Great, we've just found the perfect credit card for you!

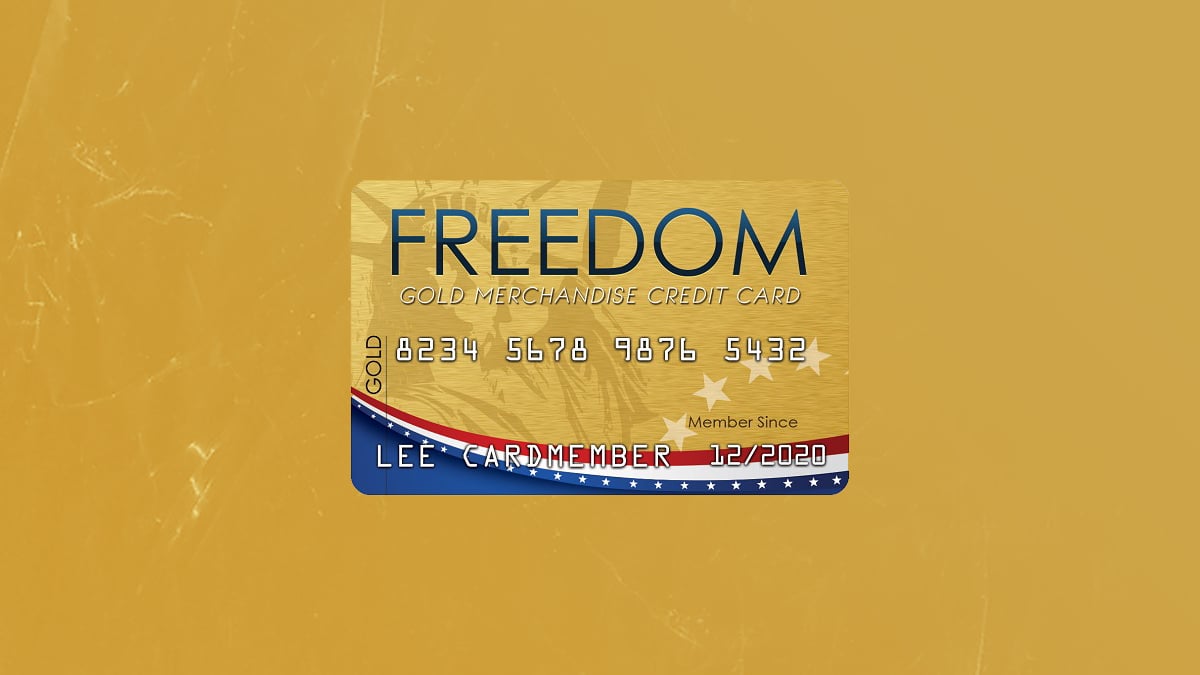

Freedom Gold card: avoid red-tape and hard inquiries with this easy-to-get credit card.

Advertisement

The Freedom Gold card is one of the best solutions for individuals with poor credit who need to get their hands on a credit card fast. The issuer will not run any credit checks on applicants. In spite of that, you get access to additional benefits such as roadside, travel and legal assistance. Additionally, the card comes with an initial $750 in unsecured credit which can be used in Horizon Outlet online purchases.

The Freedom Gold card is one of the best solutions for individuals with poor credit who need to get their hands on a credit card fast. The issuer will not run any credit checks on applicants. In spite of that, you get access to additional benefits such as roadside, travel and legal assistance. Additionally, the card comes with an initial $750 in unsecured credit which can be used in Horizon Outlet online purchases.

You will remain in the same website

Have a look at some of the benefits of getting a Freedom Gold card.

When building or rebuilding credit, the Freedom Gold Credit Card presents itself as a straightforward option, especially for those who have struggled to get approved for traditional credit cards.

Marketed as a solution for people with poor or no credit history, Freedom Gold offers some unique features that might be appealing but also have significant limitations.

Let’s examine the pros and cons of this card to help you determine whether it’s the right choice for your financial needs.

Pros of the Freedom Gold Credit Card

- No Credit Check Required: One of the biggest advantages of the Freedom Gold Credit Card is that it doesn’t require a credit check for approval. This makes it accessible to those who might not qualify for other cards due to a poor or limited credit history.

