Great, I've just found the perfect credit card for you!

Indigo® Mastercard® Credit Card, accepts low scores and has a fair APR!

Advertisement

The Indigo® Mastercard® Credit Card can help you rebuild credit and still give you some extra cash. Compared to other options, aimed at people with bad credit scores, it has a low APR. It provides monthly reports to the main agencies in the country and a good threshold to help you regain financial health.

The Indigo® Mastercard® Credit Card can help you rebuild credit and still give you some extra cash. Compared to other options, aimed at people with bad credit scores, it has a low APR. It provides monthly reports to the main agencies in the country and a good threshold to help you regain financial health.

You will remain in the same website

This card option allows for financial recovery and support for new purchases at the same time. Check out some of the main benefits:

Pre-qualifying for the Indigo® Mastercard® is simple and won’t affect your credit score. Head to the Indigo® website and click “Pre-Qualify Now.” Answer a few quick questions about your financial situation, and you’ll instantly receive a personalized offer with your estimated credit limit and annual fee.

The Indigo® Mastercard® app is available for both iOS and Android devices. Search for “Indigo Mastercard” in your app store and download it for free. Once downloaded, open the app and click “Register.” Follow the on-screen instructions, providing your card information and personal details to complete the registration process.

No, the Indigo® Mastercard® is not directly issued by a bank. It’s issued by Genesis Financial Solutions, a financial services company specializing in credit cards for individuals with limited credit history.

The Indigo® Mastercard® can be a good option for people with bad credit. They offer pre-qualification with no credit score impact, report payments to all three major credit bureaus, and offer secured and unsecured options depending on your creditworthiness. However, it’s important to consider the annual fees and interest rates before applying.

Trending Topics

Apply for Sky Blue: quick online and in-app help

Recovering your credit can be an outsourced service, but hiring is necessary. Learn how to apply Sky Blue and earn back a good credit score.

Keep Reading

Medical loans: see how to finance your medical treatments

Medical loans are a great way to pay for medical treatments. See information on how they work and the pros and cons of taking them out!

Keep Reading

Citi Premier vs Chase Sapphire Preferred card: which is the best?

Which travel card is best for you? Is it the Citi Premier or the Chase Sapphire Preferred card? Read this article to learn more about them!

Keep ReadingYou may also like

Apply for Credit Versio: 100% online application

Keeping track of your finances has never been easier! Apply for Credit Versio now and repair your score. Keep reading to learn more.

Keep Reading

Custom Choice student loan review: is it worth it?

Do you need money to complete your studies? The Custom Choice student loan may be what you are looking for. Learn more!

Keep Reading

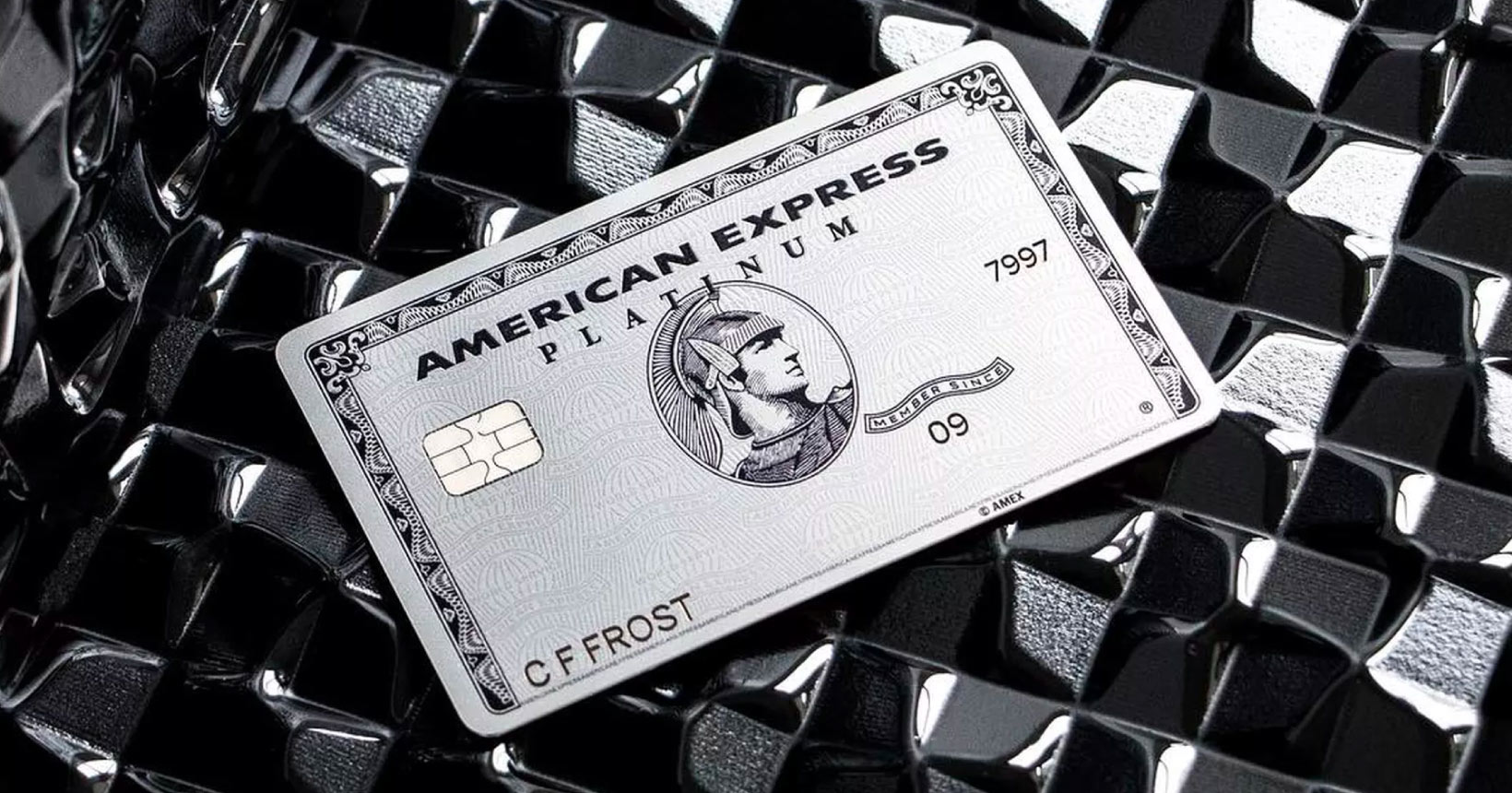

Applying for the American Express Platinum card: learn how!

Check here how to apply for the American Express Platinum card, and enjoy its benefits at airline companies and hotels around the world!

Keep Reading