Great, I've just found the perfect credit card for you!

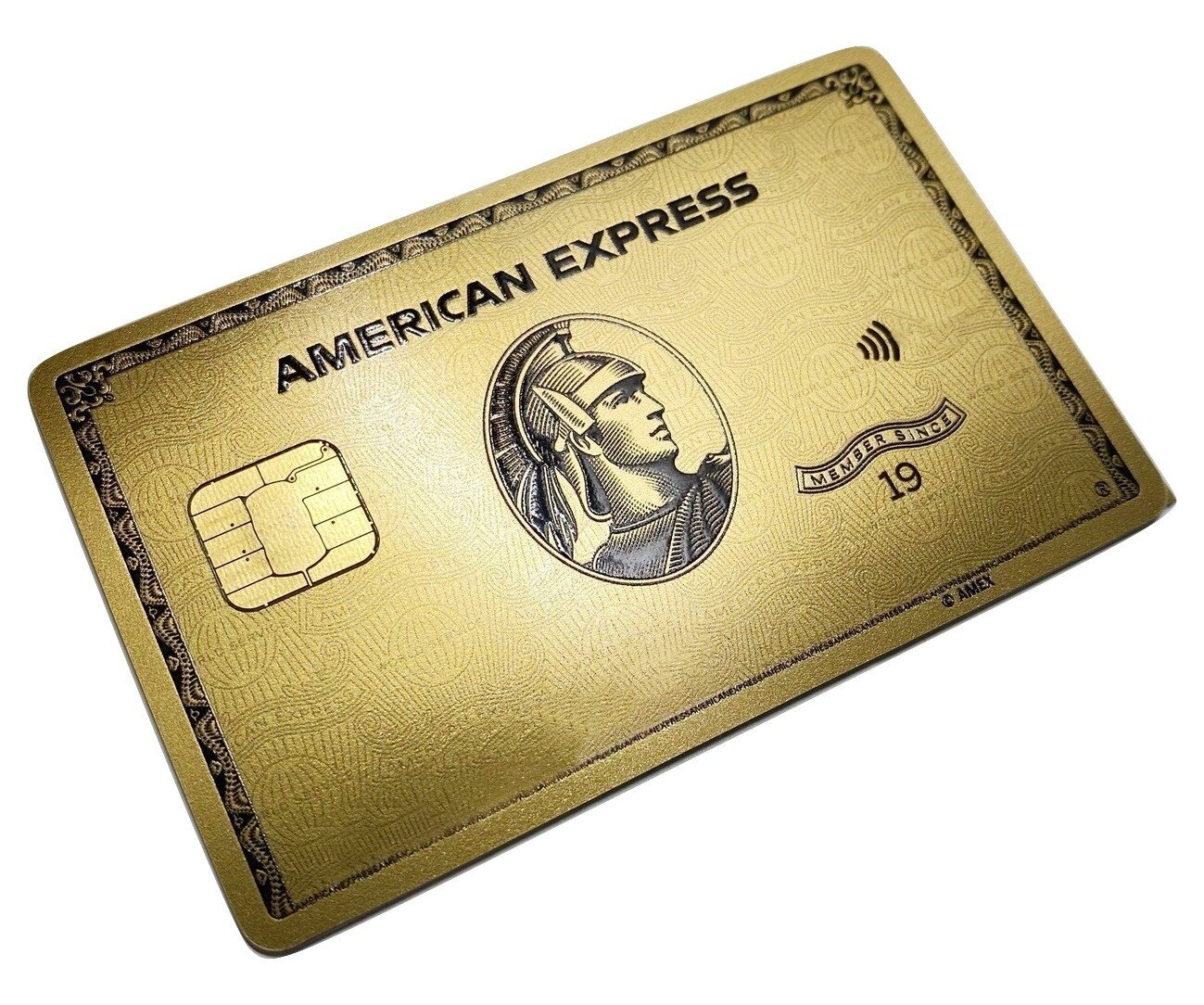

Luxury Gold credit card, for those who want the best of everything.

Advertisement

If you’re looking for a card that offers high-end services and exclusive experiences, the Luxury Gold Card might be perfect for you. With world-class service and exclusive perks, this card is sure to make your travels more luxurious. Read on the see more!

See below for some of this card’s primary features and what they can do for your lifestyle!

Having a 24/7 concierge provides cardholders with round-the-clock personalized assistance for tasks such as travel bookings, reservations, event planning, and access to exclusive experiences, saving time and enhancing convenience.

Yes, the Luxury Gold credit card is made with a metal core and plated with 24k gold for a premium and luxurious appearance. This gold plating is primarily for aesthetic purposes and does not impact the card’s functionality. It is designed to be a high-end or luxury status symbol for cardholders.

The advantage of having a premium travel credit card includes benefits like travel rewards, airport lounge access, travel insurance, statement credits, and exclusive perks, enhancing the overall travel experience.

Applying for the American Express Gold card

See how to apply for this card and enjoy its many dining and travel perks today!

Trending Topics

TOP 6 cash back credit cards: learn the best options

Check out our list of the 6 best cash back credit cards on the market and learn how to earn extra money on everyday purchases!

Keep Reading

Mission Lane Visa® Credit Card Review: Up to $2,000 credit line

The Mission Lane Visa® Credit Card offers you a chance to improve your credit without tying up hundreds of dollars into a security deposit.

Keep Reading

Capital One SavorOne Rewards for Students Credit Card Review

Discover the incredible advantages and cashback of the Capital One SavorOne Rewards for Students credit card. Check all about it here!

Keep ReadingYou may also like

Chase Freedom Flex℠ or Chase Freedom Unlimited® card: find the best choice!

Want to know if the Chase Freedom Flex℠ or Chase Freedom Unlimited® is right for you? Learn more about both cards to help you decide.

Keep Reading

Lazy investing portfolio: a beginners guide

A lazy investing portfolio is the best strategy for people who want to build wealth without having to keep track of complex market data.

Keep Reading

Netspend® Prepaid Card Review

The Netspend® Prepaid Card review is a solid option for anyone who wants to avoid high fees. Check out more!

Keep Reading