A line of credit tailored specially to meet the financial needs of military members and their families

Navy Federal HELOC, Targeted at Military Members

Advertisement

Navy Federal Credit Union’s HELOC offers low rates, payment flexibility, and easy access to funds. It’s perfect for military members, DoD employees, and families. Cover home repairs, make purchases, finance your studies, or consolidate debt with this great option.

Navy Federal Credit Union’s HELOC offers low rates, payment flexibility, and easy access to funds. It’s perfect for military members, DoD employees, and families. Cover home repairs, make purchases, finance your studies, or consolidate debt with this great option.

You will remain in the same website

Unlock your credit potential with Navy Federal HELOC – designed specifically for our military members. Enjoy exclusive advantages. Discover 4 benefits now:

Navy Federal Credit Union helps military personnel, DoD employees, and their families with money. They give out banking, lending, and investment services.

A HELOC, a home equity line of credit, enables you to borrow money using your home’s equity. It’s like a credit card, where you have a set limit and can borrow funds up to that limit as needed. Getting a home equity line of credit with bad credit may be more difficult, but it is still possible.

You can sign up for Navy Federal Credit Union online or by visiting a branch. Navy Federal Credit Union offers a range of credit cards, including cash-back cards, travel rewards cards, and secured cards for those with bad credit.

You can open a new Navy Federal Credit Union account online or by visiting a branch. You must provide personal and financial information to complete the application process.

A HELOC is a credit line that enables you to borrow money as necessary, whereas a home equity loan provides a one-time payment. In a HELOC, you are only charged interest on the amount you borrow.

Using your property as collateral allows you to access funds quickly for purposes such as education expenses, business ventures, or home improvements.

Don’t miss out on using your home equity – seize the opportunity with PNC. Learn how to apply for a PNC HELOC by reading below.

Apply for the PNC HELOC

Here's our detailed explanation of how to apply for the PNC HELOC in just a few minutes- all stages covered. Read on!

Trending Topics

Lazy investing portfolio: a beginners guide

A lazy investing portfolio is the best strategy for people who want to build wealth without having to keep track of complex market data.

Keep Reading

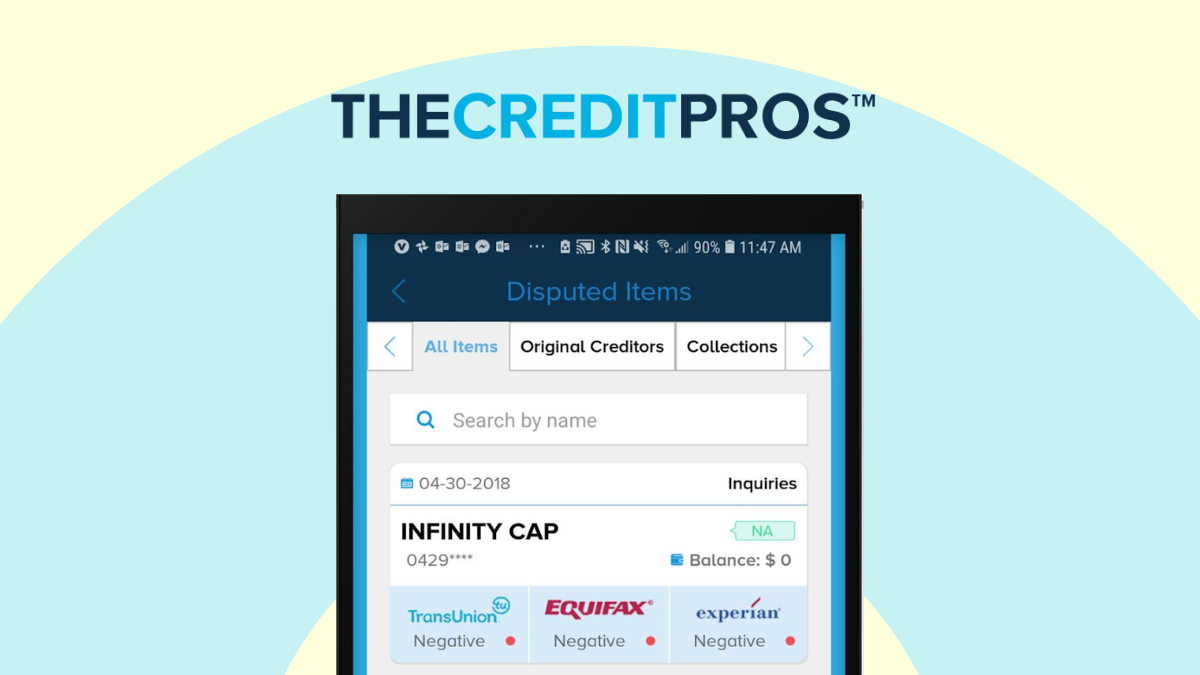

The Credit Pros review: become debt-free!

The Credit Pros deserves this review because it is one of the best credit repair companies in the US. Read to learn how it works.

Keep Reading

Medical loans: see how to finance your medical treatments

Medical loans are a great way to pay for medical treatments. See information on how they work and the pros and cons of taking them out!

Keep ReadingYou may also like

Venmo Mastercard Debit Card Review

Love using Venmo to pay friends back? You can use it to make purchases too! Read our full review of the new Venmo Mastercard Debit Card.

Keep Reading

StellarFi Account review: repair your credit with confidence

Looking to repair your credit but don’t know where to start? This review of the StellarFI Account will provide you with all the information.

Keep Reading

Get an easy home equity line of credit: Citizens Bank HELOC review!

Looking for a flexible and convenient way to access equity in your home? Check our Citizens Bank HELOC review!

Keep Reading