Credit Cards

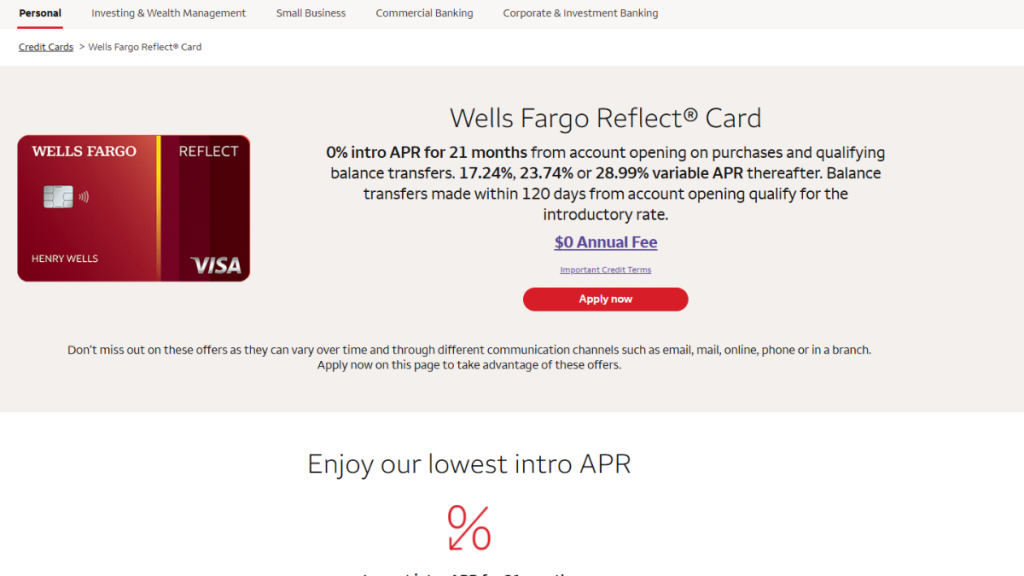

Wells Fargo Reflect® Card Review: 0% intro APR & No Annual Fee

Save more and stress less with the Wells Fargo Reflect® Card! Enjoy 0% intro APR for up to 21 months on purchases and balance transfers. Read on and discover more!

Advertisement

Looking to Save on Interest? Start Smart with a Card That Works for You!

Looking for a credit card to help you save money with interest? Then read this Wells Fargo Reflect® Card review!

Enjoy an impressive zero percent introductory APR for up to 21 months from account opening.

Enjoy a bonus cellphone protection: up to $600 of coverage for eligible theft or damage. Great perks, right? Keep reading and learn more about this and whether it’s the right choice for you! Learn More!

- Credit Score: Good to Excellent (670 – 850);

- Annual Fee: $0;

- Regular APR: 0% intro APR for 21 months from account opening on purchases and eligible balance transfers. Then, 17.24%, 23.74%, or 28.99% variable APR;

- Welcome bonus: N/A;

- Rewards: Up to $600 of cellphone protection for eligible theft or damage when using your card to pay your cellphone bill each month;

- Terms apply.

How does the Wells Fargo Reflect® Card work?

Wells Fargo’s Reflect® Card is a worthwhile credit card option for those looking to save money.

Since it offers 0% intro APR on purchases and eligible balance transfers for 18 months from account opening.

Additionally, Wells Fargo provides customers with an Intro APR extension for 3 months as long as minimum payments are made on time during the introductory period.

After that, cardholders will have a variable APR ranging from 17.24% to 28.99% variable APR. Also, customers can count on Visa acceptance nationwide and its benefits.

Moreover, balance transfers made within 120 days of account opening will qualify for the promotional interest rate and fee. To top things off, Wells Fargo doesn’t charge an annual fee!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Wells Fargo Reflect® Card pros and cons

Wells Fargo Reflect® Card has been praised for its 0% introductory APR on purchases and eligible balance transfers for 18 months from account opening.

A bonus is the three-month intro APR extension offered when customers make their minimum payments on time during those 18 months.

However, you also have some cons, like associated fees for balance transfers and foreign transactions. Check out the comparison and see if it works for your case.

Pros

- Get 21 months of 0 percent intro APR on purchases and qualifying balance transfers (terms apply);

- No annual fee;

- Receive up to $600 of cellphone protection for eligible theft or damage.

Cons

- There is no continuing benefits or rewards program;

- You must have minimum monthly payments to guarantee the 21 months of APR exemption;

- 3% balance transfer fee;

- Purchases abroad bring an associated fee of 3%.

Want to apply for the Wells Fargo Reflect® Card?

