Reclaim your financial freedom while you build up your credit score!

With the Surge® Platinum Mastercard®, you can get an initial credit limit up to $1,000!

Advertisement

Take charge of your credit with the Surge® Platinum Mastercard®! Enjoy up to a $1,000 credit limit with no security deposit, monthly reporting to all 3 credit bureaus, and free access to your Experian Vantage 3.0 Score. Use it anywhere Mastercard is accepted, with zero liability protection included.

Take charge of your credit with the Surge® Platinum Mastercard®! Enjoy up to a $1,000 credit limit with no security deposit, monthly reporting to all 3 credit bureaus, and free access to your Experian Vantage 3.0 Score. Use it anywhere Mastercard is accepted, with zero liability protection included.

You will remain in the same website

Ready to rebuild your credit? The Surge® Platinum Mastercard® gives you the opportunity to regain control of your finances. Learn how it can help you below:

The Surge® Platinum Mastercard® opens doors for those rebuilding credit, offering helpful features like bureau reporting and zero deposit requirements for unsecured access.

With global Mastercard acceptance and credit monitoring tools included, this card is a smart option for anyone seeking to boost their financial standing responsibly.

Advantages to Enjoy

- No Security Deposit Needed: Unlike secured cards, you can start using your card immediately without paying a deposit, making it hassle-free.

- Credit Building Made Easy: Your account activity is reported monthly to all three credit bureaus, providing a straightforward path to improving your credit score.

- Free Credit Score Monitoring: Keep track of your financial progress with free access to your Experian Vantage 3.0 Score by signing up for e-statements.

- Mastercard Global Acceptance: Use your card at millions of locations worldwide, ensuring it’s always handy for everyday needs or unexpected expenses.

- Zero Liability Protection: Enjoy peace of mind with fraud protection, safeguarding you against unauthorized purchases in compliance with Mastercard’s policies.

Disadvantages to Keep an Eye On

- High Fixed APR: The card’s 35.90% fixed APR can lead to costly interest charges if you carry a balance from month to month.

- Annual and Monthly Fees: Costs include up to $125 annually and a $150 maintenance fee after year one for lower credit limits, increasing total expenses.

- Limited Credit Limit: Initial credit limits start between $300 and $1,000, which may feel restrictive compared to other unsecured card options.

- Additional Card Costs: Adding an authorized user comes with a one-time $30 fee, which might not suit everyone’s budget or financial goals.

- Foreign Transaction Fee: A 3% fee on international purchases in U.S. dollars could add up quickly for frequent travelers or online international shoppers.

The Surge® Platinum Mastercard® offers a valuable opportunity for credit rebuilding with credit bureau reporting, and zero-deposit access—ideal for regaining financial confidence.

While helpful for credit repair, the card’s fees and high APR require careful management. Evaluate your budget and goals to decide if it’s the right fit.

The card is issued by Celtic Bank and managed by Continental Finance, a company specializing in credit cards for consumers with limited credit histories.

The card is tailored for individuals looking to build or rebuild their credit with features like monthly reporting to all three major credit bureaus.

Yes, you can pre-qualify online with no impact on your credit score. This allows you to determine your likelihood of approval without risking a hard inquiry on your credit report.

Missed payments can result in a fee of up to $41 and negatively impact your credit score. Consistently making payments on time is essential to avoid additional charges and penalties.

Surge® Platinum Mastercard® provides customer support via phone or through their online account portal. Representatives assist with billing, disputes, and other account-related inquiries.

The Surge® Platinum Mastercard® offers a practical solution for those looking to rebuild their credit. With up to a $1,000 limit, it’s designed for flexibility and convenience.

Monthly reporting to all three major credit bureaus supports responsible credit building. Free Experian Vantage 3.0 Score access adds value, making monitoring financial progress easy.

A versatile card for everyday needs, it provides fraud protection and global Mastercard acceptance. Explore its features in the link above to decide if it’s the right fit for you.

However, if you want to check out other alternatives, the FIT™ Platinum Mastercard® is worth considering. With a $400 initial credit limit, it offers flexible credit-building opportunities.

Like the Surge® card, the FIT™ Mastercard® reports to all three major credit bureaus monthly, helping you establish or rebuild credit with consistent and responsible usage.

