See a checking account that can offer you great financial products and cashback!

Upgrade Rewards Checking Account, up to 2% cashback and chance to get discounts on rates for Upgrade loans and cards!

Advertisement

Upgrade Rewards Checking Accounts are offering unbeatable perks, giving customers the opportunity to earn up to 2% cashback on eligible purchases and enjoy a High Yield Savings Account with an impressive 3.50% APY! Not only that, but these accounts come equipped with free debit cards which can be conveniently locked or unlocked if needed. Moreover, you’ll need an Upgrade checking account to get their credit cards and loan options (with the chance of getting up to 20% lower rates)!

Upgrade Rewards Checking Accounts are offering unbeatable perks, giving customers the opportunity to earn up to 2% cashback on eligible purchases and enjoy a High Yield Savings Account with an impressive 3.50% APY! Not only that, but these accounts come equipped with free debit cards which can be conveniently locked or unlocked if needed. Moreover, you’ll need an Upgrade checking account to get their credit cards and loan options (with the chance of getting up to 20% lower rates)!

You will remain in the same website

The Upgrade Rewards Checking Account is special for those who want a good checking account. Discover the main benefits of this option:

Upgrade’s Rewards Checking Account allows users to bank with safety and security, and Upgrade has partnered with Cross River Bank to ensure that every penny in each customer’s earnings is FDIC-insured up to $250,000. Upgrade has made it easy for account holders to do no wrong when banking responsibly and efficiently. And Upgrade is continuing its mission of facilitating better financial wellbeing in its community by taking the stress out of secure banking.

With the Upgrade Rewards Checking Account, you’ll be able to get acces to a debit card and earn up to 2% cash back on eligible everyday purchases and 1% cash back on any other purchase. Also, you’ll need to open an Upgrade Rewards Checking Account to get the other Upgrade products, such as credit cards and loans. Plus, you can even get these products with up to a 20% lower rate!

Upgrade provides their customers with an efficient way to connect with their support specialists. Customers can call the official contact number on their website for support. Upgrade also offers support via Twitter where customers can directly tweet at themfor assistance with any issue they may have about upgrading their services. Also, Upgrade ensures that customers are never left out of the loop and always get the help they need any time of the day!

How to apply for Upgrade Rewards Checking Account

Find out everything you need to know about how to apply for the Upgrade Rewards Checking Accounts. With unbeatable perks like 2% cashback. Learn more!

The Upgrade Rewards Checking Account will bring you up to 2% Cashback on eligible purchases. And you’ll need to open this account to get the other Upgrade products, such as credit cards and loans.

But HSBC Premier checking is another interesting option that can give you incredible perks, and you also need this account to get the other great HSBC financial products.

Therefore, check out how to apply for this alternative in our post below!

How to apply for the HSBC Premier Checking Account

Applying for the HSBC Premier Checking Account is simple and you can do it from the comfort of your own home. See what the requirements are and how to proceed.

Trending Topics

5 Credit Cards for Fair Credit: Best Options for You!

Looking to improve your FICO score or rebuild your credit? Here are 5 great options of credit cards for fair credit.

Keep Reading

Make up to $22,75 hourly working at Whole Foods Market: see job vacancies

Craving a job with purpose and fresh perks? Dive into Whole Foods Market open vacancies - earn up to $22.75/hour and enjoy 20% discounts!

Keep Reading

Companies are resorting to robots as a response to labor shortages

Labor shortages caused the orders for workplace robots to rise over 40% during the first quarter in the United States. Read on for more!

Keep ReadingYou may also like

Truist Future Credit Card full review: 0% APR for the first 15 months

Read our comprehensive Truist Future Credit Card review. Pay $0 annual or foreign transaction fees! Keep reading and learn more!

Keep Reading

Credit One Bank® Platinum Visa® Review: Earn cashback

Looking for a credit card to help rebuild your credit score? Check out our Credit One Bank® Platinum Visa® review to learn more about it!

Keep Reading

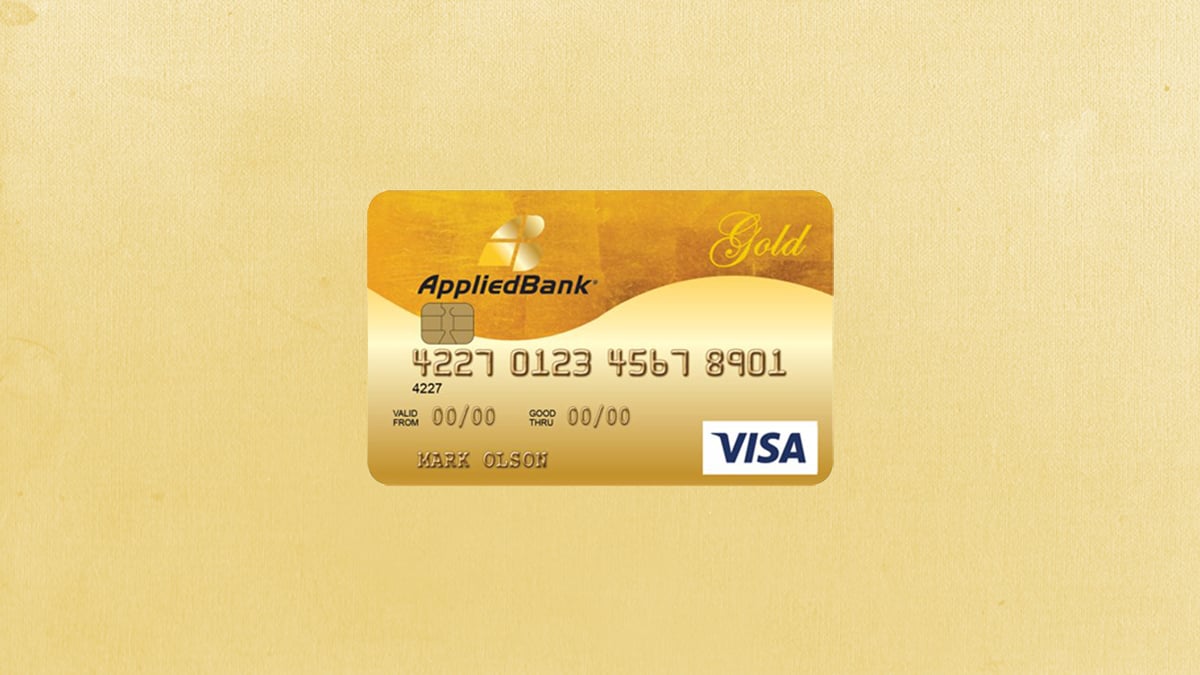

Applied Bank® Secured Visa® Gold Preferred® credit card full review

Looking for a secured credit card that offers a low-interest rate? Check our Applied Bank® Secured Visa® Gold Preferred® card review!

Keep Reading