- Guaranteed Approval: As long as you meet the basic eligibility requirements, approval is virtually guaranteed, providing a hassle-free way to start building or rebuilding your credit.

- No Interest Charges: Unlike traditional credit cards, the Freedom Gold Credit Card doesn’t charge interest on your purchases, which can be a relief for those trying to manage their finances carefully.

- Unsecured Credit Line: The card offers a $750 unsecured credit limit, meaning you don’t have to put down a security deposit as you would with a secured credit card.

Cons of the Freedom Gold Credit Card

- Limited Usability: The Freedom Gold Credit Card can only be used for purchases on the Horizon Outlet website, making it far less versatile than other credit cards.

- Inconsistent Credit Bureau Reporting: Although the card may report to at least one major credit bureau, the reporting can be inconsistent, which may not be ideal for those looking to improve their credit score quickly.

- Limited Benefits: The additional benefits, such as discounts on prescriptions and roadside assistance, might not be valuable to everyone and don’t necessarily justify the membership fee.

The Freedom Gold Credit Card is best suited for individuals who cannot qualify for traditional credit cards and need a simple, accessible way to start building credit.

However, its limited usability, monthly fees, and inconsistent credit reporting make it a less attractive option than other credit-building tools available on the market.

The Freedom Gold Card for Horizon Outlet is a closed-loop credit card, which means that it can only be used to make purchases through the Horizon Outlet online shopping website or catalog. This makes it a good card option for people with bad credit, as it is easier to qualify for closed-loop credit cards than open-loop credit cards. However, it does not build credit scores.

With the Freedom Gold Card for Horizon Outlet, you have the flexibility to make purchases of any size with your credit line, whether you’re indulging in a small treat or stocking up on your favorite items. There’s no need to worry about reaching a minimum order amount before checkout.

Your shopping spree awaits! Upon approval of your Freedom Gold Card application, you’ll receive a temporary card number that instantly unlocks your purchasing power. Start shopping right away and experience the thrill of having your virtual card at your fingertips.

No, you can only use the Freedom Gold Card to make purchases through the Horizon Outlet website or catalog. It is a closed-loop credit card, which means that it cannot be used at other retailers.

You can use the card to purchase a variety of goods from the Freedom Gold online catalog, including: Electronics, Home goods, Apparel, Accessories, and more.

The Freedom Gold Card is a straightforward option for individuals looking to build or repair their credit without the hurdle of a credit check.

While it offers guaranteed approval and credit reporting benefits, its limited usability to the Freedom Gold online catalog and associated fees may not suit everyone.

For those comfortable with these restrictions and focused on improving their credit, it can be a helpful stepping stone toward broader financial opportunities.

However, if you’re looking for a more versatile and fee-free option for building credit, the Petal 2 Visa Credit Card might be worth considering.

Unlike the Freedom Gold Card, the Petal 2 offers cash back rewards, broader usability, and no fees, making it an excellent choice for those seeking to establish or rebuild their credit.

Don’t forget to check out our next post to learn more about the Petal 2 Credit Card’s benefits and features!

Petal® 2 Visa® Credit Card Review

If you need a card with no fees and great perks, read on to learn how to apply for the Petal® 2 Visa®!

Trending Topics

What is a home equity loan? Find out the pros and cons

The dream of owning a home can be solved with a loan. But what is a home equity loan? Understand this concept and its pros and cons.

Keep Reading

Juno Debit Card full review

Need a good debit card to make your money work? Check out this Juno Debit Card review and find out if it might be what you're looking for.

Keep Reading

Make up to $23/hour working at In-N-Out Burger: see job vacancies

Get a lucrative job at In-N-Out Burger! With free meals and healthcare coverage, it's a great opportunity for a career. Learn more!

Keep ReadingYou may also like

OnPoint Community Credit Union HELOC: apply now

Get rate discount and fast funding. Apply for the OnPoint Community Credit Union HELOC and achieve your full potential! Read on and learn!

Keep Reading

OakStone Platinum Secured Mastercard credit card full review

Looking for a card to help rebuild your credit? We've got you! Check out our review of the Oakstone Platinum Secured Mastercard.

Keep Reading

Apply for a job at Outback: amazing benefits

Discover how to apply online for a job at the Outback. Medical insurance, meal discounts, paid vacation, and more!

Keep Reading