Great, I've just found the perfect credit card for you!

First Digital Mastercard®: accepts bad credit scores, helps build credit and has theft protection!

Advertisement

With bad credit it can be difficult to build new credit. Therefore, the First Digital Mastercard® may be an ideal option if this is your case. It allows application by people with bad credit scores. In addition, the company reports the good use of credit to the agencies, which can improve your score.

With bad credit it can be difficult to build new credit. Therefore, the First Digital Mastercard® may be an ideal option if this is your case. It allows application by people with bad credit scores. In addition, the company reports the good use of credit to the agencies, which can improve your score.

You will remain in the same website

Using and building a good credit score can be difficult for many people. However, the First Digital Mastercard® has incredible benefits. Check out!

No, good credit is not needed for the First Digital Mastercard®. This makes it a good option for individuals with limited or bad credit history. However, be aware of the high interest rate and monthly fees.

Payments for the First Digital Mastercard® can be made through various channels: online via the cardholder portal, by phone, or by mail. Additionally, some money transfer services and money orders might be accepted.

Checking your First Digital Mastercard® balance is easy. Simply log in to your online account or use the mobile app. You can also call customer service for assistance.

Checking your First Digital Mastercard® balance is easy. Simply log in to your online account or use the mobile app. You can also call customer service for assistance.

FIT™ Platinum Mastercard® Review: Build credit eas

You can always rebuild your economic life with good information and discipline. The Fit Mastercard can help you by providing a credit card for you.

Trending Topics

Lexington Law review: repair your credit with confidence

Need to rebuild credit? This review will show you how Lexington Law can be an excellent option and help you.

Keep Reading

5 best cards that offer welcome bonuses: choose and enjoy!

Wondering what are the cards that offer welcome bonuses? Check out the best sign-up rewards products and start earning points today!

Keep Reading

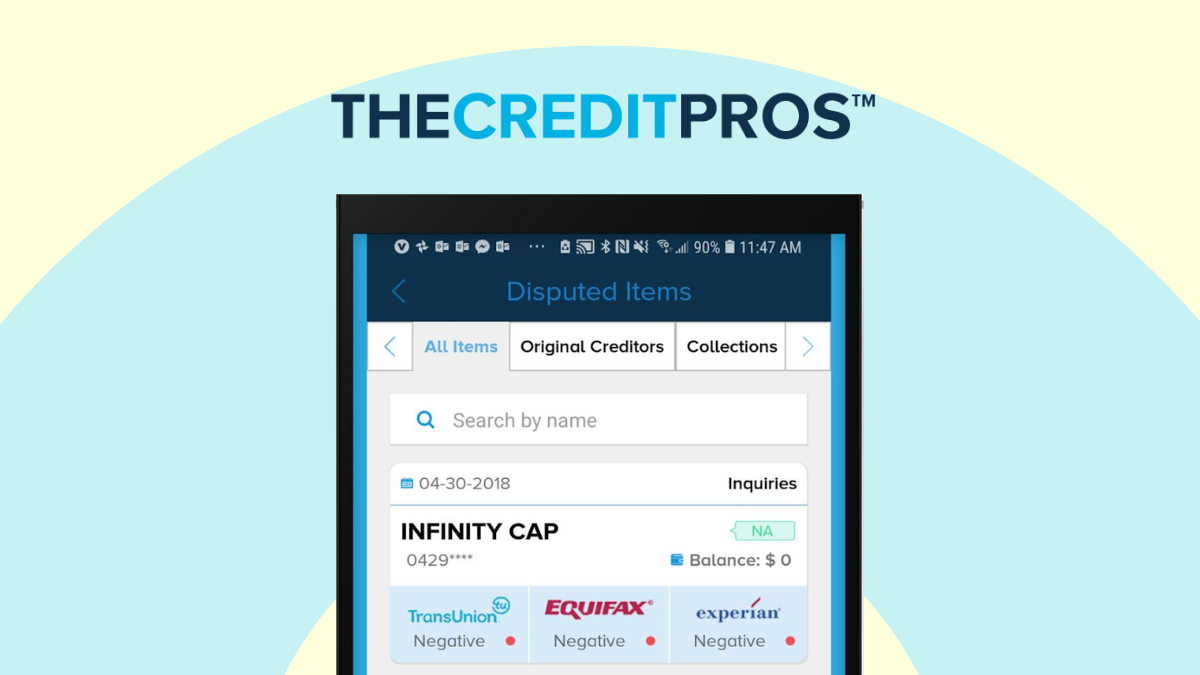

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep ReadingYou may also like

Up to 25K: OnPoint Community Credit Union Personal Loan review

Achieve your financial goals! Read our OnPoint Community Credit Union Personal Loan review and learn how to get up to $25,000 quickly!

Keep Reading

Fortiva® Mastercard® Credit Card Review

Explore our Fortiva® Mastercard® Credit Card review for insights on earning cash back on everyday purchases and building credit easily.

Keep Reading

Chime® Debit Card Review

Are you in need of a debit card that is practical and has no monthly or overdraft fees? Read our Chime® Debit Card review to learn more!

Keep Reading