Wells Fargo Reflect® Card is an excellent credit card option available in the market. It guarantees great benefits and an easy application process.

This card is a great choice for its long 0 percent introductory APR period if you’re looking for debt consolidation or large purchases.

Applying for this credit card is an easy and convenient process. You can do it completely online; we are here to show you how! Keep reading to learn more about it!

Does my credit score need to be good?

As said, the Wells Fargo Reflect® Card has some great benefits, like cell phone protection and zero annual fees.

Furthermore, it brings relatively low APR fees and also a 0% APR initial bonus for some time.

Therefore, you need a good to excellent credit score to enjoy these benefits. And the higher the credit score, the lower the associated APR.

Requirements

Here are the requirements to apply for the Wells Fargo Reflect® Card:

- Age: Applicants must be at least 18 years old or the legal age of majority in their state.

- Residency: You must be a U.S. citizen or permanent resident with a valid Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Income: Applicants must demonstrate a steady source of income to ensure they can manage credit obligations and payments.

- Existing Wells Fargo Account Restrictions: If you’ve opened a Wells Fargo credit card in the past 6 months, you may not be eligible for a new credit card.

Apply online

Wells Fargo Reflect® Card is a great way to make managing your finances easy.

To apply, you must fill out an online form with your personal information, such as address, name, and Social Security Number.

Additionally, applicants must be 18 years or older to qualify for this card.

This form will allow Wells Fargo to review applicants’ credit histories and better understand their financial responsibility.

Wells Fargo offers customer support anytime during regular business hours to simplify the application process.

Potential customers are encouraged to call Wells Fargo if they have any questions regarding the eligibility requirements.

Apply using the app

The application is made exclusively online through the website. Therefore, you need to access the browser to complete the application process.

However, you can download the official app to track your expenses and control your finances. This app is available for Android and iOS and has great user reviews for the experience.

Wells Fargo Reflect® Card vs. Citi Premier® Card

The Wells Fargo Reflect® Card is a great option for anyone with a good credit score.

After all, you don’t have an annual fee associated with it, and you can earn an APR of 18.24% if you have a very high credit score.

Additionally, this option has an initial 0% APR for the first 21 months. Thus, you can sustainably organize your finances.

However, if you’re looking for a card that can give you reward points on your spending, we recommend the Citi Premier® Card.

While the Citi Premier® Card charges an annual fee, it offers a vast array of perks in return. You can earn a substantial welcome offer, and points in all your spending.

Wells Fargo Reflect® Card

- Credit Score: Good to Excellent (670 – 850);

- Annual Fee: $0;

- Regular APR: 0% intro APR for 18 months from account opening on purchases and eligible balance transfers (possible extension for 3 months). Then, 17.24%, 23.74% or 28.99% variable APR;

- Welcome bonus: N/A;

- Rewards: Up to $600 of cellphone protection for eligible theft or damage when using your card to pay your cellphone bill each month;

- Terms apply.

Citi Premier® Card

- Credit Score: Good to Excellent;

- Annual Fee: $95;

- Regular APR: 21.24% – 29.24% variable;

- Welcome bonus: 60,000 points after $4,000 spent in the first three months;

- Rewards: 3x Points in air tickets, hotels, gas stations, supermarkets, and restaurants; 1X points on all other purchases.

Interested in the Citi Premier® Card? Then check the article below and learn more about its features. We’ll also show you how to easily apply for it.

Citi Premier® Card Review

The Citi Premier® Card has everything a smart traveler could ask for. It gives you reward points with everyday purchases to turn into air tickets or cashback.

Trending Topics

Would a rise in corporate taxes help curb inflation?

Could a rise in corporate taxes help curb inflation? Learn more about how corporate taxes could impact prices and the economy as a whole.

Keep Reading

Types of personal loans: pros, cons and how to choose

Looking for a personal loan? Check out our guide to the different types of loans available, with pros and cons.

Keep Reading

TOP 10 best personal loans 2022: even for bad credit!

Do you have a low credit score and need an affordable loan? Read this article to discover the best personal loans for bad credit.

Keep ReadingYou may also like

Applying for the X1 Credit Card: learn how!

Searching for an easy way to apply for the X1 Credit Card? Look no further! This card has no annual fee and a reward program! Read on!

Keep Reading

Quick Loan Link review: up to $50K quickly

Looking for a fast and easy loan option? Then read our Quick Loan Link review. Compare several offers and enjoy flexible conditions!

Keep Reading

OneMain Financial Personal Loans: how to apply now!

Learn how to apply for one of the many personal loans options from OneMain Financial. Get up to $20,000 for several purposes! Read on!

Keep Reading