

Still, below, you’ll find a guide on how to apply for this card.

Requirements

Here are the application requirements for the Oportun® Visa® Credit Card:

- Age Requirement: Must be at least 18 (or the age of majority in your state).

- Identification: Provide a valid government-issued ID (e.g., passport, driver’s license).

- Proof of Income: Demonstrate a steady source of income to show the ability to make payments.

- Social Security Number (SSN) or ITIN: Required for identity verification (ITIN for non-U.S. citizens).

- Credit History: While credit history may be checked, this card is also designed for credit-building purposes, making it accessible for those with limited or no credit history.

- Residency: Must have a U.S. address for billing purposes.

- Valid Contact Information: Provide a valid email address and phone number.

These requirements ensure eligibility and responsible use of the Oportun® Visa® Credit Card.

Apply online

You only need to access their credit card webpage to apply for this card. Enter your Offer Code or select “Start without offer code.”

Your application will be saved online, and you can continue it afterward. The page is also available in Spanish.

Finally, it is also important to highlight that the cashback version of this card is currently available by invitation only.

Apply using the app

Sadly, there is no way to apply for this credit card via mobile app. However, using your phone in addition to the online application process is possible. Just call the official phone number.

Oportun® Visa® Credit Card vs. FIT™ Platinum Mastercard®

Let us compare the Oportun® Visa® to another card in the same category. This way, we can better understand what they offer and which one fits you better.

We can start by seeing that they both have no rewards or bonuses, as this is not the main solution they want to offer. The other characteristics are also similar.

However, this scenario may change regarding Oportun’s credit card. The word is that an Oportun® Cash Back Visa® is ready to be launched.

Maybe the Oportun® Visa® will win over the FIT™ Platinum Mastercard® shortly.

Oportun® Visa® Credit Card

- Credit Score: Fair – Good.

- Annual Fee: $0 – $49

- Regular APR: 24.90% to 29.90% variable.

- Welcome bonus: None.

- Rewards: None.

FIT™ Platinum Mastercard®

- Credit Score: Poor – Fair.

- Annual Fee: $99.

- Regular APR: 29.99%, variable.

- Welcome bonus: None.

- Rewards: None.

If you think the FIT™ Platinum Mastercard® can be a better option for your finances, check out our post below to learn about the application process!

How to apply for the FIT™ Platinum Mastercard®

Start repairing your damaged credit score with this easy-to-use everyday credit card! See how to apply for the FIT™ Platinum Mastercard® today.

Disclaimer: The Oportun® Visa® Credit Card is no longer available for new applicants. The information in this article may be outdated.

Trending Topics

Applying for the Merrick Bank Double Your Line Secured Visa credit card: learn how!

The Merrick Bank Double Your Line Secured Visa credit card is an excellent choice if you need to improve credit and double your limit quickly.

Keep Reading

Discover it® Student Cash Back Card full review

In need of a good student card? Check out this Discover it® Student Cash Back Card review and find out if it's what you're looking for.

Keep Reading

Achieve Personal Loan (formerly FreedomPlus) review: is it worth it?

Read our Achieve Personal Loan review and learn more about this lender's services! Borrow up to $50,000 for multiple purposes!

Keep ReadingYou may also like

Get up to $25,000 with the Tally Line of Credit!

Learn how to apply for the Tally Line of Credit today. Find out about the requirements to get up to $25,000!

Keep Reading

Apply for a job at Outback: amazing benefits

Discover how to apply online for a job at the Outback. Medical insurance, meal discounts, paid vacation, and more!

Keep Reading

Applying for the PREMIER Bankcard® Secured Credit Card: learn how!

The PREMIER Bankcard® Secured Credit Card is a great option for anyone who needs to build a credit score. Find out how to apply!

Keep Reading