Credit Cards

Applying for the U.S. Bank Visa Platinum® Card: Learn How!

If you're interested in learning how to apply for the U.S. Bank Visa Platinum® Card, and getting a long low intro APR, read on and learn everything you need!

Advertisement

Simple and quick application

The U.S. Bank Visa Platinum® Card is one of the most popular credit cards on the market. It offers many benefits, including a 0% intro APR on purchases and balance transfers for 21 billing cycles.

In this blog post, we’ll walk you through everything you need to know to apply for the U.S Bank Visa Platinum®. We’ll cover eligibility requirements and how to fill out the form.

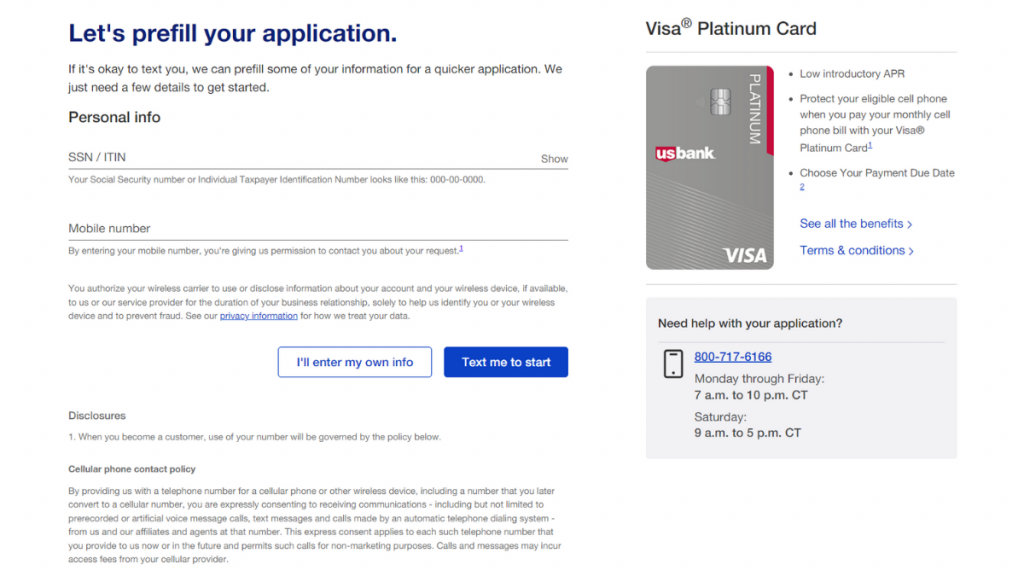

Apply online

Applying for the U.S. Bank Visa Platinum® Card is easy and convenient, with everything being done online through the website.

All you need is your financial information, personal data, and Social Security number. The process is straightforward! As a result, you can be approved in as little as 60 seconds.

There’s no need to worry about complex applications or hidden fees. Just apply online, and you’re on your way to enjoying all the benefits of the U.S. Bank Visa® Platinum.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Apply using the app

To apply for the U.S. Bank Visa Platinum® Card, you must use either a website or an app. Unfortunately, it cannot be done exclusively via the app itself.

You must provide your financial, personal, and security information when applying. As well as ensure that you are older than 18 years of age and currently residing in the U.S.

Once your account has been successfully opened, you can easily download and install the app via the respective store on your device and keep track of your finances.

U.S. Bank Visa Platinum® Card vs. Aspire® Credit Card

If you’re looking for a good credit card with no annual fee, the U.S. Bank Visa Platinum® is a great option.

With a 0% introductory APR for 21 months on both purchases and balance transfers, it’s a great way to save on interest.

The Aspire® Credit Card also has no annual fee. You can earn 3% cash back rewards on qualifying gas, grocery, and utility purchases and some payments.

Moreover, plus 1% cash back on any other eligible purchase if you enroll in the cash-back rewards program.

U.S. Bank Visa Platinum® Card

- Credit Score: Good/Excellent;

- Annual Fee: $0;

- Regular APR: 0% introductory APR for the first 21 months for purchases and balance transfers. After that, 18.74% – 29.74% (Variable);

- Welcome bonus: N/A;

- Rewards: Coverage against damage or theft of cell phones up to US$ 600.

Aspire® Credit Card

- Credit Score: 300 to 850;

- Annual Fee: $49 to $175. Then, $0 to $49 annually;

- Regular APR: 29.99% or 36% variable APR for purchases;

- Welcome bonus: None;

- Rewards: 3% cash back rewards on qualifying gas, grocery, and utility purchases and some payments. Also, you can earn a 1% cash-back reward on any other eligible purchase (valid if you enroll in the cash-back rewards program);

- Terms apply.

The Aspire® Credit Card is an excellent alternative. Want to know how to apply? Then check out the post we separated.

How to apply for the Aspire® Credit Card

The Aspire® Credit Card can help you rebuild your credit score. However, here's how to apply to be approved and start using your card.

Trending Topics

Career at Uber: How to Become an Uber Driver

Explore a career at Uber. From driving passengers to shaping the future of transportation, discover your perfect fit at Uber.

Keep Reading

American Express Platinum credit card full review

Discover everything you need to know about the American Express Platinum credit card, including eligibility requirements and rewards offered.

Keep Reading

TOP 6 cash back credit cards: learn the best options

Check out our list of the 6 best cash back credit cards on the market and learn how to earn extra money on everyday purchases!

Keep ReadingYou may also like

Credit Strong review: repair your credit with confidence

Don't let bad credit hold you back anymore. Read our review of Credit Strong to learn how to improve your finances. No hard pull!

Keep Reading

Regions Prestige Visa® Signature Credit Card full review

Check out our full review of the Regions Prestige Visa® Signature Credit Card. Earn points on every purchase and pay $0 annual fee!

Keep Reading

How to get a loan with bad credit: 5 easy tips

Are you trying to get a loan with bad credit? It is not easy but will get easier if you follow the tips we give you in this article.

Keep Reading