Want to earn points on delivery services, takeout and dining out?

The Chase Sapphire Preferred® offers 3x points on dining, plus 1x points on all other purchase!

Advertisement

The Chase Sapphire Preferred® Card is a top choice for anyone looking to get more out of their everyday spending. With every purchase, you earn valuable reward points that can be redeemed for travel, gifts, and much more. Whether you’re planning your next trip or just enjoying daily life, this card opens up a world of possibilities. Ready to explore all the benefits? Apply today and start earning rewards right away.

The Chase Sapphire Preferred® Card is a top choice for anyone looking to get more out of their everyday spending. With every purchase, you earn valuable reward points that can be redeemed for travel, gifts, and much more. Whether you’re planning your next trip or just enjoying daily life, this card opens up a world of possibilities. Ready to explore all the benefits? Apply today and start earning rewards right away.

You will remain in the same website

The benefits include plenty of reward points and discounts. You'll also have access to excellent 24/7 customer support. Take a look at some of the card's many perks:

Embark on a world of travel and dining excellence with the Chase Sapphire Preferred® Card.

Tailored for those who thrive on exploring new horizons and savoring culinary delights, this card turns your adventures into a mosaic of experiences.

Let’s dive into what makes the Chase Sapphire Preferred® a gem in the world of credit cards.

Advantages to Enjoy

- Travel Rewards Acceleration: Amplifies rewards on travel expenses, making every journey more rewarding.

- Dining Delights: Enhances your dining experiences by rewarding your gastronomic adventures.

- Broad Reward Redemption Options: Offers flexibility in redeeming points for travel, shopping, and more.

- Valuable Travel Insurance Perks: Provides peace of mind with travel insurance benefits for your adventures.

- No Extra Charges Abroad: Ideal for international travel, with no foreign transaction fees.

- Access to Exclusive Travel Partners: Transforms travel rewards into memorable experiences with top travel partners.

- DashPass Benefits: Delivers additional perks for food delivery, enhancing your dining experiences at home.

Disadvantages to Keep an Eye On

- Annual Fee Applicable: Comes with an annual fee, requiring careful consideration of usage to justify the cost.

- Rewards Program Navigation: Requires active engagement with the rewards program to maximize benefits.

- Focused Reward Categories: Rewards mainly tailored towards travel and dining, less so for other spending.

- Balance Carry Costs: Carrying a balance incurs significant interest, demanding careful financial management.

- Travel-Centric Benefits: Primarily beneficial for frequent travelers, less so for others.

- No Introductory APR Offer: Lacks the initial APR offers found in some other credit cards.

In conclusion, the Chase Sapphire Preferred® Card stands as a stellar option for frequent travelers and food enthusiasts, offering an array of benefits that enrich these experiences.

However, its annual fee and focus on specific reward categories mean it’s most beneficial for those who regularly spend in these areas.

The card’s appeal lies in turning everyday travel and dining expenses into valuable rewards and experiences, making it a worthy contender in the travel credit card arena.

Yes, the Chase Sapphire Preferred® Credit Card is a metal card, just like the other card in the Sapphire line, the Reserve. These Chase travel cards offer the best features for discerning consumers, including the Visa network for international acceptance, rewards, and excellent customer service.

No, you do not need to have a Chase checking account or investment account to apply for the Chase Sapphire Preferred® Credit Card. While having a Chase account may be convenient for managing your finances, it is not a requirement for applying for a credit card. You can opt to open a Chase account or business account if you’d like to enjoy its benefits. such as personal loans or home equity loans.

No, the Chase Sapphire Preferred® Credit Card is not a business credit card. This card is designed for individuals who want to earn rewards and benefits for personal travel and everyday spending. If you are looking for a business credit card from Chase, you might consider options like the Chase Ink Business Preferred, or even increase your credit limit to have some extra room for investing in your career.

If you’d like to learn how you can start enjoying all of these benefits, check the following link. We’ll show you how to easily apply for the Chase Sapphire Preferred® Credit Card.