The FIT™ Platinum Mastercard® also includes zero liability protection for secure transactions. Learn more about this card’s features and application process by following the link below.

FIT™ Platinum Mastercard® Review

Start repairing your damaged credit score with this easy-to-use everyday credit card! Learn all about the FIT™ Platinum Mastercard® today.

Trending Topics

Tips on how to invest in a bear market

Learn two valuable tips on how to invest during a bear market to protect your funds and make the most of this economic downturn.

Keep Reading

5 best cards that offer welcome bonuses: choose and enjoy!

Wondering what are the cards that offer welcome bonuses? Check out the best sign-up rewards products and start earning points today!

Keep Reading

Learn the best Premium Credit Cards of 2022: enjoy their benefits!

You'll find everything you need to know about the best premium credit cards of 2022 in this article. Read and find out which one you like!

Keep ReadingYou may also like

Applying for the Luxury Black credit card: learn how!

Want to know what it takes to get your hands on a Luxury Black card? We'll show you how easy it is to apply so you can start earning rewards!

Keep Reading

247LoanPros review: is it worth it?

Want to settle your debts? Follow this 247LoanPros review and see what benefits it can bring to your financial life.

Keep Reading

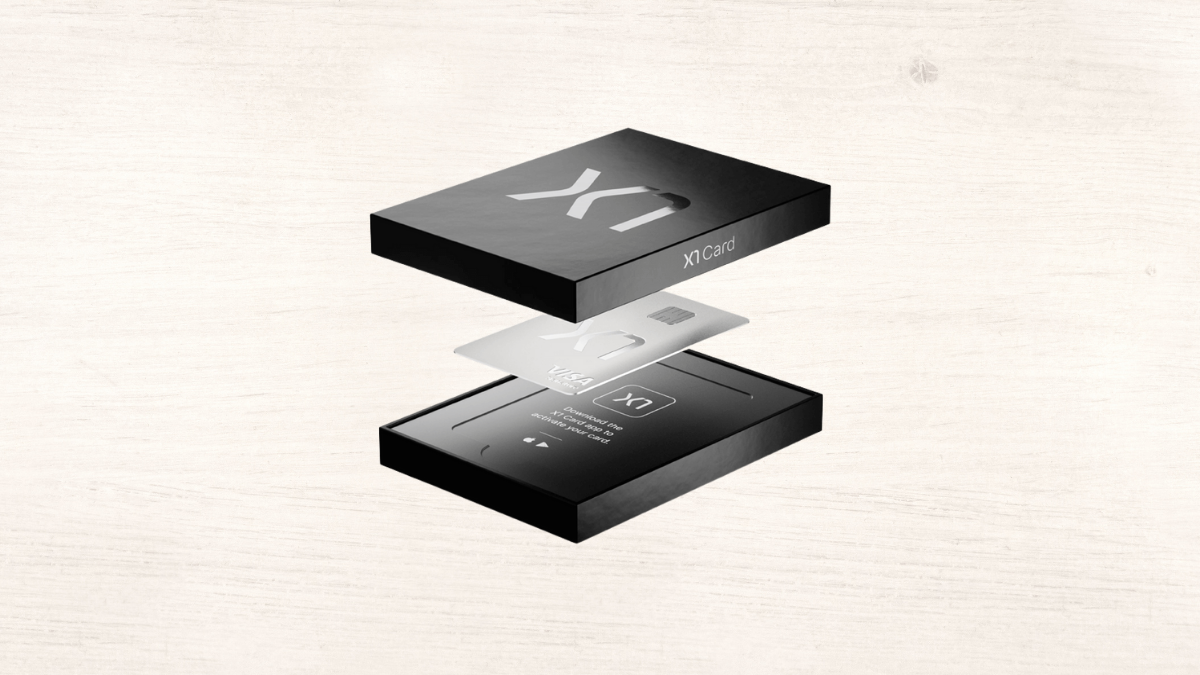

Applying for the X1 Credit Card: learn how!

Searching for an easy way to apply for the X1 Credit Card? Look no further! This card has no annual fee and a reward program! Read on!

Keep Reading