The perfect way to rebuild your credit score and unlock financial freedom!

Assent Platinum Secured Credit Card, pay no annual fee!

Advertisement

The secure way to build credit it here for you! The Assent Platinum Secured Credit Card is a full-featured Mastercard® credit card that will help you make the most of your spending! It reports your transactions to the 3 major credit bureaus monthly and offers 24/7 access to your account online! And the best part is that all types of credit are welcome to take a chance with this card! Plus, the security deposit is fully refundable. Isn’t it great?

The secure way to build credit it here for you! The Assent Platinum Secured Credit Card is a full-featured Mastercard® credit card that will help you make the most of your spending! It reports your transactions to the 3 major credit bureaus monthly and offers 24/7 access to your account online! And the best part is that all types of credit are welcome to take a chance with this card! Plus, the security deposit is fully refundable. Isn’t it great?

You will remain in the same website

Assent Platinum Secured Credit Card is undoubtedly a must-have for credit building! It brings safety and convenience to help you make the most of your money! Below, check the 4 main features offered by this credit card!

A secured credit card is a great option for those with not-so-good credit scores but still want to use plastic! Since it won’t have strict requirements for credit scores, applicants must make a deposit to open their accounts. And once done, the total deposit amount will be their credit limit. It works like a traditional card to purchase in person or online. Usually, the security deposit is refundable.

The Assent Platinum Secured Credit Card is an excellent tool to help you build or rebuild your credit score. This secured credit card accepts applicants with all types of credit and reports their payments to the 3 major credit bureaus – Equifax, TransUnion, and Experian. As a result, if you make responsible use of your card and make your payments on time, you can increase your credit rating over time.

As a credit builder card, the Assent Platinum Secured Credit Card won’t offer a very high credit limit, which is good for building credit while keeping your finances in order. Also, since this is a secured credit card, your credit limit will be the amount of your security deposit. As a result, your deposit can be as low as $200 or as high as $2,000! This gives you the flexibility to choose your credit limit and work your credit score to the top!

The Assent Platinum Secured Credit Card is a full-featured Platinum Mastercard® Secured Credit Card. As such, it will help you build credit while offering some exclusive Platinum Mastercard benefits, such as Zero Fraud Liability Protection, online account management, account alerts, worldwide acceptance, and much more!

The Assent Platinum Secured Credit Card provides a simple and fast application process. They aim to provide fast results and to process the application within 3 weeks or less. If it has been longer than three weeks without any result, you can contact them to help! You can do it through their website’s “Contact Us” page!

Apply for the Assent Platinum Secured Card

Looking for a card with a hassle-free process? Read on a learn how to apply for the Assent Platinum Secured Credit Card! $0 annual fee!

Do you want to consider more options before applying for the Assent Platinum Secured Credit Card? Then we’ve got you! Keep reading and learn how the Truist Enjoy Cash Secured Credit Card application works!

This credit card offers cash back on purchases and some exclusive benefits! So don’t miss our following article; we’ll teach you everything you need!

Applying for the Truist Enjoy Cash Secured Credit

Find out how to apply for Truist Enjoy Cash Secured Credit Card. Get all the details now! Earn unlimited cash back on purchases! Read on!

Trending Topics

Truist Enjoy Travel Credit Card full review

Get all the Truist Enjoy Travel Credit Card details in this review. Earn 20,000 bonus miles in the first 90 days! Keep reading and learn!

Keep Reading

Applying for the Wayfair Credit Card: learn how!

Applying for the Wayfair Credit Card is easy! Qualify with bad credit and enjoy no annual fee. Keep reading to learn how.

Keep Reading

Chase Sapphire Preferred® Credit Card Review

The Chase Sapphire Preferred® Credit Card has everything you need to travel and get a lot of rewards for using it. Keep reading to learn how!

Keep ReadingYou may also like

Applying for the Capital One Quicksilver Student Cash Rewards Card: learn how!

Apply for the Capital One Quicksilver Student Cash Rewards Card and get a no annual fee card with 5% cash back without having great credit.

Keep Reading

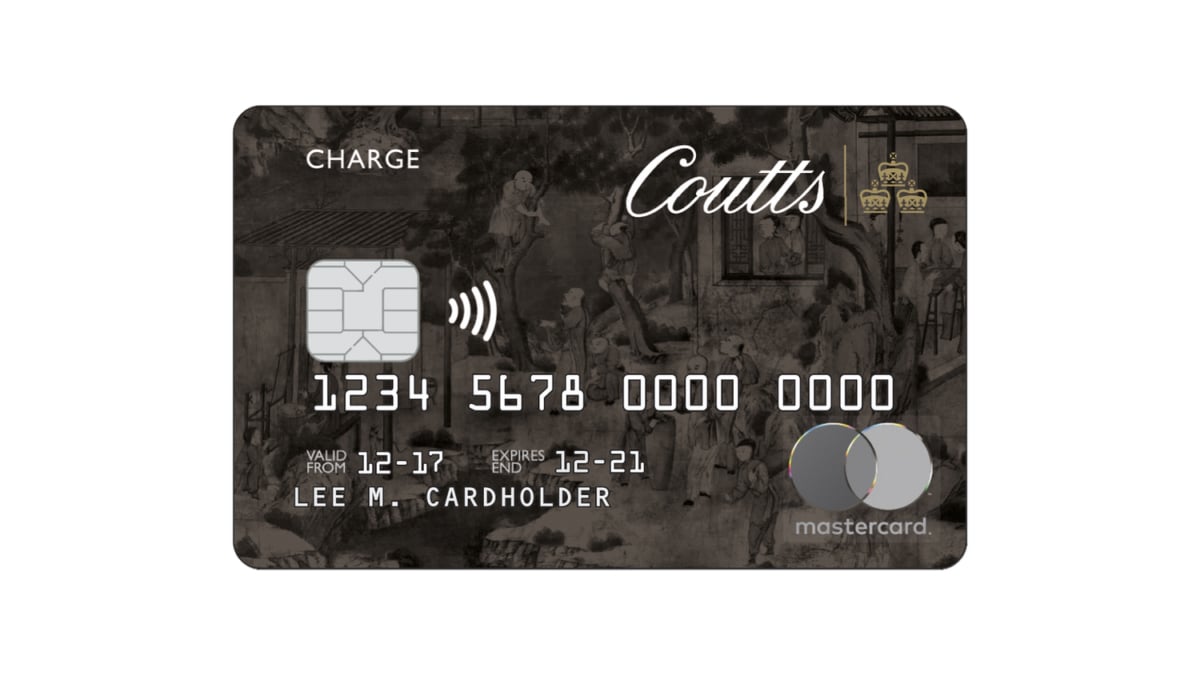

Coutts World Silk credit card full review

Discover everything you need to know about the Coutts World Silk credit card, including its features and benefits. Keep reading to see more!

Keep Reading

LendingPoint Personal Loan: how to apply now!

Looking for an easy way to apply for your personal loan? Learn how to apply for LendingPoint Personal Loan today! Up to $36,500!

Keep Reading