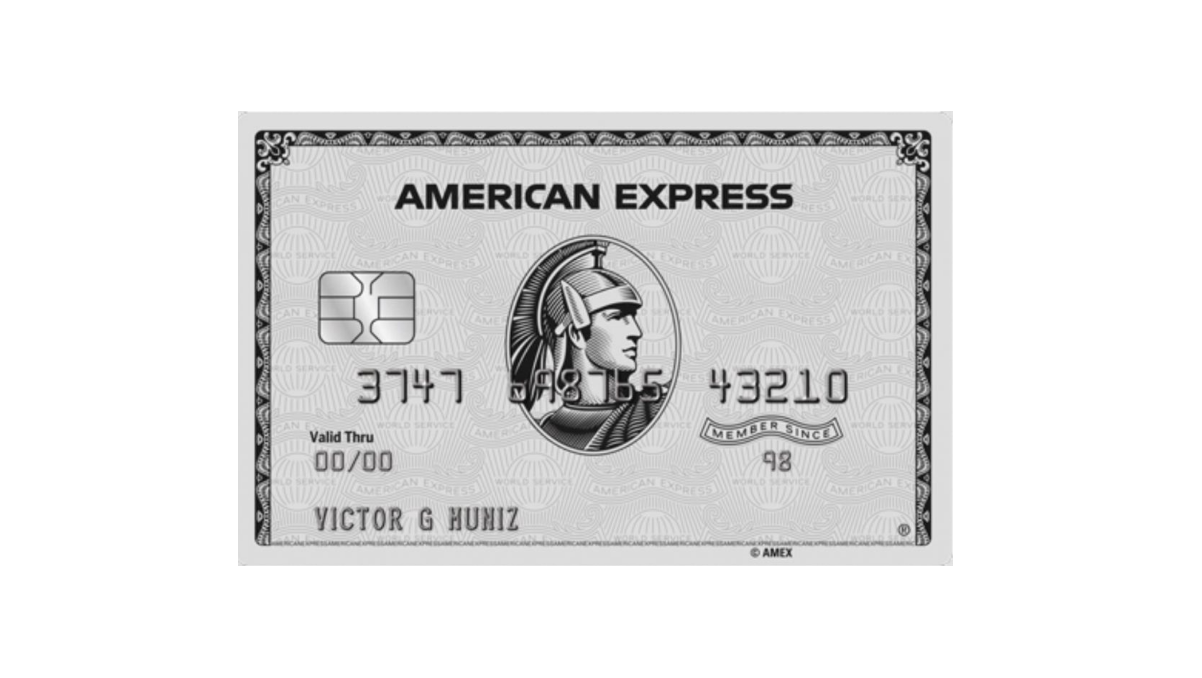

But if luxury is what you’re after, there’s another premium credit card that might catch your eye: The Platinum Card® from American Express.

The Amex Platinum Card offers endless perks for the avid traveler, but that’s not nearly all it has in store. Curious for more? See the following link to explore and learn how to apply.

How do you get The Platinum Card from Amex?

Learn how to apply for The Platinum Card® from American Express and check out the benefits you'll get with the best travel card in the market!

Trending Topics

Credit Saint review: repair your credit with confidence

Credit Saint review helps you rebuild your credit score. Learn what the pros and cons of this option are and how it works.

Keep Reading

Home Depot’s quarterly earnings are better than expected

Home Depot had a strong growth in its first quarter. It might be a sign that the housing market is alive and well despite mortgage rates.

Keep Reading

Choose a credit card to build credit and improve your finances

Having a good credit score is critical to good business. See how choosing a credit card to build credit can be important!

Keep ReadingYou may also like

Curious about the crypto millionaires? Find out who they are!

Want to see who crypto millionaires that are famous in the world are? Then check out the list we prepared in this post!

Keep Reading

Start budgeting: 5 simple steps on how to start!

Want to get your finances under control? This article will show you how to start budgeting in 5 easy steps. Find out more about it here!

Keep Reading

Truist Enjoy Beyond Credit Card full review

Read this comprehensive Truist Enjoy Beyond Credit Card review before signing up. You can earn up to 3x points for every dollar spent!

Keep Reading